Citi Lazada Credit Card Review — Is It Only Good For Lazada Shoppers?

From the unexpectedly popular UOB KrisFlyer card to the newly introduced GrabPay credit card, there have been quite a few branded credit cards launched in the market. Here’s one more to add to the list: the Citi Lazada card.

As you can probably guess, this card targets those who shop on Lazada. That’s a lot of people: according to a report by Statista, Lazada is second to Shopee as the top e-commerce site in Singapore with more than 7 million monthly web visits in the first quarter of 2021.

In a nutshell, the Citi Lazada card offers a whopping 10X rewards ($1 = 4 miles) on Lazada purchases, and 5X ($1 = 2 miles) rewards for other key spending categories like dining, travel, entertainment and transport.

Is the Citi Lazada card really a godsend for Laz-addicts, or did they literally “play it up”? Here’s our take on the card.

Citi Lazada credit card overview

First, let’s look at the card benefits like bonus reward points (or air miles):

Spending category | Citi Lazada card benefits | |

Lazada (excludes RedMart) | 10X rewards | 4 mpd |

Dining (fast food, restaurants, bars and clubs, caterers) | 5X rewards | 2 mpd |

Entertainment (movie tickets, Netflix, Spotify) | 5X rewards | 2 mpd |

Transport (bus, MRT, taxi, Grab, Gojek) | 5X rewards | 2 mpd |

Travel (flights, hotels, cruises, car rental, travel agencies, tour operators) | 5X rewards | 2 mpd |

Everything else | 1X rewards | 0.4mpd |

Citi Lazada credit card promotions

Those who sign up for the card get $250 welcome gift of Lazada and RedMart vouchers. This is provided you meet the minimum spend of $250 on Lazada.

You also get to benefit from the “Refer-a-friend” programme to get $120 cash for every successful credit card application.

Shipping Rebates on Lazada

Citi Lazada Credit Card

More Details

Key Features

Spend S$250 on Lazada & Redmart and get S$250 Lazada and RedMart Vouchers. T&Cs apply.

5X Reward Points on Dining, Travel, Entertainment and Commute

Earn 1X Reward Points on everything else, no cap

Accelerated Rewards capped at a maximum of 9,000 Points per statement month. Bank's T&Cs apply.

Enjoy complimentary shipping rebates with min. spend of S$50 per transaction on Lazada, capped at 4 shipping rebates per calendar month. T&Cs apply.

Enjoy the freedom of redeeming your Reward Points with Citi Pay with Points or for cash rebate via SMS.

Get exclusive offers on Lazada throughout the year for Citi Lazada Credit Cardholders only

Citi Lazada card review — for Lazada shopping

Pros

Up to 10X rewards / 4 mpd on Lazada shopping

Shipping rebate of $1.99 cash back when you spend at least $50 per transaction on Lazada, capped at 4 rebates per month

Cons

Bonus earn rate excludes RedMart orders (1X rewards / 0.4 mpd)

If you are planning to make big-ticket Lazada purchases, you could really benefit from the 10X rewards. Say you’re renovating and intend to shop for furniture and electronics online, you can consider this card to shop for what you need via Lazada.

Read also: Lazada Promo Codes — How to Use Lazada Voucher Codes in Singapore

Another huge caveat is that this 10X earn rate does not apply to RedMart orders. This is quite disappointing, and I’d imagine it to be a deal breaker for many.

In fact, RedMart orders don’t even earn the second tier of 5X rewards. It falls under “everything else” and only earns 1X rewards, which is very low.

Do note, however, that your earnings are capped at 9,000 bonus reward points per month.

Citi Lazada card review — for general spending

Pros

5X rewards / 2 mpd for public transport expenses incurred via SimplyGo

5X rewards / 2 mpd for travel

5X rewards / 2 mpd for dining includes bars and clubs too

Free travel insurance (must charge flight tickets to the card)

Cons

Mediocre earn rate of 5X rewards / 2 mpd on key spending categories

Shared rewards cap of 10,000 points

The Lazada perks may sound impressive, but those don’t mean much unless you shop heavily on that one platform.

For non-Lazada benefits, it’s a mediocre 5X rewards (or 2 mpd) earn rate for dining, travel, entertainment and transport (commute) and 1X rewards (0.4 mpd) for everything else.

If you can accept the earn rate, there are some noteworthy features of the card:

First of all, public transport fares incurred via SimplyGo are eligible for 5X rewards / 4 mpd under the “commute” category (MCC 4111 — local/suburban commuter passenger transportation — railroads, ferries, local water transportation).

Read also: SimplyGo (Formerly ABT) is Here. Should You Ditch Your EZLink Card?

Next, the “dining” spending category actually refers to what some other banks call “wine and dine”. That’s because it includes not just the usual eateries, restaurants and caterers, but drinking places like bars, lounges and night clubs as well.

Lastly, it’s (sort of) not bad for travel bookings as well (5X rewards / 4 mpd). If you charge your flight tickets to your card, you will also receive complimentary (albeit very basic) travel insurance coverage.

Citi Lazada card review — as an air miles card

If you’re a miles chaser, then 12X rewards / 4.8 mpd for Lazada used to be pretty impressive. Sadly, it was for a limited, promotional period only, and the usual 10X rewards (or 4 mpd) is very “meh”.

There are many other cards that offer the same 10X on broader spending categories (like online shopping in general), making it much easier to chock up points/miles.

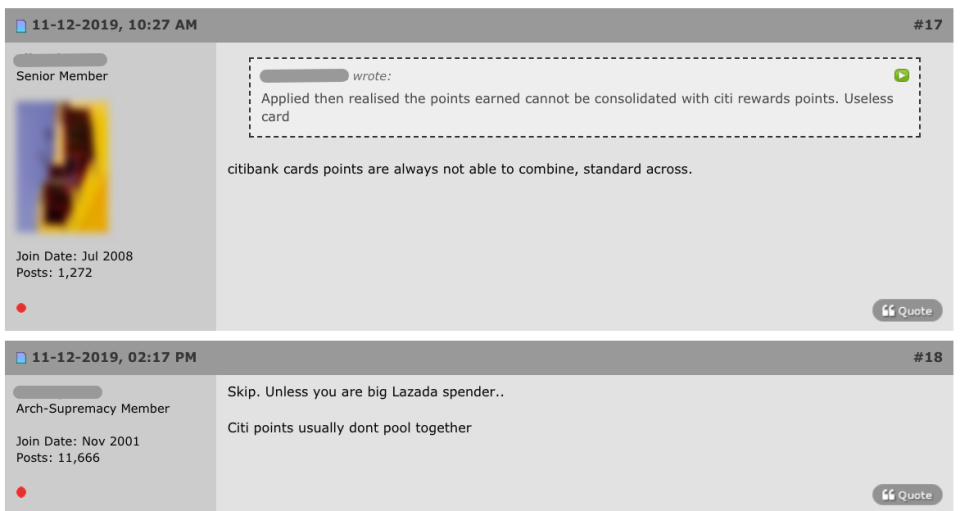

Another note: like all Citibank cards, the rewards earned from the Citi Lazada card must be redeemed on their own, and cannot be pooled together with other cards.

For those accumulating miles from multiple Citibank cards, this could mean paying more conversion fees.

Here’s an example: If you have points under both your Citi Rewards card and your Citi Lazada card accounts, you can’t pool them together and convert them to miles at one shot.

You’ll have to do the conversion and pay twice. Also, you must earn at least 25,000 on each card because that’s the minimum block conversion.

Although separating the redemptions is not unheard of, quite a few other banks like DBS and UOB actually do point pooling.

Read also: KrisFlyer Miles Redemption Guide — How to Start Playing the Miles Game in Singapore

Citi Lazada credit card for food delivery orders

The fact that this is a Citibank card means that it gets quite a lot of discount promo codes on any of the major food delivery platforms like GrabFood, foodpanda, Deliveroo and WhyQ. Still, by that virtue, there are other, better Citibank cards to apply for, like the Citi Cash Back+ Mastercard.

Conclusion — who should use the Citi Lazada credit card?

In my opinion, the Citi Lazada card is quite average. It’s not terrible, but for most of the key spending categories, there are better cards out there.

Alternatives to the Citi Lazada credit card

Citi Cash Back+ Mastercard

Straight up cashback is just better than rewards or points these days, which is why the Citi Cash Back+ Mastercard is excellent for your shopping and utilitarian habits. You get 1.6% unlimited cashback for nearly all spends, and this includes grocery shopping as well.

MoneySmart Exclusive

No Expiry on Cash Back Earned

Citi Cash Back+ Mastercard®

MoneySmart Exclusive:

Apply and spend $200 to get: $300 Cash OR Beats Studio Buds RED + $100 Cash (worth $319)

OR

Apply and spend $500 to get MORE: $350 Cash OR the NEW 10.2-inch Apple iPad Wi-Fi 64GB (worth $499) OR Beats Studio Buds RED + $100 Cash (worth $319)!

Valid until 19 Oct 2021

More Details

Cash Back Features

Flat 1.6% cashback on all your purchases, no minimum spend

No caps on the cashback you can earn, and cashback earned does not expire

Cashback earned will be stored and specified in the monthly statement

Redeem your cashback with the Citi Pay with Points feature via Citibank Online or the Citi Mobile App or SMS. Redemption requires 7 working days before it’s reflected on your statement

Cash rebates redemption: Send “RWDS last 4 digits of the card number ” to 72484 via SMS

Redemption values and codes: CSHBK10 for S$10, CSHBK20 for S$20, and CSHBK50 for S$50

For example, to redeem $10 cash rebate, the SMS should be: “RWDS XXXX CSHBK10”

General exclusions apply, for e.g. annual fees, instalments, bills, payments to educational, governmental, and financial institutions, insurance premiums, and more

Citi Rewards card

The most common comparison is with the Citi Rewards card, which offers 10X rewards / 4 mpd on all online spend (excluding travel). This means you can use it for not just Lazada, but RedMart and every other e-commerce site there is too. The rewards cap is the same, at 10,000 points per month.

Apply for the Citi Rewards Card here:

MoneySmart Exclusive

Earn Points for Online Spending

Citi Rewards Card

MoneySmart Exclusive:

Apply and spend $200 to get: $300 Cash OR Beats Studio Buds RED + $100 Cash (worth $319)

OR

Apply and spend $500 to get MORE: $350 Cash OR the NEW 10.2-inch Apple iPad Wi-Fi 64GB (worth $499) OR Beats Studio Buds RED + $100 Cash (worth $319)!

Valid until 19 Oct 2021

More Details

Key Features

10X Rewards on all online purchases (excludes travel-related transactions). Bank's T&Cs apply

10X Rewards on Ride-hailing, Shopping and Online spends. T&Cs apply

10X Citi Rewards program gives you an additional bonus of 9X Rewards points per S$1 spend on eligible categories on top of the base rate

10X Rewards capped at 10,000 Points per statement month and expires every 5 years

DBS Woman’s World card

The DBS Woman’s World card is another alternative to consider. This one offers 10X rewards for online purchases too, but in blocks of $5 spent only. If you travel often, the DBS Woman’s World card also gives you 3X rewards on overseas purchases.

The only thing is that the minimum income requirement for this card is $80,000 (instead of the entry-level $30,000).

Apply for the DBS Woman’s World Card here:

DBS Woman's World Card

More Details

Key Features

10 DBS rewards points per S$5 local and overseas online spend

3 DBS rewards points per S$5 overseas spend

1 DBS rewards point per S$5 spent on all other categories

Online hotel booking and staycation deals with Agoda and Klook

Beauty deals with Laneige, Skin Inc, Strip, Browhaus, High Brow etc.

Online shopping promotions with Fayth, Her Velvet Vase, The Closet Lover, and Senreve etc.

Activate SimplyGo to use your card as an EZ-Link. Bus and MRT fares are charged directly to your card, so you don’t even need to top-up or set up auto top-up arrangements

DBS Points earned can be redeemed for Apple products via the DBS Apple Rewards Store, NTUC, and Takashimaya vouchers, Golden Village movie tickets, and more

HSBC Revolution card

The HSBC Revolution card has similar earn rate of 5X rewards on dining, online and entertainment, but its key appeal lies in that there’s no rewards cap. If you intend to make really big-ticket online purchases — like order a $7,000 TV or something — then this one is better.

Apply for the HSBC Revolution Card here:

Online Promo

Earn Points for Everyday Spending

HSBC Revolution Credit Card

Online Promo:

Get up to $200 cashback for new HSBC cardmembers. Existing HSBC cardmembers receive $60 cashback. T&Cs apply.

Valid until 31 Oct 2021

More Details

Key Features

No annual credit card fees

Get 10X Rewards Points, equivalent to 4 air miles per dollar spent

Redeem your rewards points for home, dining, retail, travel, or charity cash vouchers online or offset cash rebates on transactions online via rewards catalogue or the HSBC mobile app

Travel Insurance: Enjoy up to S$300,000 coverage when you charge travel expenses to card

What do you think of the new Citi Lazada credit card? Tell us in the comments below.

* iPrice map of e-commerce in Singapore

Forum screenshots taken from Hardware Zone.

The post Citi Lazada Credit Card Review — Is It Only Good For Lazada Shoppers? appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Citi Lazada Credit Card Review — Is It Only Good For Lazada Shoppers? appeared first on MoneySmart.sg.

Original article: Citi Lazada Credit Card Review — Is It Only Good For Lazada Shoppers?.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance