CI or HUM: Which HMO Stock is Better Placed at the Moment?

The U.S. health insurance industry, more commonly referred to as the Health Maintenance Organization (“HMO”) space, is aided by growing premiums and an expanding customer base within the Government business. An aging U.S. population, the active pursuit of a merger and acquisition (M&A) strategy and a solid financial position are other factors acting as tailwinds for the industry participants.

Health insurers devise affordable health plans and foray deeper into several U.S. communities and keep upgrading these plans with lucrative features from time to time. The beneficial features of the plans continue to fetch several contract wins or renewed agreements for health insurers from the federal or state authorities.

This contributes to membership growth and drives premiums, the most significant contributor to any health insurer’s top line. The demand for the Medicare plans (primarily meant for people aged 65 or above) devised by HMO industry players is also likely to stay solid in the days ahead, considering a rapidly increasing aging U.S. population.

Per a report published by the Administration on Aging, which functions under an operating division of the U.S. Department of Health and Human Services, individuals aged 65 and older witnessed a significant uptick from 40.5 million in 2010 to a decade-later figure of 55.7 million. The age group is anticipated to clock a figure of 94.7 million by 2060.

The industry players rely on an active M&A strategy to advance their capabilities, bring diversification benefits, broaden the customer base and strengthen their global presence. A solid financial position has provided them with a cushion to pursue these growth initiatives.

In light of the ongoing digitization across every sphere of life and the amount of ease and convenience such services provide, health insurers have incurred substantial investments to devise telehealth services for extending virtual healthcare services to patients. This has generated a steady revenue stream for industry participants.

The prevailing scenario makes us optimistic about consistent growth in the HMO industry, which should bolster the prospects of companies with sound business fundamentals.

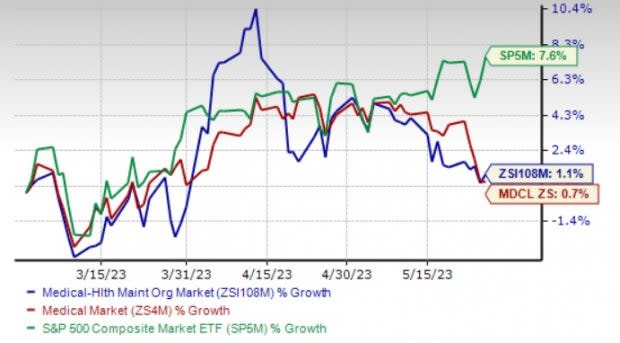

The Zacks Medical-HMO industry, which is housed within the broader Zacks Medical sector, has increased 1.1% in the past three months compared with the sector’s growth of 0.7%. Meanwhile, the S&P Index has risen 7.6% in the same period.

Image Source: Zacks Investment Research

Against this backdrop, let’s take a look at two HMO stocks, The Cigna Group CI and Humana Inc. HUM, with market capitalizations of $72.3 billion and $62.3 billion, respectively. Both the stocks carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let's delve deeper into specific parameters to ascertain which company is better positioned at the moment.

Price Performance

Though shares of both companies have underperformed the industry’s growth of 1.1% in the past three months, Humana has the edge over Cigna on this front. While shares of HUM have risen 0.1% in the past three months, CI declined 15.5% in the same period.

Image Source: Zacks Investment Research

Earnings Surprise History

A stock’s earnings surprise track helps investors get an idea about its performance in the previous quarters.

Cigna’s bottom line beat estimates in each of the trailing four quarters, the average surprise being 6.56%. Meanwhile, Humana’s earnings surpassed the consensus mark in each of the trailing four quarters, the average surprise being 8.87%. Thus, HUM has a better reading than CI.

Return on Equity (ROE)

ROE is a profitability measure, which indicates how efficiently the company is utilizing its shareholders' funds.

Humana’s ROE of 21% compares favorably with Cigna’s ROE of 12.7% but remains lower than the industry’s average of 24.8%.

Valuation

Price-to-earnings (P/E) value is the best multiple used for valuing healthcare stocks. Compared with HUM’s forward 12-month P/E ratio of 16.68, CI is cheaper, with a reading of 9.31. The HMO industry’s P/E ratio is 16.98.

Debt-to-Equity Ratio

The lower the debt-to-equity ratio, the better for the company as it implies a sound solvency level. Humana’s leverage ratio of 69.8% remains lower than Cigna’s ratio of 73.1% and the industry’s average of 71.3%. Therefore, HUM holds an edge over CI in this case.

Robust 2023 Prospects

The Zacks Consensus Estimate for Cigna’s 2023 earnings indicates a year-over-year improvement of 6.5%, while the same for Humana suggests 11.9% year-over-year growth this year. Thus, Humana has the edge over Cigna here.

Long-Term Growth Projection

The expected long-term earnings growth rate of Humana is 13.5%, which is better than Cigna’s figure of 11.2% and the industry’s average of 13.4%.

VGM Score

The VGM Score rates each stock on its combined weighted styles, helping identify those with the most attractive value, the best growth and the most promising momentum. Both Cigna and Humana have an impressive VGM Score of A, faring equally on this front.

Membership Growth

Rising membership usually contributes favorably to the top line of a health insurer. Total medical customers of Cigna came in at 19.5 million as of Mar 31, 2023, while the same for Humana was reported at 17.2 million. Therefore, Cigna wins this round.

Conclusion

Our comparative analysis shows that Humana is better poised than Cigna for its price performance, earnings surprise, ROE, debt-to-equity ratio, 2023 prospects and long-term growth forecast. Meanwhile, CI scores higher in terms of valuation and membership figures. With the scale tilted significantly toward Humana, the stock appears to be better poised.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Humana Inc. (HUM) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance