CNA Financial (CNA) Q1 Earnings Miss Estimates, Down Y/Y

CNA Financial Corporation CNA reported first-quarter 2020 core earnings of 40 cents per share, which lagged the Zacks Consensus Estimate by 28.6%. The bottom line declined 65.8% year over year.

The quarter saw solid underwriting performance including improvement in combined ratio as well as net written premium growth. However, financial market volatility attributable to COVID-19 outbreak resulted in unfavorable returns on alternative investments and equity holdings. Charges from COVID-19 outbreak amounted to $15 million, pretax.

Behind First-Quarter Headlines

Net written premiums at Property & Casualty Operations improved 3.2% year over year to $1.8 billion.

Net investment income plunged 40% year over year to $279 million. The decline was attributable to loss from limited partnership and common stock investments during the period, partially offset by stable earnings from fixed-income and other investments.

Property & Casualty combined ratio improved 30 basis points (bps) year over year to 97.5%.

Book value excluding AOCI as of Mar 31, 2020, was $42.12 per share, down 6% from Dec 31, 2019.

Core return on equity was 3.7%, down 700 bps.

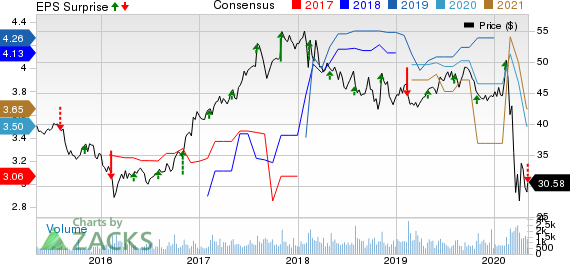

CNA Financial Corporation Price, Consensus and EPS Surprise

CNA Financial Corporation price-consensus-eps-surprise-chart | CNA Financial Corporation Quote

Segmental Results

Specialty’s net written premiums decreased 1% year over year to $694 million, attributable to higher level of ceded reinsurance. Combined ratio improved 100 bps to 91.3%.

Commercial’s net written premiums increased 12% year over year to $950 million, driven by higher new business and favorable rates. Combined ratio deteriorated 60 bps to 101.9%.

International’s net written premiums decreased 15% year over year to $219 million, attributable to a change in the timing of ceded reinsurance contract renewals, and the continued impact of the strategic exit from certain Lloyd's business classes, offset by growth in Canada. Combined ratio improved 200 bps to 99.9%.

Life & Group’s total operating revenues were $335 million, in line with the year-ago quarter’s figure. Core income was $4 million, down 60% year over year.

Corporate & Other’s core loss of $18 million was wider than loss of $6 million incurred in the prior-year period, attributable to lower amortization of deferred gain related to the A&EP Loss Portfolio Transfer.

Dividend Update

CNA Financial announced dividend of 37 cents per share. The dividend will be paid out on Jun 4, 2020, to stockholders of record as of May 18.

Zacks Rank & Other Releases

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the insurance industry that have reported first-quarter earnings so far, the bottom line of Brown & Brown, Inc. BRO beat the Zacks Consensus Estimate while that of RLI Corp. RLI and Travelers Companies TRV missed the same.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance