We Close Out the Week on Fairly Optimistic Tone in Equities

The strong consensus view is that we will see a cut in July, with the probability of a cut here, dropping a touch to 78.7% probability this morning, after having adjusted and reacted to the news Trump was suspending implementing the 5% tariff on Mexico. We can look across the fed fund futures curve and see a move of some 6-basis points higher in the contracts past September, with US 2-year Treasuries gaining 4bp, with 10-year Treasury futures up 3bp – this needs close attention as buyers are starting to emerge. The USD is up smalls vs all G10 FX, except the NOK, which is benefiting from a 0.3% gain in Brent futures.

The Mexican peso finds relief buying

In FX markets, most of the focus has been on USDMXN though, and a 1.9% sell-off will in no way surprise, as before Friday, it was widely seen that Trump would lift tariffs on its Central American neighbour. Nasdaq and S&P 500 futures are both up 0.3%, indicating we should see the S&P 500 cash opening around 2880 and a possible test the 10 and 16 May high 2891/2 in the near-term, but we see both futures market drift toward the flat line. The Nikkei 225 (+1.2%) is also overlooking to Friday’s sell-off in USDJPY, with the Hang Seng 1.9% higher.

Mexico clearly made the right moves, and Trump felt appeased, although there is no mistaking that the administration would have seen the deterioration in broad financial conditions through May as a litmus test. When you look to alter the dynamic of decades of globalisation and supply chains and accelerate the fragmentation of relationships, the market will tell you how they feel about it, and they have. We would have seen higher implied volatility if it weren’t for the fact the Fed, ECB, RBA, and others, have expressed a firm view that they would all act appropriately to maintain the economic expansion.

Interestingly, USDMXN 1-week implied volatility has dropped a touch, but at 14.05% it suggests options traders are still very much on edge and pricing in punchy moves through this period. It begs the question of whether today’s gap in USDMXN will be filled and by when. Certainly one to watch, although, whether we can use this cross as a guide around trade tensions is becoming less clear, and perhaps we need to revert to USDCNH as the focus is back on the China-US relationship and whether we see tariffs of between 10% to 25% on the $300b tranche of Chinese exports. Comments from PBoC governor Yi Gang (in a Bloomberg interview) that there is “obviously a link between the trade war and the movement in the renminbi” have suggested its back to watching this cross.

USDCNH ready to break out?

USDCNH has seen small buying on the open of the new week, where the pair is eyeing a breakout of the 6.9500 to 6.9000 consolidation range (see chart below). Options traders see upside, with USDCNH 1-week risk reversals (the difference between options call volatility over put volatility) sits at 0.4175, having come off a high of 1.5 on 9 May and a what was a huge belief that USDCNH trades higher. We saw China’s May trade data far earlier in the session than usual, and the numbers will only add weight to those seeing further economic fragility. A 8.5% decline in imports throws up increased concerns about the China demand story, and while we saw a better-than-expected 1.1% gain in exports, although it’s still not going to excite.

US Treasury Secretary, Steven Mnuchin, tweeted overnight that he had a constructive and candid conversation with PBoC governor Yi Gang at weekend G20 finance ministers meeting, and that the focus should turn to the G20 leaders’ summit on 28/29 June. We await this meeting intently.

Where to for the greenback?

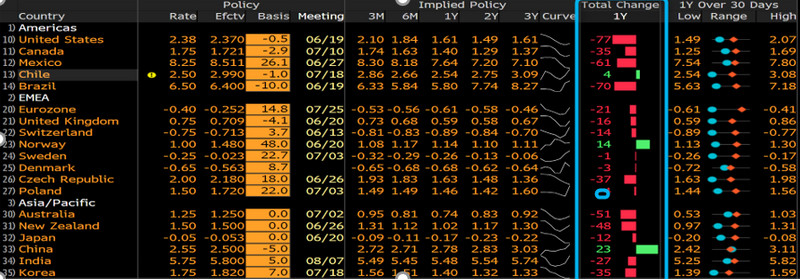

The question I find fascinating is with such aggressive easing priced into global rates/swaps markets and the front-end of bond markets, is where does the USD trade from here? Consider over the coming 12-months swaps markets are pricing 77bp (over three) of rate cuts in the US, 35 bp in Canada, 21bp in Europe (as well as revisiting QE), 51bp in Australia and 48bp in New Zealand. I can go on, but the market has made up its mind on the global economy and demanding action.

Granted, the likes of the RBA and RBNZ have already started its easing cycle, and we should consider QE in Europe ahead of rate cuts, and the impact balance sheet expansion has on a currency. But the desire for a weaker currency, as a by-product from easing, is front and centre, and has led many to refocus on the notion of currency wars. It will be a huge theme in the G20 leaders’ summit, but there is little doubt that the world could use a weaker USD, although with the world moving in alignment that is in no way guaranteed.

The USD tends to head lower around five weeks or so before a Fed rate cut, and that may play out this time around. The USD also declines if traders feel the US economy is the issue at the core, and by not putting up tariffs on Mexico that risk has been modestly hosed down. However, the risk remains and the aside from tweets and statements on trade, the 19 June FOMC meeting and the G20 meeting.

Chris Weston, Head of Research at Pepperstone

Sign up here for my Daily Fix or Start trading now

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance