CNH Industrial (CNHI) Q1 Earnings & Revenues Miss Estimates

CNH Industrial N.V. CNHI posted first-quarter 2020 adjusted loss per share of 6 cents, as against the Zacks Consensus Estimate of earnings of 7 cents per share. In the prior-year quarter, adjusted earnings were 18 cents per share. This decline primarily resulted from lower revenues in the Agricultural Equipment, Construction Equipment, Commercial and Specialty vehicles, and Powertrain segments.

The company reported adjusted net loss of $54 million, as against the prior-year quarter’s net income of $264 million.

Consolidated revenues declined 15% from the year-ago quarter level to $5,461 million, missing the Zacks Consensus Estimate of $5,751 million. The company’s net sales for Industrial Activities came in at $5 billion, down 17% year on year. Adjusted EBITDA (earnings before interest, tax, depreciation and amortization) was $245 million in the first quarter, marking a slump of $722 million, year on year.

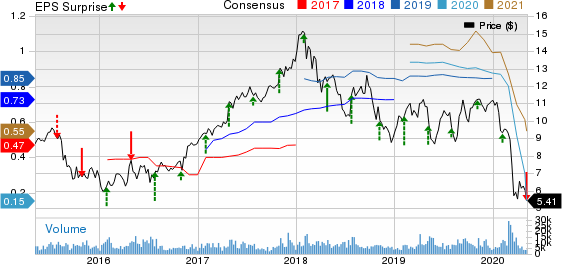

CNH Industrial NV Price, Consensus and EPS Surprise

CNH Industrial NV price-consensus-eps-surprise-chart | CNH Industrial NV Quote

Segmental Performances

Net sales in the Agricultural Equipment segment declined 9.9% year over year to $2.24 billion in the quarter on industry volume deceleration. Moreover, the segment’s adjusted EBIT came in at $24 million, considerably down 85.7% from the year-ago quarter, thanks to unfavorable volume and mix, lower wholesale volume and inflated product costs.

The Construction Equipment segment’s sales slid 34.1% year over year to $422 million in first-quarter 2020. This decline chiefly resulted from deteriorating market conditions across all regions amid the coronavirus crisis. Further, the segment incurred a pretax loss of $83 million, as against the income of $13 million recorded in the prior-year quarter, hurt by elevated product costs due to plant shutdowns on the coronavirus scare.

During the March-end quarter, revenues in Commercial and Specialty vehicles fell 16.3% year over year to $2.02 billion on market slowdown in Europe due to the coronavirus pandemic. The segment incurred pretax loss of $56 million, as against the income of $51 million recorded in the prior-year quarter. This downside primarily stemmed from unfavorable foreign-currency translation, lower volumes and higher product costs.

The Powertrain segment’s quarterly revenues declined 27.3% year over year to $753 million on lower sales volume across regions. The segment’s adjusted EBIT was $31 million, down from the year-ago quarter’s $96 million due to unfavorable volume and mix.

The Financial Services segment revenues climbed 3.2% year over year to $489 million in the first quarter on higher used equipment sales in North America. Adjusted EBIT was $110 million, down from the year-earlier period’s $131 million.

Financial Details

CNH Industrial had cash and cash equivalents of $3.85 billion as of Mar 31, 2020, compared with $4.87 billion as of Dec 31, 2019. The company’s debt was $23.52 billion as of Mar 31, 2020, compared with $24.85 billion as of Dec 31, 2019.

As of Mar 31, 2020, CNH Industrial’s net cash used in industrial activities was $1,373 million compared with net cash used of $814 million in the prior-year quarter.

CNH Industrial suspended its quarterly cash dividend due to the coronavirus pandemic-related uncertainties.

2020 Outlook

CNH Industrial scrapped the 2020 guidance as it expects the coronavirus pandemic’s impact to strain its operations in the days to come.

Zacks Rank & Stocks to Consider

Currently, CNH Industrial carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Veoneer, Inc. VNE, Unique Fabricating, Inc. UFAB and Modine Manufacturing Company MOD, each carrying a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

CNH Industrial NV (CNHI) : Free Stock Analysis Report

Unique Fabricating Inc (UFAB) : Free Stock Analysis Report

Veoneer Inc (VNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance