Citizens Financial's (CFG) Q3 Earnings Beat, Expenses Rise

Citizens Financial Group CFG delivered a positive earnings surprise of 3.3% in third-quarter 2018, riding on higher revenues. Adjusted earnings per share of 93 cents topped the Zacks Consensus Estimate of 90 cents. Also, the bottom line compared favorably with 68 cents per share reported in the prior-year quarter.

The company experienced continued expansion of margins and loan growth, which aided higher revenues. Also, higher fee income was another tailwind. However, increase in expenses and provisions were main undermining factors.

After considering non-recurring items, the company reported net income of $436 million or 91 cents per share compared with $341 million or 68 cents recorded in the year-ago quarter.

Revenues & Loans Increase, Expenses Escalate

Total revenues in the quarter were $1.56 billion, which lagged the Zacks Consensus Estimate of $1.57 billion. However, the reported figure was up 8% year over year. On an underlying basis, total revenues increased 7%.

Citizens Financial’s net interest income increased 8% year over year to $1.15 billion. The rise was primarily attributable to average loan growth and improved margin. In addition, net interest margin expanded 14 basis points year over year to 3.19%.

Non-interest income increased 9% to $416 million. The rise was due to growth in card fees, foreign exchange, interest rate products, along with trust and investment services fees. On an underlying basis, non-interest income climbed 3%.

Non-interest expenses were up 6% year over year to $910 million. The increase reflects higher salary and employee benefits tied to higher revenue-based compensation, along with the impact of strategic growth initiatives. Expenses increased 2% on an adjusted basis.

Efficiency ratio declined to 58% in the third quarter from 59% in the prior-year quarter. Generally, lower ratio is indicative of the bank’s improved efficiency.

As of Sep 30, 2018, period-end total loan and lease balances increased nearly 4% year over year to $114.7 billion and total deposits grew 3% from the prior-quarter quarter to $117.1 billion.

Credit Quality: A Mixed Bag

As of Sep 30, 2018, net charge-offs in the quarter increased 32% year over year to $86 million. Allowance for loan and lease losses increased 1% to $1.24 billion on a year-over-year basis. Also, provision for credit losses increased 8% to $78 million.

However, total non-performing loans and leases were down 11% to $832 million.

Capital Position

Citizens Financial remained well capitalized in the quarter. As of Sep 30, 2018, Common Equity Tier 1 capital ratio was 10.8%, down from 11.1% on an annual basis. Further, Tier 1 leverage ratio came in at 9.9%, flat year over year. Total Capital ratio was 13.4% compared with 13.8% in the prior-year quarter.

Capital Deployment Update

As part of its 2018 Capital Plan, the company repurchased $400 million of common stock during the quarter. Notably, including common stock dividends, it returned $529 million to its shareholders.

Other Developments

Citizens Financial launched the next phase of its Tapping Our Potential (TOP) efficiency program that aims at driving continuous improvement in overall efficiency and effectiveness of the organization, while self-funding investments to drive future growth. The new TOP V program is expected to deliver pre-tax expense and revenue enhancements of nearly $90-$100 million by the end of 2019.

Also, TOP IV Program initiatives are largely complete, with the company on track to achieve run-rate pre-tax benefit of approximately $105-$110 million by 2018-end.

Our Viewpoint

Citizens Financial’s results highlight a strong quarter. We are further optimistic as the company continues to make investments in technology in order to improve customers’ experience. Further, with a diversified traditional banking platform, Citizens Financial is well poised to benefit from the recovery of economies, wherein it has a strong footprint. Also, its progress in TOP programs and balance sheet optimization initiatives bodes well for long-term growth.

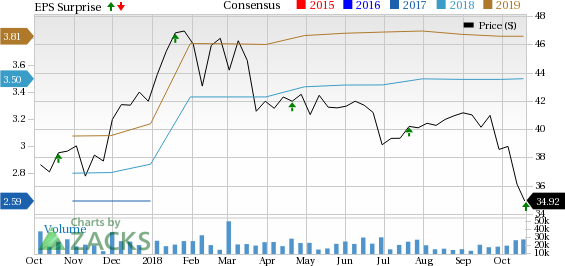

Citizens Financial Group, Inc. Price, Consensus and EPS Surprise

Citizens Financial Group, Inc. Price, Consensus and EPS Surprise | Citizens Financial Group, Inc. Quote

Citizens Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Texas Capital Bancshares Inc. TCBI reported a negative earnings surprise of 4.1% in third-quarter 2018. Earnings per share of $1.65 lagged the Zacks Consensus Estimate of $1.72. However, the results compare favorably with $1.12 recorded in the prior-year quarter.

M&T Bank Corporation MTB reported net operating earnings of $3.56 per share in third-quarter 2018, surpassing the Zacks Consensus Estimate of $3.35. Moreover, the bottom line improved 59% year over year.

Northern Trust Corporation’s NTRS third-quarter 2018 earnings per share of $1.58 missed the Zacks Consensus Estimate of $1.60, as a reflection of high costs. However, earnings compared favorably with $1.20 recorded in the year-ago quarter.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Texas Capital Bancshares, Inc. (TCBI) : Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance