How to Choose Winning Stocks in Any Kind of Market

There are many factors to consider before selecting a stock. There are also differing reasons for investment, differing investment horizons and different risk appetites. However, no matter what these differences may be, there are certain characteristics/hallmarks of a stock that may be considered a good investment. These include:

Strong financials: A company with strong financials is more likely to be able to weather economic downturns and continue to grow its business. Therefore, companies with a history of profitability, positive cash flow and low debt levels are the obvious choice.

Growing market: The market or industry of which it is a part is a very important consideration. A company that is operating in a growing market, or in a market that is seeing strong demand, is more likely to see its sales and profits increase over time. Conversely, when the operating climate for a company is not conducive to growth, the company is unlikely to do as well.

Competitive advantage: A company with a competitive advantage is more likely to be able to outperform its competitors and generate above-average profits. Patents, trademarks or other unique assets generally give companies an edge over their rivals.

Strong management team: An experienced management team is usually behind every successful company. They are the ones that take the important decisions to position the company for success with a focus on innovation, building on its competitive strengths and implementing a suitable marketing strategy.

Reasonable valuation: A stock that is trading at a reasonable valuation is more likely to provide a good return on investment. Although growth stocks often trade at elevated valuations because of the promise of future potential, these stocks are, as a rule, riskier.

With these points in mind, here are a few stocks that are worth adding to your portfolio today:

Ingersoll Rand Inc. (IR)

Davidson, North Carolina-based Ingersoll is a company that provides mission-critical technologies in air, fluid, energy, specialty vehicles, and medical sectors. The company operates through two segments: Industrial Technologies and Services and Precision and Science Technologies.

The Industrial Technologies and Services segment offers air and gas compression, vacuum and blower products, as well as fluid transfer equipment, power tools and lifting equipment under various brand names. The Precision and Science Technologies segment focuses on designing and manufacturing pumps, gas boosters, compression systems, automated liquid handling systems and other related components for specialized applications in various industries. Ingersoll Rand sells its products through a network of direct sales representatives and independent distributors.

The company has been growing its earnings and cash flows since the pandemic lows and also paying down its debt. The current debt level is very manageable.

Ingersoll is part of the Manufacturing - General Industrial market, which according to the Zacks ranking system is in the top 11% of Zacks-classified industries, thus supporting growth.

A company’s market position and management efficiency show up in its performance and analyst confidence in these may be seen in estimate revisions. In the case of Ingersoll, we’re seeing 11.5% revenue growth and 13.1% earnings growth estimated for this year. For 2024, growth rates are expected to come down to a respective 3.6% and 7.2%. Estimates for 2023 and 2024 are up 5.1% and 5.9%, respectively in the last 30 days.

IR shares are trading at a slight discount to their median level over the past year. Therefore, the shares are worth buying. The shares carry a Zacks Rank #1 (Strong Buy).

AGCO Corporation (AGCO)

Duluth, Georgia-based AGCO is a global manufacturer and distributor of agricultural equipment and replacement parts. The company offers a wide range of products, including horsepower tractors for various agricultural operations, utility tractors for small- and medium-sized farms, compact tractors for specialized uses, grain storage and handling equipment, seed-processing systems, feed storage and delivery systems for swine and poultry, and equipment for egg and broiler production.

AGCO also provides a variety of harvesting and packaging equipment for vegetative feeds, as well as implements for soil preparation, planting and cultivation. The company sells its products under multiple brands through a network of independent dealers and distributors worldwide.

AGCO has been growing its earnings and cash flows in the last few years. Its current debt level is very reasonable.

The company belongs to the Manufacturing - Farm Equipment industry, also in the top 11% of Zacks-classified industries.

For AGCO, analysts are projecting 15.1% revenue growth and 17.7% earnings growth this year. The probability of a recession next year is likely prompting the 1.04% expected revenue growth and 0.08% expected earnings decline next year. However, sentiments appear to be improving, as seen from the 8.1% increase in the 2023 estimate and 5.2% increase in the 2024 estimate in the last 30 days.

AGCO generally trades at a discount to the S&P 500. Currently it is also trading at a 14.9% discount to its median level over the past year, suggesting upside potential. Zacks has a #1 rank (Strong Buy) on the shares.

Tetra Tech, Inc. (TTEK)

Pasadena, California-based Tetra Tech is a global company that offers consulting and engineering services. It operates through two segments: the Government Services Group (GSG) and the Commercial/International Services Group (CIG). The GSG segment provides services such as data collection, monitoring, analysis, engineering design, project management and operations and maintenance for government clients. It also offers climate change and energy management consulting.

The CIG segment provides similar services to clients in natural resources, energy, utilities and sustainable infrastructure markets. Tetra Tech serves a wide range of sectors, including water resources, environmental monitoring, waste management, and civil infrastructure planning.

In the last quarter, Tetra Tech closed the acquisition of London-based RPS group. With a workforce of 5,000 employees spread across the UK, Europe, Asia Pacific and North America, RPS specializes in providing consulting and engineering solutions for complex projects primarily in the energy transformation, water management, program management and data analytics markets.

As a result, its debt balance soared. But since its pre-acquisition debt was so low, even post-acquisition, the debt level remains in a reasonable range. Its profitability and cash flows remain strong.

The company belongs to the Pollution Control industry, which is in the top 32% of industries, still a relatively strong position for growth.

Analysts are every optimistic about Tetra Tech’s prospects in the years ending September 2023 and 2024. Revenue for the two years is currently projected to increase a respective 27.8% and 12.5%. Earnings are expected to increase 13.8% and 22.1%, respectively. The estimate for the current year is up 10 cents (2.0%) and for next year, is up 25 cents (4.2%).

TTEK shares have almost always traded a at a premium to the S&P 500. What is more significant however is that it is currently trading at a 14.7% discount to its median level over the past year, suggesting upside. Additionally, Zacks has a #1 rank on the shares.

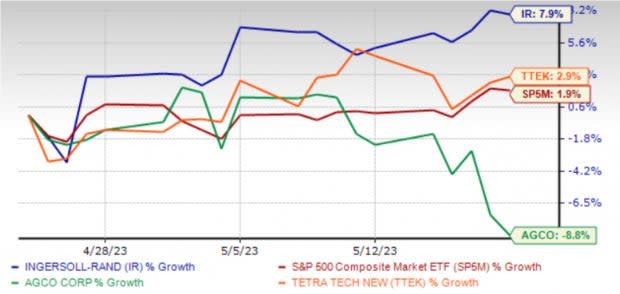

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance