Cisco Enters Chip Market: Should AVGO, INTC, ANET Take Note?

Cisco CSCO recently upped the ante in its network hardware business with Cisco Silicon One Q100 networking chip.

The new Silicon One Q100 networking processor functions as both switch and routing chip. It is enabled to transfer data at a faster rate and can be programmed as required.

The company also announced Cisco 8000 series routers, powered by the Silicon One Q100. The routers are designed to support 400 Gbps port rates and beyond, and offer high-performance with data transfer rate of 10.8 Terabits per second (or Tbps).

Moreover, Cisco aims to enhance Silicon One architecture to support 25 Tbps performance. This is anticipated to aid the company address evolving demands of web scale operators for higher bandwidth, amid increasing Internet traffic and proliferation of IoT.

The latest move challenges Broadcom AVGO, Intel INTC, Arista Networks ANET, and Juniper Networks JNPR, to name a few.

Cisco’s Transforming Business Model: A Key Catalyst

Traditionally, the company has utilized its own chips to develop the networking-equipment it sold. In a first, Cisco is selling standalone-chips and promoting a flexible take on open ecosystem.

Notably, with the new chip, the company attempts to provide customers with design-your-own network hardware. This is a major positive given that hyperscalers are increasingly looking to minimize data-center spending and develop in-house networking gear.

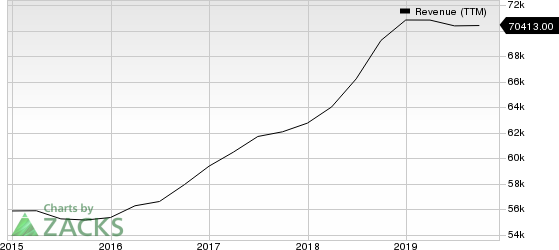

Cisco Systems, Inc. Revenue (TTM)

Cisco Systems, Inc. revenue-ttm | Cisco Systems, Inc. Quote

The company’s CEO, Chuck Robbins, known for propensity toward a business model focused on software and licensing, said, “We really want our customers to consume this technology in any way they want.”

Pure Play Chipmakers at Risk

Cisco’s new Silicon One Q100 is already gaining traction among prominent companies with significant data center operations including Microsoft MSFT, and Facebook FB.

Moreover, the company’s acquisitions of Leaba Semiconductor (2016), Luxtera (2018) and Acacia Communications (2019) are expected to strengthen its competence in this vertical.

The robust capabilities of the new chip are expected to challenge Broadcom’s growing presence in the networking chip market. Notably, Broadcom’s robust switch chips are utilized by networking equipment providers including Arista, Cisco’s key competitor in networking hardware market.

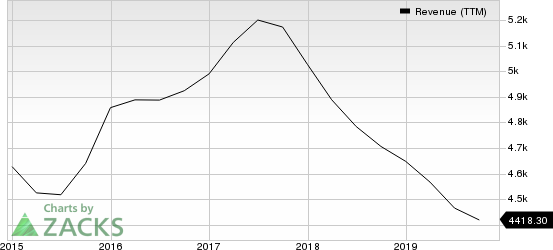

Broadcom Inc. Revenue (TTM)

Broadcom Inc. revenue-ttm | Broadcom Inc. Quote

Moreover, Cisco’s move also poses a threat to Intel, which offers switch chips. In fact, Intel acquired Barefoot Networks in a bid to strengthen its competitive position in the space.

Intel Corporation Revenue (TTM)

Intel Corporation revenue-ttm | Intel Corporation Quote

Arista and Juniper Under Threat

Although Arista does not offer standalone chips as of now, Cisco’s new chip can lure away its customers, which include Facebook and Microsoft. These companies are already using Cisco’s latest offering.

Arista Networks, Inc. Revenue (TTM)

Arista Networks, Inc. revenue-ttm | Arista Networks, Inc. Quote

The option to buy chips and not the entire network hardware, is likely to aid Cisco entice hyperscalers and web scale operators looking to develop in-house "white box" network equipment.

Per Raymond James’ analyst, “Arista typically derives nearly 30% of sales from web scale customers and Juniper typically obtains 20-25% of sales from this vertical."

Juniper Networks, Inc. Revenue (TTM)

Juniper Networks, Inc. revenue-ttm | Juniper Networks, Inc. Quote

Consequently, higher sales of Cisco’s Silicon One Q100 are likely to weigh the top line performance of both Arista and Juniper, in the days ahead.

Wrapping Up

In this era of cloud computing, the semiconductor industry has evolved beyond traditional processers to advanced networking chips, AI chips and more.

With the new chip, Cisco aims to simplify functioning of networks and boost operating efficiency to support evolving Internet traffic loads.

Cisco’s latest move is strategically in sync with growing clout of customized hardware among hyperscalers and cloud networking players, and increasing demand for sturdy hardware infrastructure to support ML, AI-based automated workloads, and manage exponential growth in data.

Moreover, accelerated deployment of 5G and growth in Internet traffic is expected to boost the adoption of the new chip.

Cisco’s innovation and expanding presence in a market dominated by Broadcom, bodes well for its market share. We believe Silicon One strategy is a step in the right direction as it opens up new avenues for the company.

Zacks Rank

While Cisco, Juniper and Broadcom currently carry a Zacks Rank #3 (Hold), Intel has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Meanwhile, Arista has a Zacks Rank #4 (Sell).

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Juniper Networks, Inc. (JNPR) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance