Cigna (CI) Q1 Earnings Beat on High Membership, Ups '22 EPS View

Cigna Corporation CI reported first-quarter 2022 adjusted earnings of $6.01 per share, which surpassed the Zacks Consensus Estimate by 17.2%. The bottom line increased 27.1% year over year.

Adjusted revenues improved 7.6% year over year to $44.1 billion. The top line beat the consensus mark by 1.2%.

The quarterly results of Cigna gained on the back of strong contributions from its businesses. Growth in the medical customer base contributed to the upside. However, the upside was partly offset by elevated benefits and expenses.

In the quarter under review, the total medical customer base of Cigna came in at 17.8 million, which reflected an increase of 4.1% sequentially or 6.6% year over year. Both the increases were led by growth within the U.S. Commercial and International Health markets, partly offset by a decline in U.S. Government business (including the Medicaid business divestiture).

Total benefits and expenses of $41.8 billion escalated 7% year over year, primarily due to a higher pharmacy and other service costs. Meanwhile, adjusted selling, general and administrative (SG&A) expense ratio improved 60 basis points (bps) year over year to 7.4% in the quarter under review.

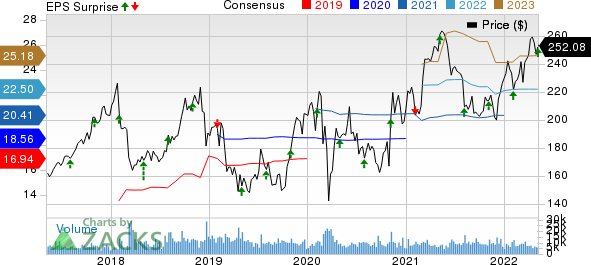

Cigna Corporation Price, Consensus and EPS Surprise

Cigna Corporation price-consensus-eps-surprise-chart | Cigna Corporation Quote

Segmental Performances

Evernorth: The segment reported adjusted revenues of $33.6 billion in the first quarter, which improved 10% year over year, driven by solid organic growth in specialty pharmacy services.

Adjusted operating income on a pre-tax basis grew 6% year over year to $1.3 billion, courtesy of business growth and steady affordability improvements. However, the upside was partly offset by strategic investments made to bolster its digital prowess and services portfolio.

Cigna Healthcare: Adjusted revenues of $11.4 billion rose 3% year over year in the quarter under review. The growth can be attributed to increased premiums and higher specialty contributions, partly offset by the Medicaid business’ divestiture.

On a pre-tax basis, adjusted operating income of $1.3 billion climbed 22.7% year over year, driven by greater specialty contributions.

Medical care ratio ("MCR") deteriorated 60 bps year over year to 81.5% due to escalating medical costs within the Individual business and risk adjustment updates linked with previous years. Nevertheless, reduced direct COVID-19 costs provided some respite to the metric.

Financial Position (as of Mar 31, 2022)

Cigna exited the first quarter with cash and cash equivalents of $4.4 billion, which declined nearly 13% from the 2021-end level. Total assets of $152.6 billion fell 1.5% from the figure at the 2021-end.

Long-term debt amounted to $31 billion, down 0.4% from the 2021-end level

Shareholders’ equity slipped 2.2% from the figure at the 2021-end to $46.1 billion.

Net cash provided by operating activities soared 85.7% year over year to $2 billion.

Debt-to-capitalization ratio deteriorated 200 bps year over year to 41.9% during the first quarter.

Share Repurchase Update

Till May 5, 2022, Cigna bought back 7.6 million shares of common stock worth around $1.8 billion.

2022 Guidance Revised

Concurrent with the first-quarter results, Cigna revised its 2022 outlook for some of its metrics.

EPS is now estimated to be a minimum of $22.60 for 2022, higher than the projection of “at least $22.40.” The revised guidance indicates a minimum growth of 10.4% from the 2021 reported figure.

CI anticipates total medical customer growth of at least 7,25,000, up from the prior view of “at least 5,75,000.”

Meanwhile, the forecast for 2022 adjusted revenues (a minimum of $177 billion) remains unchanged. MCR continues to be estimated within 82-83.5%. Adjusted SG&A continues to be projected between 6.9% and 7.3%.

Zacks Rank

Cigna currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported first-quarter results so far, the bottom line of Centene Corporation CNC, Humana Inc. HUM and Community Health Systems, Inc. CYH beat the Zacks Consensus Estimate.

Centene reported first-quarter 2022 adjusted earnings per share of $1.83, which surpassed the Zacks Consensus Estimate by 8.9%. The bottom line improved 12.3% year over year. Total revenues of Centene rose 24% year over year to $37.2 billion in the first quarter. The top line beat the consensus mark by 7.2%. Managed care membership of CNC grew 8% year over year to 26.2 million as of Mar 31, 2022.

Humana reported first-quarter 2022 adjusted earnings per share of $8.04, which surpassed the Zacks Consensus Estimate of $6.83. The bottom line improved from the year-ago figure of $7.67 per share. Humana’s revenues of $23,970 million were up from $20,668 million in the prior-year quarter. The top line beat the Zacks Consensus Estimate of $23,550 million. While revenues from premiums and services increased 12.8% and 171.2% year over year, respectively, investment income declined 96.2% for HUM.

Community Health reported first-quarter 2022 adjusted net income of 14 cents per share, which outpaced the Zacks Consensus Estimate by 7.7% but declined 61.1% year over year. Net operating revenues of Community Health amounted to $3.1 billion, which rose 3.3% year over year in the first quarter, driven by higher adjusted admissions. Yet, the top line missed the consensus mark by 1.6%. CYH’s admissions slipped 1.7% year over year, while adjusted admissions grew 2.2% year over year in the quarter under review.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

Community Health Systems, Inc. (CYH) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance