Compass Minerals International And Other Great Materials Income Stocks

The materials industry is deeply cyclical with producers benefiting highly during an economic boom and many players going bankrupt in a bust. Therefore, this industry is a macroeconomic play with the opportunity of riding the wave in times of robust demand for commodities. Another key driver of a materials company’s profit is the commodity prices which in turn steers the level of dividend payouts and yield. Below is my list of huge dividend-paying stocks in the materials industry that continues to add value to my portfolio holdings.

Compass Minerals International, Inc. (NYSE:CMP)

CMP has a substantial dividend yield of 4.35% with a high payout ratio . CMP’s last dividend payment was US$2.88, up from it’s payment 10 years ago of US$1.34. The company has been a dependable payer too, not missing a payment in this 10 year period. Compass Minerals International could be a good investment for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next 12 months More detail on Compass Minerals International here.

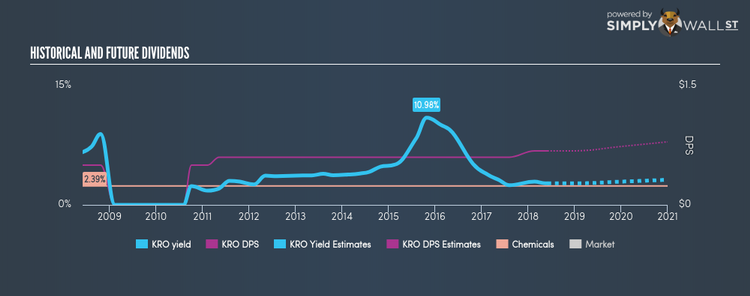

Kronos Worldwide, Inc. (NYSE:KRO)

KRO has a sizeable dividend yield of 2.71% and their current payout ratio is 18.50% , with analysts expecting a 24.55% payout in three years. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from US$0.50 to US$0.68. The company outperformed the us chemicals industry’s earnings growth of 18.02%, reporting an EPS growth of 362.93% over the past 12 months. More detail on Kronos Worldwide here.

Greif, Inc. (NYSE:GEF)

GEF has a nice dividend yield of 2.83% and has a payout ratio of 47.36% . In the last 10 years, shareholders would have been happy to see the company increase its dividend from US$1.52 to US$1.68. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Continue research on Greif here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance