Collins Foods And Two More ASX Dividend Stocks To Consider

Over the past year, the Australian market has shown resilience with a 9.8% increase, despite recent stagnation where it remained flat over the last week. In this context of anticipated earnings growth forecasted at 13% annually, dividend stocks like Collins Foods can be particularly appealing for investors seeking steady income streams in a growing market.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.52% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.19% | ★★★★★☆ |

Collins Foods (ASX:CKF) | 3.12% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.25% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 7.25% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 4.17% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.97% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.83% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.55% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.14% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Collins Foods

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Collins Foods Limited operates and manages a chain of restaurants in Australia and Europe, with a market capitalization of approximately A$1.05 billion.

Operations: Collins Foods Limited generates revenue primarily through its KFC restaurants in Australia, which brought in A$1.12 billion, followed by its KFC outlets in Europe with A$313.47 million, and Taco Bell restaurants contributing A$54.38 million.

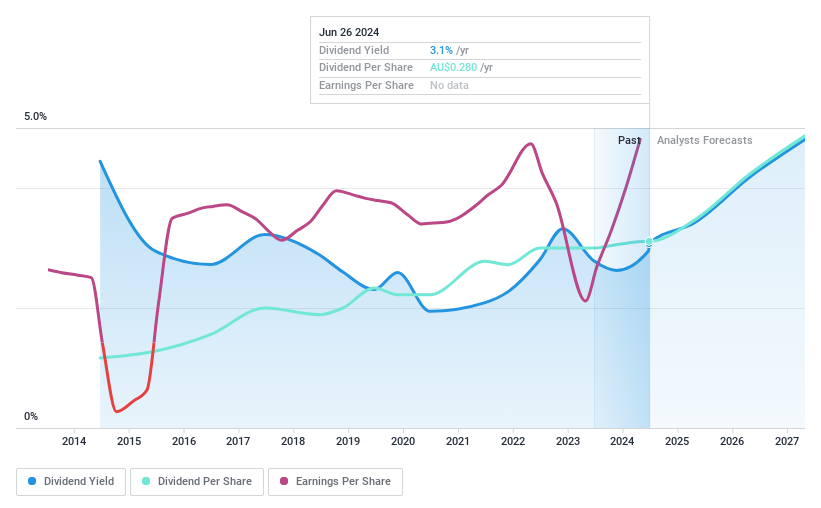

Dividend Yield: 3.1%

Collins Foods, a notable player in the Australian market, recently declared a dividend of A$0.155 and showcased a robust financial performance with yearly sales rising to A$1.49 billion from A$1.35 billion. Net income significantly increased to A$76.72 million, reflecting operational efficiency and market strength. Despite leadership changes with CEO Drew O'Malley stepping down and Kevin Perkins taking over as interim CEO, the company maintains stable dividends backed by earnings (payout ratio: 59.1%) and cash flows (cash payout ratio: 35.2%). However, its dividend yield at 3.13% remains lower compared to top Australian dividend payers.

Nick Scali

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in the sourcing and retailing of household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.15 billion.

Operations: Nick Scali Limited generates its revenue primarily through the retailing of furniture, amounting to A$450.45 million.

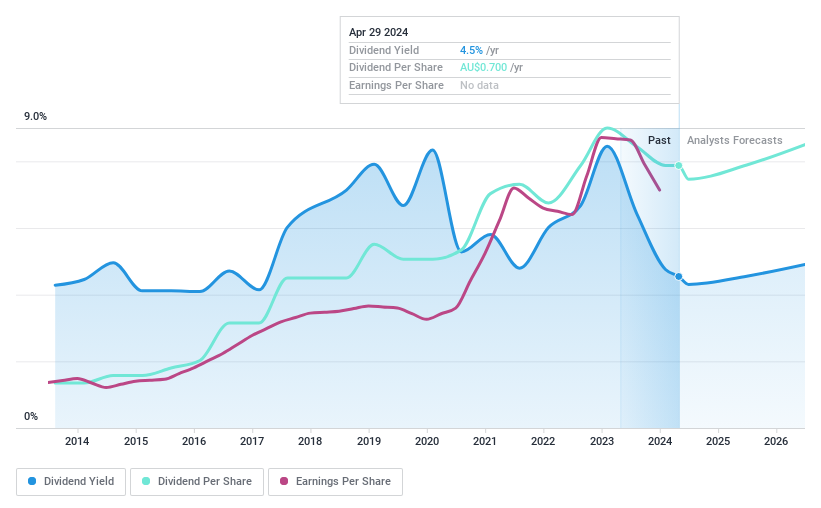

Dividend Yield: 5.2%

Nick Scali offers a consistent dividend yield of 5.19%, supported by a sound payout ratio of 67.9% and a cash payout ratio of 45.6%, ensuring dividends are well-covered by both earnings and cash flows. Despite its reliable dividend growth over the past decade, its yield trails behind the top quartile of Australian dividend stocks at 6.45%. Recent equity offerings totaling A$60 million may impact shareholder value but reflect potential for strategic expansion or debt management.

Delve into the full analysis dividend report here for a deeper understanding of Nick Scali.

Our valuation report here indicates Nick Scali may be undervalued.

Sonic Healthcare

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited provides medical diagnostic services to a range of healthcare providers and their patients, with a market capitalization of approximately A$12.41 billion.

Operations: Sonic Healthcare Limited generates revenue primarily through its laboratory and radiology services, with A$7.12 billion from laboratory operations and A$0.84 billion from radiology.

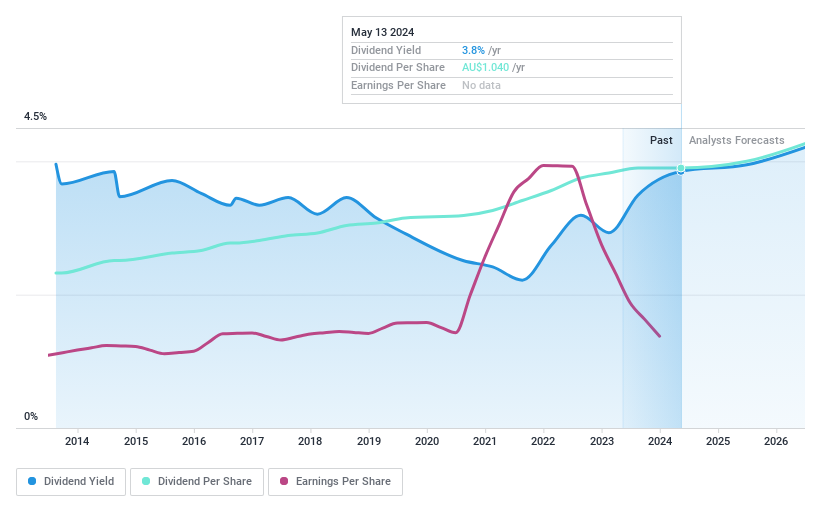

Dividend Yield: 4%

Sonic Healthcare's dividend yield of 4.02% lags behind Australia’s top dividend payers, with a high payout ratio of 98% indicating potential risk in sustainability despite a stable ten-year track record. Its dividends are covered by cash flows at 87.5%, but earnings coverage is weak. Recent M&A activity could impact financial stability, as it eyes an A$800 million acquisition that may stretch its resources further, given its significant market presence and focus on international expansion.

Make It Happen

Embark on your investment journey to our 27 Top ASX Dividend Stocks selection here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CKF ASX:NCK and ASX:SHL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com