Comtech (CMTL) Rejigs Leadership, Spurs Long-Term Growth Strategy

Comtech Telecommunications Corp. CMTL recently underwent a leadership rejig. The company announced the appointment of Michael Porcelain as the chief executive officer and a member of the board of directors. His role as part of the board is effective Jan 3, 2022.

The company also selected Wendi Carpenter and Mark Quinlan as independent directors of the board, effective Jan 3, 2022. The appointment marks the completion of Comtech’s long-term CEO succession planning strategy.

Michael Porcelain has been serving as the chief operating officer and president of Comtech since October 2018 and January 2020, respectively. Prior to Comtech, he held a vast experience of working in various organizations such as the manager of the Transaction Advisory Services Group of PricewaterhouseCoopers and director of Corporate Profit and Business Planning for Symbol Technologies.

Wendi Carpenter was the Commander of the Navy Warfare Development Command, wherein she emphasized on technology development for enhanced warfighting communications. She has also completed an illustrious 34-year career in the U.S. Navy and currently serves as an independent director and chair of the Compensation Committee of a U.S.-owned $1.2-billion semiconductor manufacturing entity, SkyWater Technology.

Meanwhile, Mark Quinlan had been part of Stifel — an investment banking company — through its merger with Thomas Weisel Partners in 2010. He had also worked in Merrill Lynch and Brown Brothers Harriman & Co. as an advisor of various strategic and corporate finance decisions. Also, he is the co-founder of White Hat Capital Partners LP that creates sustainable value in technology companies.

Of late, Comtech has been on a roll with accretive contracts from various government organizations for improved satellite communications. With the inclusion of these distinguished individuals in Comtech, the company is likely to streamline day-to-day operations, facilitate shareholder value creation and drive a new level of performance within the organization.

Comtech has created a niche market for highly secure wireless solutions to defend global security and improve public safety. The company continues to provide market-leading products for messaging, location and deployable wireless communications. It offers services to integrate networks, servers, gateways, and intelligent peripherals and provides transmission responses to users.

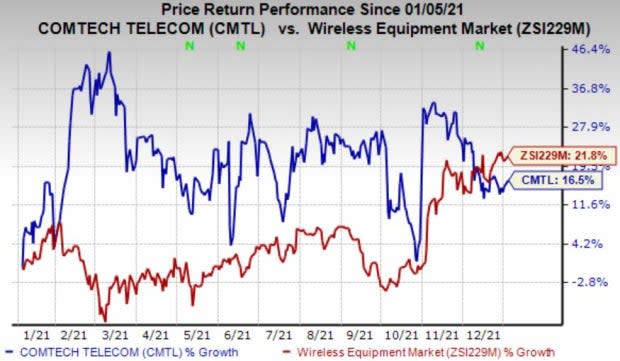

Comtech currently has a Zacks Rank #4 (Sell). Its shares have returned 16.5% compared with the industry’s growth of 21.8% in the past year.

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vocera Communications, Inc. VCRA is a solid pick in the broader industry, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its earnings for the current year has been revised 6.2% upward over the past 60 days.

Vocera delivered a trailing four-quarter earnings surprise of 109.6%, on average. The stock has soared 52.1% in the past year. VCRA has a long-term earnings growth expectation of 18%.

Clearfield, Inc. CLFD also sports a Zacks Rank #1. The Zacks Consensus Estimate for its earnings for the current year has been revised 8.8% upward over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.8%, on average. CLFD has catapulted 230.4% in the past year.

SeaChange International, Inc. SEAC currently carries a Zacks Rank #2 (Buy). The consensus estimate for the current year has narrowed from a loss of 20 cents per share to a loss of 18 cents over the past 60 days.

SeaChange International delivered a trailing four-quarter earnings surprise of 37.2%, on average. The stock has gained 29.9% in the past year. SEAC has a long-term earnings growth expectation of 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Vocera Communications, Inc. (VCRA) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance