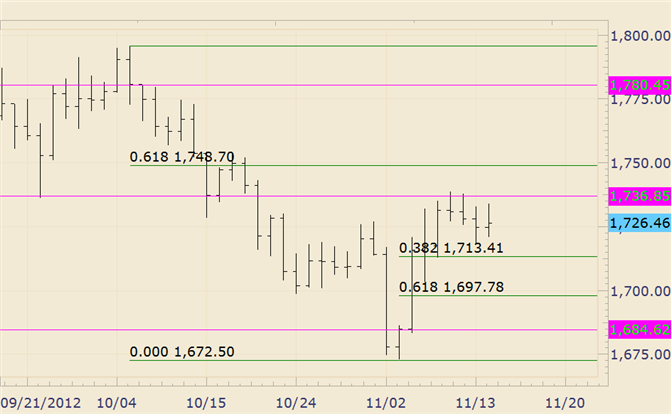

Commodity Technical Analysis: Gold Enters Day 4 of Tight Consolidation

Daily Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: Gold has traded sideways the last 4 days after rallying for 4 days from a multi month low. The 61.8% retracement at 1749 remains of interest. 1780 can’t be ruled out either. The low on day 3 of the month and emotional trade at the low (11/2 was a JS Thrust day) suggests that price is likely to stay above 1672.50 for the remainder of November.

Commodity Trading Strategy: I’m on the lookout for a wave 2 or B top below the October high at higher levels.

LEVELS: 1685 1698 1713 1749 1762 1780

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance