Colgate (CL) Q2 Earnings & Sales Miss Estimates, Decline Y/Y

Colgate-Palmolive Company CL reported dismal second-quarter 2019 results, wherein the top and bottom lines missed the Zacks Consensus Estimate. Both the metrics also dipped year over year. Unfavorable foreign currency mainly marred the company’s results. Nevertheless, the company reiterated its guidance for 2019.

Adjusted earnings of 72 cents per share dropped 6% from the prior-year quarter and lagged the Zacks Consensus Estimate by a penny. Including one-time items, earnings were 68 cents per share compared with 73 cents in the year-ago period.

Total net sales of $3,866 million dipped 0.5% from the year-ago period and slightly missed the Zacks Consensus Estimate of $3,867 million. This year-over-year decline can be primarily attributed to negative currency impact of 4.5%. However, this downside was somewhat offset by a 1% increase in global unit volume and a 3% rise in pricing.

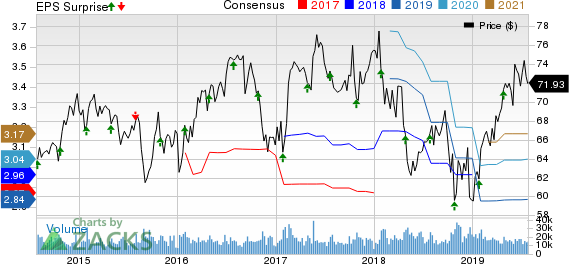

Colgate-Palmolive Company Price, Consensus and EPS Surprise

Colgate-Palmolive Company price-consensus-eps-surprise-chart | Colgate-Palmolive Company Quote

On an organic basis, the company’s sales improved 4% driven by higher volumes and pricing. In fact, the company witnessed positive pricing in its all operating divisions.

Deeper Insight

An adjusted gross profit margin of 59.6% expanded 30 basis points (bps) from the prior-year quarter due to increased pricing and gains from cost savings under funding-the-growth program. Growth was somewhat negated by escalated raw and packaging material expenses, including foreign currency transaction costs.

In the reported quarter, adjusted operating profit of $928 million fell 8%, while adjusted operating margin contracted 180 bps to 24%. Operating margin was mainly impacted by a 200-bps increase in adjusted selling, general & administrative expenses, as a percentage of sales, partly offset by higher gross margin.

Year to date, Colgate’s market share of manual toothbrushes has reached 31.7%. Further, the company has continued with its leadership in the global toothpaste market, with 41.4% market share year to date.

Segmental Discussion

North America’s net sales (22% of total sales) improved 2.5%, reflecting a 2% rise in unit volume and a 1% increase in pricing, offset by currency headwinds of 0.5%. On an organic basis, sales improved 3%.

Latin America’s net sales (24% of total sales) slipped 0.5% year over year due to a negative currency impact of 7.5%. However, unit volume growth of 1.5% and price increases of 5.5% partly negated the decline in sales. During the quarter under review, volume benefited from gains in Mexico and Colombia, partly offset by a decline in Brazil. On an organic basis, sales were up 7%.

Europe’s net sales (15% of total sales) dropped 5% year over year due to 6% adverse impact of unfavorable currency exchange, somewhat offset by flat unit volume and a 1% rise in pricing. Volume benefited from gains in Spain and Greece, offset by decline in Germany and France. Further, organic sales in Europe inched up 1%.

The Asia Pacific’s net sales (17% of total sales) declined 4%, attributable to a 1.5% decline in unit volume and 3% impact of unfavorable currency exchange while pricing inched up 0.5%. Lower volume in Greater China was somewhat compensated with volume growth in Thailand. On an organic basis, sales for the Asia Pacific declined 1%.

Africa/Eurasia’s net sales (6% of total sales) edged up 0.5% year over year owing to a 3.5% rise in unit volume and a 6% increase in pricing, offset by currency headwinds of 9%. During the quarter, volume gains in Russia and the Gulf States were partly negated by declines in Saudi Arabia and South Africa. Organic sales for Africa/Eurasia improved 9.5%.

Hill’s Pet Nutrition’s net sales (16% of total sales) rose 3.5% from the year-ago quarter. Results gained from a 2% increase in unit volume and a 4% rise in pricing, offset by a 2.5% negative impact of currency. Volume growth in the United States, South Africa and Western Europe were partly negated by soft volumes in Japan. On an organic basis, sales rose 6%.

Other Financial Details

Colgate ended second-quarter 2019 with cash and cash equivalents of $863 million, and total debt of $6,645 million. Net cash provided by operating activities amounted to $1,249 million as of Jun 30, 2019.

Outlook

Going into 2019, the company expects top-line gains backed by accelerated investments in its brands, higher pricing and strong innovation. Further, the company is on track to expand its premium skin care portfolio with the agreement to buy the Filorga skin care business. This impact is not included in the guidance.

Driven by these efforts, the company reiterated sales and earnings view for 2019. It expects sales to be between flat and up low-single digit on current spot rates. Moreover, it estimates organic sales growth of 2-4% for the current year. Management expects top-line results to come toward the higher end of its guided range.

Moreover, the company expects gross margin expansion in 2019, both on a GAAP and adjusted basis. On a GAAP basis, earnings per share for 2019 are likely to decline in a low-single-digit. Meanwhile, adjusted earnings per share are expected to decline in a mid-single-digit.

Price Performance

Year to date, this Zacks Rank #2 (Buy) stock has gained 20.9% compared with the industry’s 18% rally.

3 Other Key Picks

The Estee Lauder Companies Inc. EL has a long-term earnings growth rate of 13% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PepsiCo Inc. PEP, with a long-term earnings growth rate of 7%, currently carries a Zacks Rank #2.

Church & Dwight Co. Inc. CHD has a Zacks Rank #2 and an impressive long-term earnings growth rate of 8.6%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pepsico, Inc. (PEP) : Free Stock Analysis Report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance