Clearway Energy (CWEN) Q1 Earnings Beat Estimates, Sales Lag

Clearway Energy Inc. CWEN reported first-quarter 2021 earnings of 31 cents per share against the Zacks Consensus Estimate of a loss of 37 cents. In the prior-year quarter, the company incurred a loss of 24 cents per share.

Total Revenues

The company's total revenues for first-quarter 2021 were $237 million, which lagged the Zacks Consensus Estimate of $244 million by 2.9%. Total revenues also dropped 8.1% year over year.

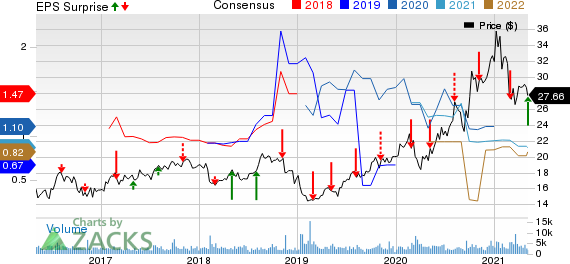

Clearway Energy, Inc. Price, Consensus and EPS Surprise

Clearway Energy, Inc. price-consensus-eps-surprise-chart | Clearway Energy, Inc. Quote

Highlights of the Release

Total operating expenses for first-quarter 2021 amounted to $251 million, increasing 21.8% year over year.

Interest expenses for the quarter were $45 million, decreasing 73% year over year.

Due to the COVID-19 pandemic, the company has implemented adequate measures to maintain safe and reliable operations at its facilities.

Financial Position

It had cash and cash equivalents of $144 million as of Mar 31, 2021, down from $268 million on Dec 31, 2020. Total liquidity as of Mar 31, 2021 was $831 million, down from the Dec 31, 2020 level of $894 million.

Long-term debt as of Mar 31, 2021 was $7,463 million compared with $6,585 million as of Dec 31, 2020.

The company's net cash flow from operating activities for first-quarter 2021 was $47 million compared with $87 million in year-ago period.

Guidance

Clearway Energy has reaffirmed its 2021 cash available for distribution guidance of $325 million.

Zacks Rank

The company currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

NextEra Energy Partners, LP NEP reported earnings of $2.66 per unit for first-quarter 2021, beating the Zacks Consensus Estimate of 39 cents by 582.1%.

Enphase Energy, Inc. ENPH reported first-quarter 2021 adjusted earnings of 56 cents per share, which surpassed the Zacks Consensus Estimate of 41 cents by 36.6%.

SolarEdge Technologies SEDG came out with first-quarter earnings of 98 cents per share, which lagged the Zacks Consensus Estimate of $1.01 by 2.9%.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year’s 2020 Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

NextEra Energy Partners, LP (NEP) : Free Stock Analysis Report

Clearway Energy, Inc. (CWEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance