ConocoPhillips (COP) to Acquire Additional Stake in APLNG

ConocoPhillips COP plans to acquire an additional stake in Australia Pacific LNG (“APLNG”) from a subsidiary of institutional investor EIG.

ConocoPhillips currently holds a 47.5% stake in the APLNG project. The company operates the 9-metric-ton-per-annum LNG export facility on Curtis Island near Gladstone. Origin Energy, the current upstream operator, owns a 22.5% stake.

ConocoPhillips agreed to acquire up to an additional 2.49% interest in APLNG for $500 million, subject to customary adjustments. Once the transaction closes, the energy giant will own up to 49.99% stake and become the upstream operator of APLNG.

APLNG is currently the largest natural gas supplier of Australia’s East Coast domestic market. APLNG addresses about 20-30% of the region’s total demand. In January 2016, the facility shipped its first LNG cargo after five years of development and construction.

In 2022, ConocoPhillips produced about 136 thousand barrels of oil equivalent per day from APLNG. The facility will continue supplying customers in China and Japan with reliable energy, lower in carbon intensity than other fossil fuel alternatives.

ConocoPhillips owns several LNG assets all over the world, through which it can make significant profits during this rising demand for cleaner energy sources. The transaction, subject to Australia regulatory approvals and other customary closing conditions, is expected to close in early 2024.

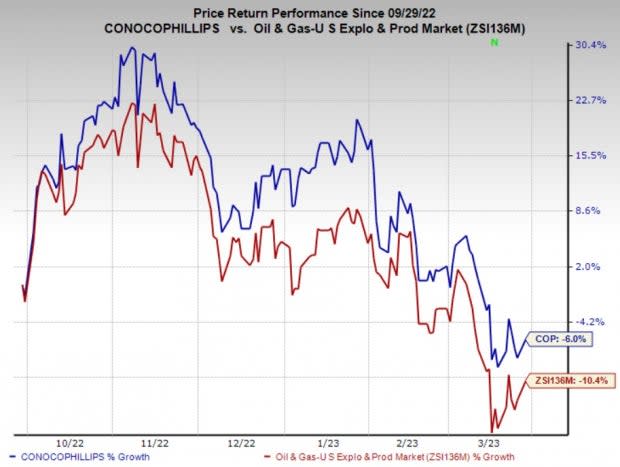

Price Performance

Shares of COP have outperformed the industry in the past six months. The stock has declined 6% compared with the industry’s 10.4% fall.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

ConocoPhillips currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

W&T Offshore, Inc.’s WTI fourth-quarter 2022 adjusted earnings (excluding one-time items) of 10 cents per share beat the Zacks Consensus Estimate of 3 cents. The strong quarterly results were driven by higher production and the realization of commodity prices.

W&T Offshore has been generating positive free cash flows for 20 consecutive quarters. In 2022, the company’s free cash flow of $376.4 million increased fourfold from $90.9 million reported a year ago. This reflects the company’s strong operations.

Liberty Energy Inc.’s LBRT fourth-quarter 2022 earnings per share of 82 cents handily beat the Zacks Consensus Estimate of 71 cents. The outperformance reflects the impacts of strong execution and increased service pricing.

As part of its shareholder return policy, LBRT repurchased $125 million of its stock at an average price of $15.29 a piece since July and reinstated a quarterly cash dividend of 5 cents in the fourth quarter.

Murphy USA Inc.’s MUSA fourth-quarter 2022 earnings per share of $5.21 missed the Zacks Consensus Estimate of $6.16. The underperformance can be attributed to lower-than-expected petroleum product sales.

Murphy USA expects the 2023 fuel volume to be 240-245 thousand gallons on an APSM basis. Murphy USA’s 2023 guidance includes up to 45 new stores, up to 30 raze-and-rebuilds and $795-$815 million in merchandise margin contribution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ConocoPhillips (COP) : Free Stock Analysis Report

W&T Offshore, Inc. (WTI) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance