CIMB World Mastercard—MoneySmart Review 2023

Cashback credit cards are some of the most worthwhile cards to sign up for because they’re essentially giving you free money. Seeing as even fast food outlets charge for sauce these days, we’ll take whatever free stuff we can get.

But most cashback cards require you to satisfy minimum spending requirements and impose a cap on the amount of cashback you can earn each month—meaning you have to work for that “free” money.

The CIMB World MasterCard used to offer unlimited cashback of up to 2% with no minimum spending requirement.

But that has since changed as they decided to implement a minimum spending requirement of $1,000 in 2021. Bummer!

Let’s find out if the card is still worth your time.

CIMB World Mastercard—Is it MoneySmart? | |||||

| |||||

Pros—What we like | Cons—What we don’t like | ||||

– No annual fees for life | – You have to spend $1,000 a month to enjoy 2% cashback (1% otherwise) | ||||

The CIMB World Mastercard at a glance | |||||

Category | Our rating | The deets | |||

Earn rates: Cashback | ★★★☆☆ | – 2% unlimited cashback (with $1,000 minimum monthly spend) on these categories: Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods. | |||

Earn categories | ★★★★☆ | ||||

Annual fees and charges | ★★★★★ | No fees for life. | |||

Accessibility | ★★★☆☆ | Minimum income requirement: $30,000 (Singaporeans and PRs). | |||

Extras/periphery rewards | ★★☆☆☆ | – Mastercard Travel Rewards: Cashback or discounts in categories such as arts and culture, food, entertainment, shopping, sports and wellness, and travel. | |||

Sign-up bonus | ★★★☆☆ | Welcome gift: S$250 Cash via PayNow | |||

See our credit card ranking rubric to find out how we rank credit cards.

CIMB World Mastercard—MoneySmart Review 2023

1. CIMB World Mastercard Review

The CIMB World Mastercard is a cashback card that offers unlimited cashback of up to 2% when you spend money on dining, online food delivery, movies, digital entertainment, taxi rides, ride-hailing, automobile and luxury goods.

That’s not all. The card doesn’t charge any annual fees. So even if you one day decide it’s nothing more than a useless piece of plastic, you can continue holding on to it for free.

MoneySmart Exclusive

Unlimited 2% Cashback | LUCKY DRAW

CIMB World Mastercard

MoneySmart Exclusive:

[LUCKY DRAW]

Get S$250 Cash via PayNow when you apply and spend a min of S$988. T&Cs apply.

PLUS, stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart! T&Cs apply. Check out our past Lucky Draw winners here.

Valid until 31 Dec 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

2. CIMB World Mastercard Terms and Conditions

CIMB World Mastercard is an entry-level credit card, meaning you can sign up for it once you’ve snagged your first job, provided it pays you at least $30,000 per annum.

CIMB World Mastercard | |

Annual Fee | None! |

Annual Fee Waiver | Not needed. |

Supplementary Card Annual Fee | None! |

Interest Fee Period | 23 days |

Annual Interest Rate | 27.8% |

Late Payment Fee | $100 |

Minimum Monthly Repayment | 3% or $50, whichever is higher |

Foreign Currency Transaction Fee | 3% |

Cash Advance Transaction Fee | 8% or S$15, whichever is higher |

Overlimit Fee | S$50 or 5% of the excess amount, whichever is higher. |

Minimum Income | $30,000 (Singaporean / PR) |

Card Association | Mastercard |

Contactless Payment | Mastercard PayPass |

Is the CIMB World Mastercard open to foreigners?

It seems like CIMB is only opening their CIMB World Mastercard to Singaporeans and PRs as main cardholders. However, foreigners can hold supplementary cards.

They don’t explicitly state that foreigners aren’t eligible to be principal cardholders, but they did state that the minimum annual income of $30,000 to apply is for Singaporeans and Singapore PRs, with no mention of foreigners. I trawled their website and found this statement under the “Requirements” section:

“A photocopy of both sides of an NRIC for both Principal and Supplementary Card applicants (if any) OR a photocopy of a valid passport for foreign Supplementary Card applicants (if any).”

So I think it’s safe to conclude that Singaporeans and PRs can hold main card or supplementary cards, while foreigners can only hold supplementary cards.

Do note that the eligibility age also differs: 21 – 70 years old for principal cardholders, and a lower minimum age of 18 years old for supplementary ones.

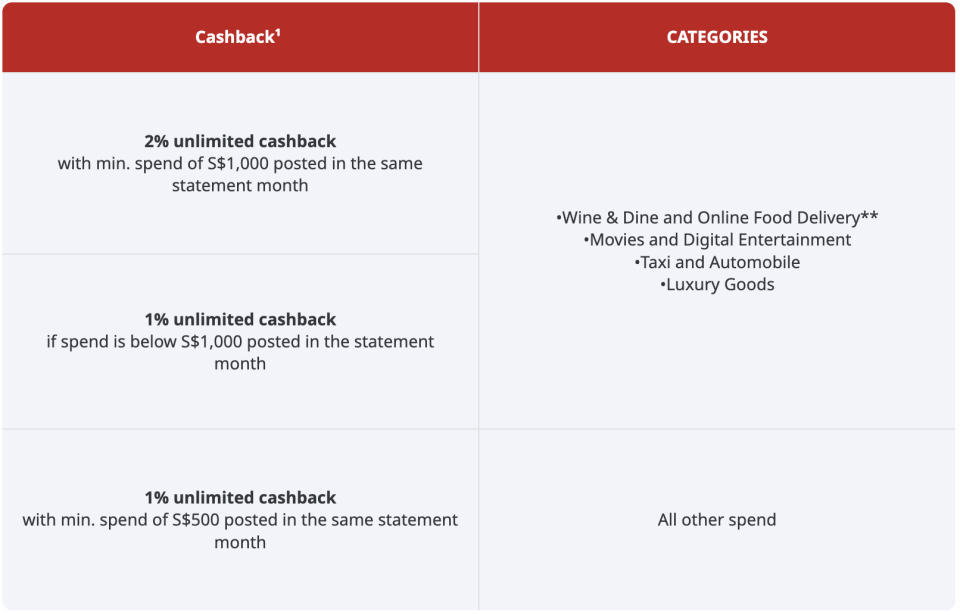

3. CIMB World Mastercard Cashback

The CIMB World Mastercard gives you the chance to earn up to 2% cashback when you spend locally or overseas in the following categories:

Dining–Most eateries except wedding banquets or hotels

Online food delivery–Only Deliveroo, Foodpanda, GrabFood (Grab transactions under MCC 5814 classification – Fast Food Restaurants only), WhyQ and AirAsia Food.

Movies and digital entertainment–audiovisual media, games and other digital goods, theatres. But note that if you are paying for certain merchants (e.g. Netflix, Spotify, Disney+, Amazon Prime Video) through subscriptions with Starhub and Singtel, these aren’t eligible.

Taxi rides—limousines are included, if you want to lead the high life.

Ride-hailing

Automobile–automotive repair and service shops, vehicle sales and supply stores

Luxury goods–Stores classified as selling precious stones and metals, watches, jewellery, clocks, silverware, leather goods, luggage

Now for the hardest part: To clinch the maximum cashback of 2%, you must satisfy the minimum spending requirement of $1,000 in a statement month. If you fail to hit the minimum spending requirement, your cashback in eligible categories will fall to 1%.

The good news is that there is no cashback cap. So, if you are a big spender or have a big purchase coming up, such as a luxury watch costing $50,000, you can earn 2% cashback on the full sum.

The next-best unlimited cashback cards only offer 1.5% to 1.7% of cashback—we’ll talk about them later. However, these “lesser” cards offer unlimited cashback on everything with no minimum spending requirement, while the CIMB World Mastercard only offers cashback in certain spending categories, and requires you to hit their $1,000 minimum spending requirement to qualify for the full 2% cashback.

If you want to dissect the cashback T&Cs on the CIMB World Mastercard like I like to do, here’s the document you’re looking for: CIMB World Mastercard Cashback Programme T&Cs.

4. CIMB World Mastercard Travel Privileges

By way of travel privileges, the CIMB World Mastercard comes with two types.

Mastercard Travel Rewards

These rewards include cashback or discounts in categories such as arts and culture, food, entertainment, shopping, sports and wellness, travel. Each offer is specific to a particular country. There are also several online offers. For example, there are 6 Boggi Milano offers: Online offer, Italy, Austria, France, UK and Spain.

If you ask me, these deals look pretty upmarket, and the minimum spends are from S$100 to S$500. They won’t be useful to the budget traveller.

Explore the full list of Mastercard Travel Rewards to see for yourself.

Mastercard Travel Pass (Provided by Dragonpass)

Since 16 Oct 2023, the CIMB World Mastercard has come with Mastercard Travel Pass privileges too. What this means is you get to access airport lounges at a discounted rate and enjoy some extra dining and spa offers in airports via the “Mastercard Travel Pass” app.

I like that the airport lounge access rate applies to over 1,300 airport lounges worldwide. I don’t like that this airport lounge access isn’t free—it’s USD32 per person per visit. While this is a preferential rate, free is always better. I’d personally rather take a fixed number of 100% free airport lounge visits per year than an unlimited number of visits, but with a fee. For example, the Standard Chartered Journey Credit Card comes with 2 complimentary visits to Priority Pass lounges each year. But that’s me, someone who doesn’t travel more than twice a year generally. More avid travellers may appreciate the CIMB World Mastercard’s preferential access rate.

5. CIMB World Mastercard Golf Privileges

Under the Mastercard Southeast Asia Golf Program, cardholders get 50% off green fees at 42 golf courses in Asia, as well as 50% off golf lessons at the Golf Performance 360 Golf Academy in Singapore.

Participating clubs include local ones like Sentosa, Warren and Sembawang Clubs, as well as various golf courses in Indonesia, Malaysia, Thailand, Myanmar, Vietnam, the Philippines, Taiwan, China and Korea.

This is great if you’re a golfer. But golfing is a rich man’s hobby, and this positions the CIMB World Mastercard as a rich man’s card—especially when you consider that the minimum spend per month to enjoy 2% cashback is $1,000.

6. How to maximise my CIMB World Mastercard?

To maximise the card on a monthly basis, always try to hit the $1,000 spending requirement so you can give your cashback a boost from 1% to 2%.

As the 2% cashback is unlimited, the card is ideal when you make big purchases—for instance, that $20,000 Rolex watch (luxury goods), or an overhaul of your car (automobile).

7. CIMB World Mastercard Promotion

MoneySmart Exclusive

Unlimited 2% Cashback | LUCKY DRAW

CIMB World Mastercard

MoneySmart Exclusive:

[LUCKY DRAW]

Get S$250 Cash via PayNow when you apply and spend a min of S$988. T&Cs apply.

PLUS, stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart! T&Cs apply. Check out our past Lucky Draw winners here.

Valid until 31 Dec 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

Apply for the CIMB World Mastercard and get S$250 Cash via PayNow when spend a minimum of S$988 within a 60-day period from the date your card is approved.

You’ll also stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store).

ALSO READ: The Best Entry-Level Luxury Watches to Buy in a Falling Market: Top Picks From Our Resident Watch Collector

8. Should I get the CIMB World Mastercard?

Unlimited cashback cards tend to be useful because they let you spend on those big-ticket, miscellaneous purchases that no other card will be able to reward you adequately for. Things like wedding dinners and home renovations.

But you wouldn’t be able to do that with the CIMB World Mastercard, which limits the 2% cashback to a few categories. The categories in which you could potentially spend a ton include luxury goods and automobile, so don’t forget to use the card the next time you treat yourself to a Louis Vuitton suitcase or decide to pimp your ride.

Those who can benefit most from this card are high spenders who have no problem hitting at least $1,000 a month in the eligible categories.

The problem is that some of these categories like dining and/or transport already enjoy more generous cashback through other cards like the Citi Cash Back Card (6% cashback on dining with $800/month spend) and the OCBC 365 Credit Card (5% cashback on dining and online food delivery with $800/month spend), with less onerous minimum spending requirements.

So, in the end, people who would truly benefit from this card would probably be high rollers who have busted the cashback caps on their other cards and are looking for an alternative way to earn cashback on spending in the eligible categories…and who are still able to meet the card’s $1,000 spending requirement.

For instance, if you’re looking to buy a $20,000 Hermes handbag, you could get 2% cashback or $400 back by using the card to pay, since one of the eligible categories is luxury goods. In this case, it’d be hard to find another card that would be willing to pay $400 worth of cashback in a single month.

What’s the card’s biggest plus? It is free for life. So, there’s no harm in just applying for it and keeping it on hand in case you really decide to buy a $20,000 Hermes handbag someday.

MoneySmart Exclusive

Unlimited 2% Cashback | LUCKY DRAW

CIMB World Mastercard

MoneySmart Exclusive:

[LUCKY DRAW]

Get S$250 Cash via PayNow when you apply and spend a min of S$988. T&Cs apply.

PLUS, stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart! T&Cs apply. Check out our past Lucky Draw winners here.

Valid until 31 Dec 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

9. Alternative unlimited cashback cards

Truth be told, the newly-revamped CIMB World Mastercard isn’t for everyone. It’s really for a specific kind of person who spends a lot on drinking, dining and luxury shopping. That probably applies to a significant chunk of Singaporeans, though.

However, if this credit card unfortunately doesn’t suit you, there are plenty of other unlimited cashback cards to choose from. Here are some of the best I like because they all some with unlimited cashback on almost anything, and with no minimum spend.

Citi Cash Back+ Card: 1.6% cashback on all spending, with no cashback cap and no minimum spend. It plays second fiddle to the UOB Absolute below (0.1% cashback difference), but I like that’s it’s Mastercard and not Amex.

MoneySmart Exclusive

EARN SMARTPOINTS | LUCKY DRAW

Citi Cash Back+ Mastercard®

MoneySmart Exclusive:

[6 Weeks Faster Gift Redemption* | SmartRewards | Your Points, Your Choice 🫵]

Apply and spend a min. of S$500 in "Qualifying Spends" within 30 days from the card approval date and enjoy the ultimate flexibility to CHOOSE ANY GIFT at our Rewards Store, including:

1. Apple iPad Wi-Fi 9th Generation, 64GB (5,040 SmartPoints)

2. Sony WH-1000XM5 Wireless Noise Cancelling Headphones (4,990 SmartPoints)

3. Nintendo Switch OLED (5,000 SmartPoints)

OR any other combination of gifts available in the Rewards Store, by earning 5,100 SmartPoints.

Alternatively, you can also choose S$300 Cash via PayNow. T&Cs apply

PLUS, stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart. T&Cs apply. Check out our past Lucky Draw winners here.

Valid until 17 Dec 2023

More Details

Key Features

1.6% cashback on your spend

No minimum spend required and no cap on cash back earned

Cash back earned does not expire

Redeem your cash back instantly on-the-go with Pay with Points or for cash rebate via SMS

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

UOB Absolute Cashback Card: 1.7% cashback on all spending, with no cashback cap and no minimum spend. Just note that it’s an American Express card and some merchants don’t accept it.

MoneySmart Exclusive

Get Unlimited 1.7% Cashback | LUCKY DRAW

UOB Absolute Cashback Card

MoneySmart Exclusive:

[LUCKY DRAW]

Stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart. T&Cs apply. Check out our past Lucky Draw winners here.

PLUS receive up to S$350 Cash Credit from UOB when you are the first 200 new-to-UOB customers who successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 per month, for 2 consecutive months from the card approval date. T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

1.7% limitless cashback on everything, including groceries, insurance, school fees, wallet top-ups, healthcare, Utilities & Telco Bills and Rental

No minimum spend

No minimum spend

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Standard Chartered Simply Cash Credit Card: 1.5% cashback on all spending, with no cashback cap and no minimum spend.

MoneySmart Exclusive

EARN SMARTPOINTS | LUCKY DRAW

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

[SmartRewards | Your Points, Your Choice

🫵

]

Choose ANY gift you want at our Rewards Store including:

1. Sony WF-1000XM5 Wireless Noise Cancelling Headphones (4,000 SmartPoints)

2. Nintendo Switch Generation 2 (3,990 SmartPoints)

3. ErgoTune Classic Ergonomic Chair (3,990 SmartPoints)

4. Apple Watch SE (GPS), 40mm (3,830 SmartPoints)

Or any other combination of gifts, by earning 4,000 SmartPoints.

Alternatively, you can choose to get up to S$350 Cash via PayNow*. T&Cs apply.

PLUS, stand a chance to win a Panerai Radomir Quaranta Timepiece (worth S$8,700) OR 16,490 SmartPoints (worth an iPhone 15 Pro, 128GB in the Rewards Store) OR 5,990 SmartPoints (worth an Apple Watch Series 9 (GPS), 41mm in our Rewards Store) when you apply through MoneySmart. T&Cs apply. Check out our past Lucky Draw winners here.

Valid until 31 Dec 2023

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

1 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

P.S. Here’s our MoneySmart credit card ranking rubric

In case you’re wondering, here’s how we decide on our credit card rankings.

Is that credit card MoneySmart? Our MoneySmart credit card ranking rubric | |

Category | Our rating |

Overall | The average rating for the credit card on the whole, calculated from the ratings for the individual categories below. Plus, we’ll give you a one-liner on who we think the credit card is best suited for. |

Earn rates: Air miles / Cashback / Rewards points | Air miles / Cashback / Rewards points . This category looks at the depth rather than breadth of earn rates.

|

Earn categories | This category looks at the breadth rather than depth of your earnings.

|

Annual fees and charges |

|

Accessibility | Minimum income requirements:

Exclusivity: We dock 1-2 stars if there is/are another category/categories that make the card exclusive and very specific to a certain clientele. |

Extras/periphery rewards | These include:

We count the number of benefits and award between 0.5 to 2 stars for each, depending on how good the perk is. |

Sign-up bonus |

|

Check out our ultimate list of credit card reviews for the low-down on credit cards in Singapore.

Know someone whose lifestyle fits this credit card to a T? Share this article with them.

The post CIMB World Mastercard—MoneySmart Review 2023 appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post CIMB World Mastercard—MoneySmart Review 2023 appeared first on MoneySmart Blog.

Original article: CIMB World Mastercard—MoneySmart Review 2023.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance