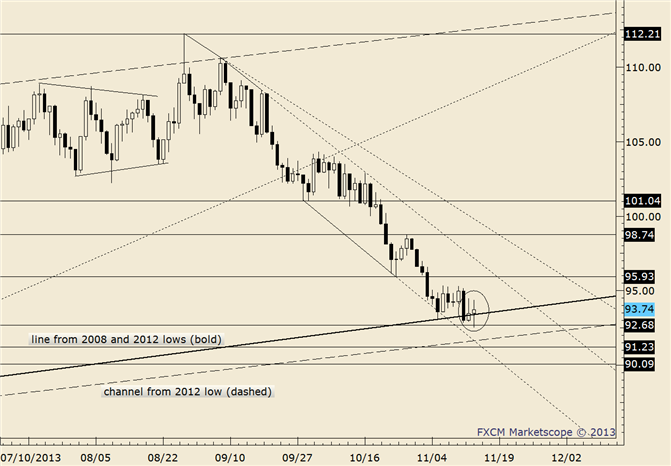

Commodity Technical Analysis: Crude Trendline Break Targets 9900

Daily Bars

Chart Prepared by Jamie Saettele, CMT

Commodity Analysis: Crude closed the week above a nearly 11 month trendline (extends off of the 2012 highs) on Friday. Immediate focus shifts to the September high at 10040 although there is likely resistance at 99. It’s worth noting the daily RSI is above 70. Since the 2009 low, RSI has been unable to stay above 70 for longer than a few days.

Commodity Trading Strategy: Flat

LEVELS: 9380 9515 9620 9900 10040 10175

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance