Church & Dwight (CHD) Gains on High Demand Amid Cost Concerns

Church & Dwight Co., Inc. CHD has been benefiting from consumers’ rising demand for its products, especially amid the pandemic-induced at-home consumption. The company’s robust brands, backed by focus on innovation and buyouts, have been helping it make the most of such trends. Apart from this, the company’s online sales have been rising. Such upsides fueled Church & Dwight in second-quarter 2021, wherein the top and bottom lines increased year over year and beat the Zacks Consensus Estimate.

However, the company is battling supply-chain headwinds, which weighed on its sales guidance. It is also encountering escalated input costs, which are likely to linger through 2021. Together, these factors dented management’s earnings view. We note that on its last earnings call, management curtailed its sales and earnings view, though the figures still suggest year-over-year growth. Let’s delve deeper.

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Pandemic-Led Demand a Driver

In second-quarter 2021, net sales of $1,271.1 million advanced 6.4% year over year and topped the Zacks Consensus Estimate of $1,255 million. Church & Dwight continued to witness robust consumption in the quarter. The company saw consumption gains in 13 out of 16 domestic categories, such as gummy vitamins, dry shampoo, water flossers and cat litter. The company’s personal care category is gaining on higher consumer mobility. The international business saw a broad-based organic sales improvement despite a number of countries undergoing lockdowns. Although management lowered its sales and organic sales guidance for 2021 due to supply-chain headwinds, the view still suggests year-over-year growth. It now expects reported sales growth of roughly 5% compared with the 5-6% rise anticipated earlier.

During the quarter, organic sales rose 4.5%, fueled by volume gains. Organic sales are expected to rise nearly 4% in 2021, though it was projected to be up 4-5% earlier. For the third quarter of 2021, organic sales are projected to rise nearly 1.5%. Moving on, Church & Dwight’s e-commerce sales have been playing a strong role amid the pandemic, backed by consumers accelerated online shopping preferences. During second-quarter 2021, global online sales increased 7.2% and formed 14.2% of the quarterly sales. For 2021, the company estimates online sales to form 15% of the total sales.

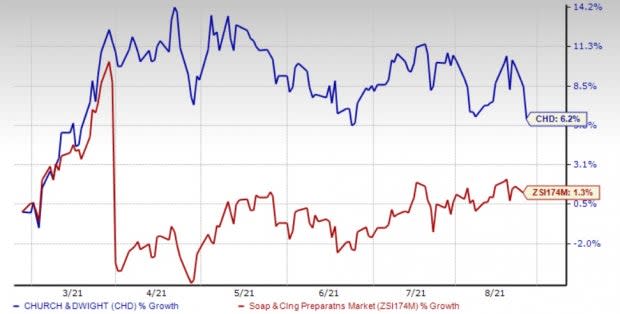

Image Source: Zacks Investment Research

Brand Strength Aids

Church & Dwight has strengthened its brand portfolio with robust innovation and lucrative buyouts. Management considers innovation to be a major growth driver, and is encouraged about its 2021 product launches. The company launched OXICLEAN Laundry and Home Sanitizer in its household products portfolio. In its personal care products space, VITAFUSION introduced Elderberry gummies, Triple immune gummies, and Power Zinc gummies to make the most of consumers’ growing inclination toward boosting immunity. Additionally, WATERPIK came up with WATERPIK ION, which is a water flosser. FLAWLESS is also focused on capitalizing on increased at-home beauty and selfcare trends — with at-home manicure and pedicure options.

Talking of buyouts, the company took over Matrixx Initiatives in December 2020, which owns the ZICAM brand. Zicam is a leading zinc supplement in the United States in the vitamins, minerals, and supplements (VMS) cough/cold shortening category. Apart from this, the buyouts of FLAWLESS and WATERPIK have been prudent additions to Church & Dwight’s portfolio, which are also key subsidiaries of the company. In the Consumer Domestic unit, WATERPIK consumption soared 72% in the second quarter, on the back of consumers’ heightening focus on health and wellness, and rebound from the pandemic-induced lows.

Key Headwinds

During the second quarter of 2021, Church & Dwight encountered shortage of several raw materials. Apart from these, the company is facing supply-related hurdles due to labor shortages and transportation hiccups. Gross margin shrunk 340 basis points (bps) to 43.4% due to elevated distribution costs and increased manufacturing costs, largely owing to commodities and elevated tariffs. The company further stated that it pulled back on marketing in the second quarter for certain products, mainly household products, due to a reduced case fill rate.

Management expects escalated input and transportation costs for the rest of 2021. Its gross margin guidance reflects considerable material and component cost inflation. Management now expects additional input costs of $125 million for 2021 compared with the $90 million expected before. However, this is likely to be partly negated by reduced coupons and promotions, lower SG&A and the announced price hikes. Church & Dwight has been on track with its pricing efforts to counter commodity, labor and transportation cost hikes. That said, full benefit from pricing actions will only be experienced in 2022. Gross margin in 2021 is expected to contract 75 bps compared with the earlier view of being flat year over year.

Management curtailed its earnings view due to elevated input costs and the timing lag of pricing actions. It now expects 2021 adjusted earnings per share growth to be at the lower end of its previously-issued range of 6-8%. The company projects adjusted operating margin to expand 70 bps now compared with the 80 bps anticipated before.

That said, the above-mentioned upsides are likely to help this developer, manufacturer, and marketer of household, personal care, and specialty products, keep its growth story going. Shares of the Zacks Rank #3 (Hold) company have gained 6.2% in the past six months compared with the industry’s growth of 1.3%.

3 Robust Consumer Staple Picks

J&J Snack Foods JJSF sports a Zacks Rank #1 (Strong Buy), at present, and its bottom line outpaced the Zacks Consensus Estimate by a wide margin in the preceding four quarters, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sysco Corporation SYY, currently carrying a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 13.3%, on average.

Medifast MED, with a Zacks Rank #2, has a trailing four-quarter earnings surprise of about 16%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance