CNO Financial (CNO) Up 2% on Q2 Earnings Beat on Lower Costs

Shares of CNO Financial Group, Inc. CNO have gained 2.2% since second-quarter 2022 earnings announcement on Aug 1. Earnings outpaced the Zacks Consensus Estimate and were aided by a strong variable investment income, stable underlying insurance product margins, and a decline in benefits and expenses. The quarter also witnessed steep growth in new money rates and improved earned yields, which in turn, benefited the net investment income of CNO. However, lower insurance policy income hampered the top line of the insurer in the quarter under review.

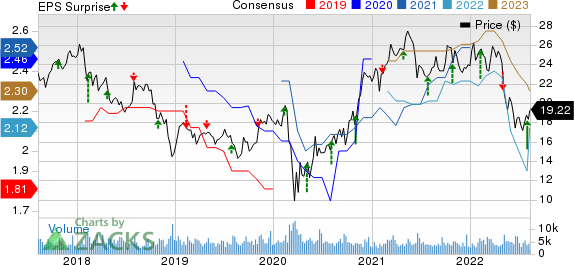

CNO Financial Group, Inc. Price, Consensus and EPS Surprise

CNO Financial Group, Inc. price-consensus-eps-surprise-chart | CNO Financial Group, Inc. Quote

Q2 Update

CNO Financial reported second-quarter 2022 adjusted earnings per share (EPS) of 85 cents, which outpaced the Zacks Consensus Estimate by a whopping 80.9%. The bottom line climbed 29% year over year.

Total revenues amounted to $855 million, which dropped 20.3% year over year. The top line lagged the consensus mark by 4.9%.

Total insurance policy income of $625.6 million dipped 1% year over year in the second quarter.

Net investment income improved 8% year over year to $291.1 million.

Annuity collected premiums of $435 million climbed 26% year over year in the quarter under review.

New annualized premiums for health and life products dropped 5% year over year to $88.8 million.

Total benefits and expenses of $679.6 million decreased 30% year over year, attributable to reduced insurance policy benefits and other operating costs and expenses.

Financial Update (as of Jun 30, 2022)

CNO Financial exited the second quarter with unrestricted cash and cash equivalents of $567.2 million, which tumbled 13.1% year over year.

Total assets of $33.8 billion fell 4.7% year over year.

Total shareholders’ equity plunged 58.5% year over year to $2,212 million.

Book value per share came in at $19.27, which slumped 53.3% year over year.

Operating return on equity improved 120 basis points (bps) year over year to 10.3%.

Debt-to-capital ratio of 34% deteriorated 1,640 bps year over year at the second-quarter end.

Share Repurchase and Dividend Update

CNO Financial rewarded $76.5 million to its shareholders through share buybacks of $60 million and dividends worth $16.5 million.

2022 Outlook

Management forecasts growth in sales this year.

Investment income, allocated to products, is anticipated to stay relatively flat to modestly up, while the earlier view for the metric was to be relatively flat. Investment income, not allocated to products, is likely to remain lower than the 2021 figure.

Fee income is predicted to witness an uptrend in 2022 from the 2021 level, with the metric remaining seasonally softer in the third quarter of 2022 (on a sequential basis) and gradually picking up in the fourth quarter.

Expenses (excluding significant items) are estimated to be decently higher than the 2021 figure.

Free cash flow is expected to be lower than the 2021 level.

Zacks Rank

CNO Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Some Other Insurers

Of the insurance industry players that have reported second-quarter results so far, the bottom-line results of Chubb Limited CB, Aflac Incorporated AFL and First American Financial Corporation FAF beat the respective Zacks Consensus Estimate for earnings.

Chubb Limited’s second-quarter 2022 core operating income of $2.40 per share outpaced the Zacks Consensus Estimate by about 17%. The bottom line improved 16% from the year-ago quarter’s level. Net premiums written of Chubb improved 7.9% year over year to $10.3 billion in the quarter. CB’s adjusted net investment income was a record $950 million, up 0.5%.

Aflac reported second-quarter 2022 adjusted EPS of $1.46, which beat the Zacks Consensus Estimate by 13.2%. The bottom line, however, declined 8.2% year over year. Total revenues of Aflac amounted to $5,400 million, which decreased 2.9% year over year in the second quarter. Yet, the top line surpassed the consensus mark by 12.3%. AFL’s adjusted net investment income of $920 million fell 6.4% year over year in the quarter under review.

First American Financial’s second-quarter 2022 operating income per share of $1.97 beat the Zacks Consensus Estimate by 21.6%. Also, the bottom line declined 7.5% year over year. FAF’s revenues of $2.1 billion declined 9.3 year over year due to lower direct premiums and escrow fees, and net investment losses. The top line missed the Zacks Consensus Estimate by 4%. Net investment income of FAF decreased 5.4% to $53 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNO Financial Group, Inc. (CNO) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

First American Financial Corporation (FAF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance