Collins Foods And Two More ASX Dividend Stocks To Consider

Amidst a fluctuating week on the ASX, with sectors like Materials and Real Estate making notable gains while Consumer Staples saw a slight decline, investors continue to navigate through the diverse performance landscape of the Australian market. In this context, understanding the attributes that contribute to a resilient dividend stock becomes crucial, especially when certain sectors show strength and others falter.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.63% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.11% | ★★★★★☆ |

Fortescue (ASX:FMG) | 9.99% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.12% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.05% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.69% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.13% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.70% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.23% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.10% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Collins Foods

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates and manages a chain of restaurants in Australia and Europe, with a market capitalization of approximately A$1.06 billion.

Operations: Collins Foods Limited generates revenue primarily through its KFC restaurants in Australia, which brought in A$1.12 billion, and its KFC and Taco Bell outlets in Europe, which contributed A$313.47 million and A$54.38 million respectively.

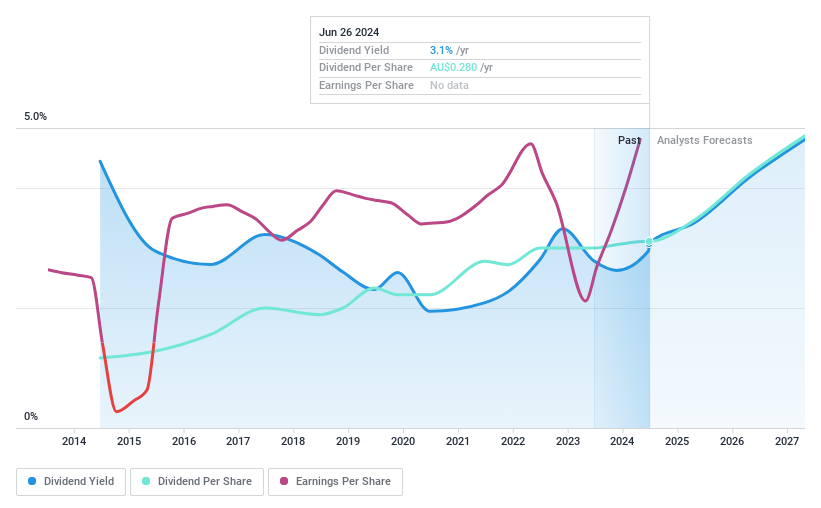

Dividend Yield: 3.1%

Collins Foods has demonstrated stable dividend growth over the past decade, with a current yield of 3.11%. Despite this, its yield remains below the top quartile in the Australian market. The company's dividends are well-supported by earnings and cash flows, with a payout ratio of 59.1% and a cash payout ratio of 35.2%, respectively. Recent financials show significant profit increase to A$76.72 million from A$12.75 million last year, suggesting improved financial health which could support future dividends despite recent executive changes following personal losses within leadership.

Click to explore a detailed breakdown of our findings in Collins Foods' dividend report.

Our valuation report here indicates Collins Foods may be undervalued.

Nick Scali

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in sourcing and retailing household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.27 billion.

Operations: Nick Scali Limited generates its revenue primarily through the retailing of furniture, amounting to A$450.45 million.

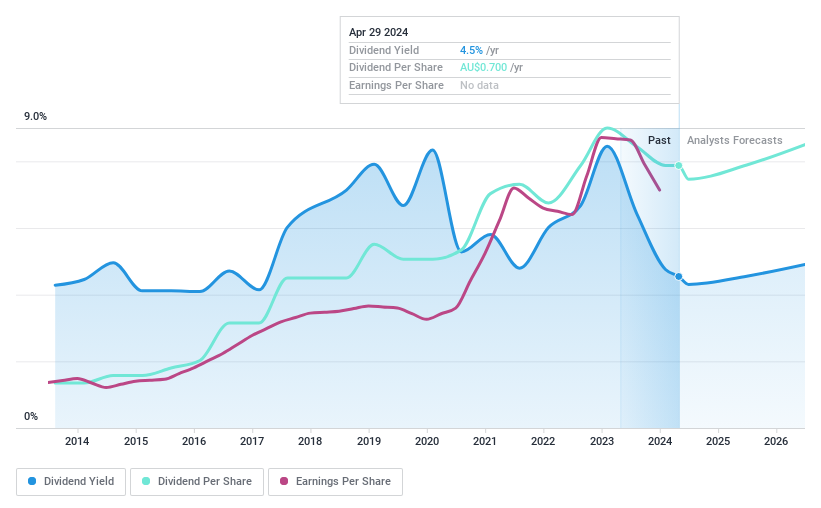

Dividend Yield: 4.7%

Nick Scali has maintained a stable dividend over the past decade, currently offering a yield of 4.69%. Despite its dividends being well-covered by both earnings (payout ratio of 67.9%) and cash flows (cash payout ratio of 45.6%), its yield is lower than the top quartile of Australian dividend stocks (6.18%). The company's recent A$10 million equity offering at A$13.25 per share might impact shareholder value but supports financial flexibility. Nick Scali trades at a significant discount to estimated fair value, suggesting potential undervaluation.

Sonic Healthcare

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited provides medical diagnostic services to a range of healthcare providers and their patients, with a market capitalization of approximately A$13.09 billion.

Operations: Sonic Healthcare Limited generates A$7.12 billion from its laboratory services and A$0.84 billion from radiology.

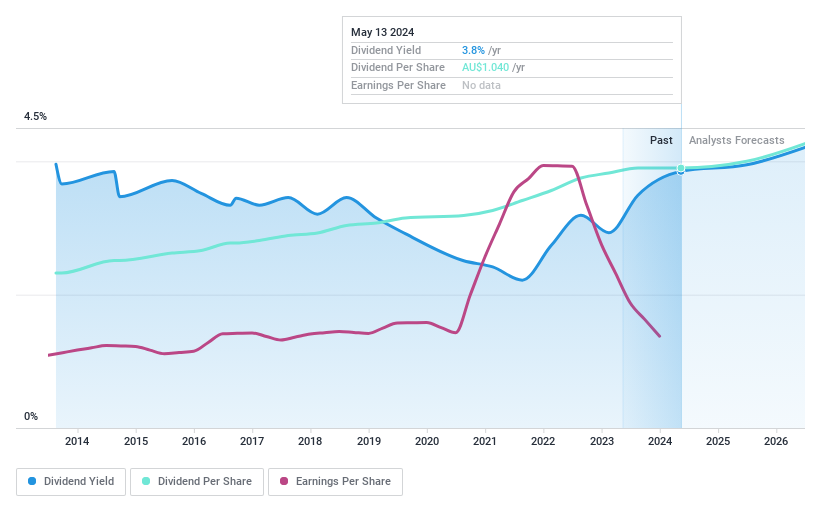

Dividend Yield: 3.8%

Sonic Healthcare's dividend yield stands at 3.82%, which is lower than the top quartile of Australian dividend stocks at 6.18%. Despite a stable history over the past decade, its dividends are not well-covered by earnings, with a high payout ratio of 98%. Recent moves to acquire Healius Limited’s diagnostic imaging business for up to A$800 million indicate strategic growth but could impact short-term financial stability. The company's profit margins have also declined from last year, complicating its dividend sustainability further.

Seize The Opportunity

Click here to access our complete index of 30 Top ASX Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CKF ASX:NCK and ASX:SHL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com