Commodity Technical Analysis: Crude Respects Resistance Line Once Again

Daily Bars

Chart Prepared by Jamie Saettele, CMT

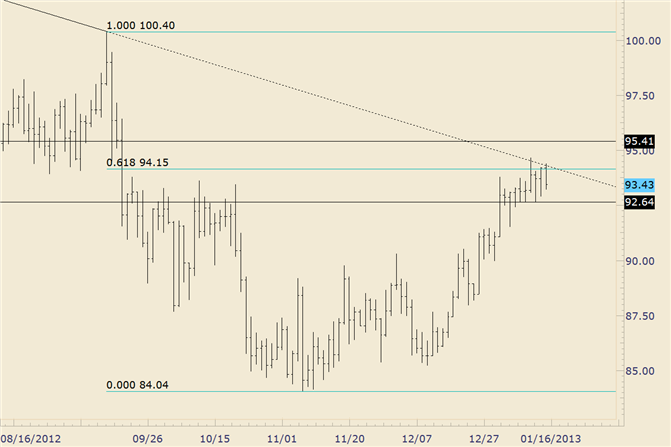

Commodity Analysis: Crude has reached the 61.8% retracement of the 10040-8404 decline at 9415 and trendline that extends off of the 2012 (February and September) highs. The level is reinforced by highs in October. The rally is certainly stretched and this well-defined resistance level would be a good place for a top. Weakness below Friday’s low would be a good start for bears.

Commodity Trading Strategy: Weakness below 9264 would warrant a bearish bias.

LEVELS: 9051 9146 9264 9477 9541 9719

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance