Commercial real estate continues to see investment at record levels

Resurgent commercial real estate activity in U.S. and growth in Asia in 2019; investment volumes expected to remain elevated in 2020

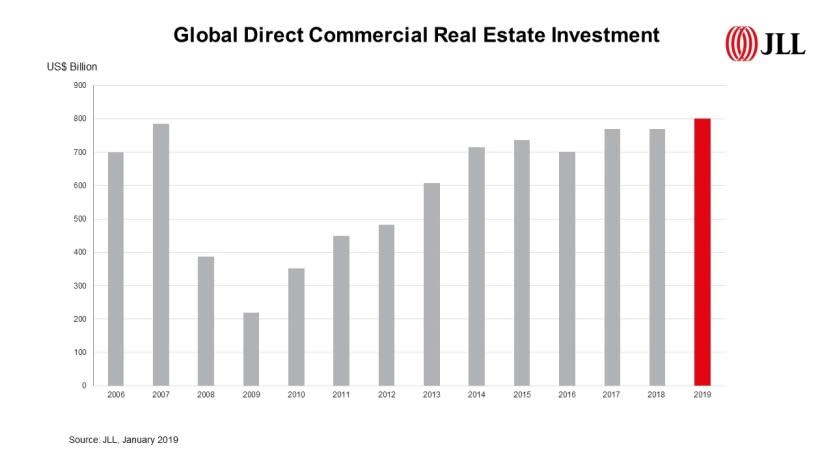

Global commercial real estate transaction volumes reached an all-time high of $800 billion, increasing 4% year-over-year and making 2019 the most liquid year on record.

Outperformance in the U.S. and core commercial real estate markets in Asia are driving growth, led by New York, Japan, China, South Korea and Singapore.

Paris has jumped into a leading global commercial real estate investment position, benefiting from significant foreign investment, low interest rates and strong fundamentals.

Direct commercial real estate investment volumes in London are expected to rebound this year following a Brexit resolution, having almost halved in 2019.

Commercial real estate investors are increasingly favoring high-growth, mid-sized cities as they focus on access to yield and longer-term resilience.

London remains the second-largest destination for cross-border capital targeting real estate, despite political uncertainties. London experienced a 41% decline in direct commercial real estate investment in 2019, according to research published today by JLL. This resulted in the market slipping down to an estimated $23 billion of direct investment. However, the level of liquidity targeting London is expected to increase in 2020 with a Brexit resolution, particularly from overseas investors who are keen to exploit London’s yield arbitrage over other major European cities.

Globally, 2019 was an impressive year for transaction volume, which reached $800 billion, the highest level on record. However, ongoing political uncertainty and a gradual slowdown of the global economy are combining to create market conditions that favor established global cities such as New York, Paris and Tokyo. Investors are increasingly cautious and are struggling to invest the near-record amount of available capital sitting in funds across the world.

The findings show that Asia Pacific continues to perform well, with investment in the region rising each year since 2015, reaching a peak of $169 billion in 2019. Helped by a more global outlook from foreign investors, Shanghai, Beijing and Singapore have all seen elevated investment in 2019 – over $16 billion across the three cities according to data analyzed by JLL.

Richard Bloxam, Global CEO of Capital Markets at JLL, said: “As the real estate cycle extends into its tenth year, investors are increasingly favoring locations and sectors that are resilient to economic or geopolitical disruption. Cities that offer a diverse range of talent and innovation attract significant investment interest, with the industrial and ‘living’ sectors continuing to perform well in the current global climate.”

Real estate investment volumes are expected to remain elevated throughout 2020 as investors continue to view it as an attractive asset class. Looking ahead, investors will be cautious in their decisions and look for sectors and markets deemed more robust to economic or geopolitical disruption.

Beyond the gateway cities, high-growth, secondary cities in both mature and transparent markets will continue to present opportunities for investors. Mid-sized cities with innovation credentials, a highly qualified workforce and cost efficiencies are seeing economic growth and increased concentrations of human capital. These innovation geographies are attracting companies and investors are following these enterprise trends, factoring in talent considerations and innovation potential as a means of mitigating risk and spotting future resilience. This will continue to benefit liquidity in leading innovation hubs such as Silicon Valley, Boston and San Francisco. However, this hierarchy is likely to be more fluid as we look beyond 2020 and market dynamics shift.

An earlier report by JLL said that the biggest gainers following the 2018 property cooling measures will likely be owners of commercial buildings. Mr Paul Ho, Chief Mortgage Consultant at iCompareLoan, said that despite the property curbs introduced by the Government last year, Singapore is still an attractive residential market for investors.

Commercial real estate may be bought under personal name, but total debt servicing Total Debt Servicing Ratio (TDSR) will apply on the individual’s income on such purchases. To buy a commercial or industrial property under company name, total debt servicing ratio TDSR also applies on the individual director’s income if the company is an investment holding company or an operating company that is loss-making or does not have sufficient cash flow to servicing the repayment.

Although the property market exuberance has been curbed to some extent with the property cooling measures introduced last year, Singapore as a property market investment destination still remains among the top – shoulder to shoulder with other cities in the world like London, New York, Shanghai and Sydney.

“We have to be mindful that there is a lot of excess capital fluidity here and at 1.9 – 2 percent, Singapore has one of the lowest interest rates for home loans in the region,” he added.

The prime commercial building will be especially attractive to investors because of its location, as investment properties of such nature are scarce in that area.

If you are planning to invest in commercial properties but are ensure of funds availability for purchase, you should speak to a mortgage broker who can set you up on a path that can get you a loan in a quick and seamless manner. Brokers have close links with the best lenders in town and can help you compare best commercial loans and settle for a package that best suits your commercial real estate purchase needs. You should also find out about money saving tips here.

If you are looking for a new home loan or to refinance, a Mortgage broker can also help you – from getting everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all their services are free of charge.

The post Commercial real estate continues to see investment at record levels appeared first on iCompareLoan Resources.

Yahoo Finance

Yahoo Finance