China No Match for Japan in Southeast Asia Infrastructure Race

By Michelle Jamrisko

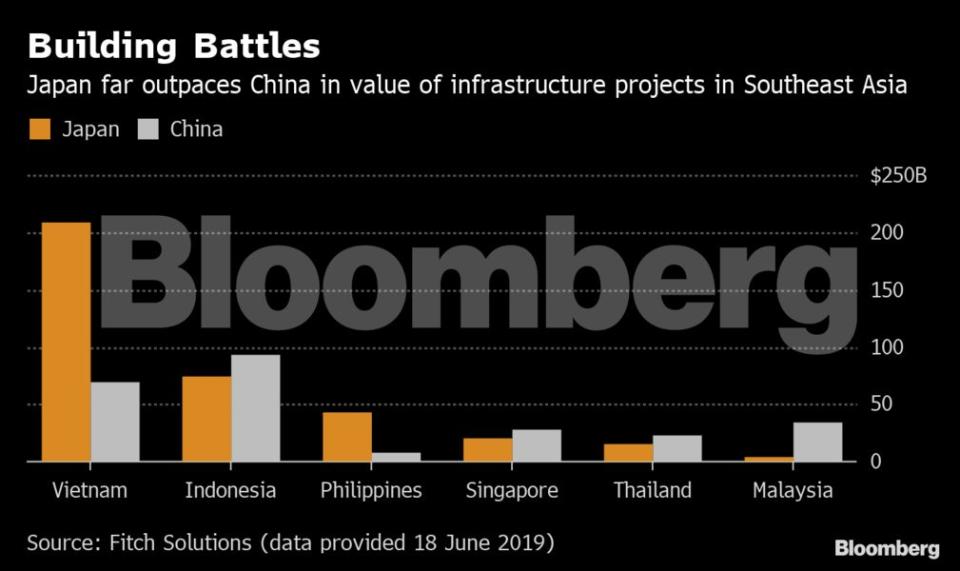

Japan is still winning the Southeast Asia infrastructure race against China, with pending projects worth almost one and a half times its rival, according to the latest data from Fitch Solutions.

Japanese-backed projects in the region’s six biggest economies – Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam – are valued at $367 billion, the figures show. China’s tally is $255 billion.

The figures underline both the rampant need for infrastructure development in Southeast Asia, as well as Japan’s dominance over China, despite President Xi Jinping’s push to spend on railways and ports via his signature Belt and Road Initiative. The Asian Development Bank has estimated that Southeast Asia’s economies will need $210 billion a year in infrastructure investment from 2016 to 2030, just to keep up the momentum in economic growth.

The latest Fitch figures, provided in an emailed response to Bloomberg, count only pending projects – those at the stages of planning, feasibility study, tender and currently under construction. Fitch data in February 2018 put Japan’s investment at $230 billion and China’s at $155 billion.

Vietnam is by far the biggest focus for Japan’s infrastructure involvement, with pending projects worth $209 billion -- more than half of Japan’s total. That includes a $58.7 billion high-speed railway between Hanoi and Ho Chi Minh City in Vietnam.

For China, Indonesia is the primary customer, making up $93 billion, or 36%, of its overall. The prized project there is the Kayan River hydropower plant, valued at $17.8 billion.

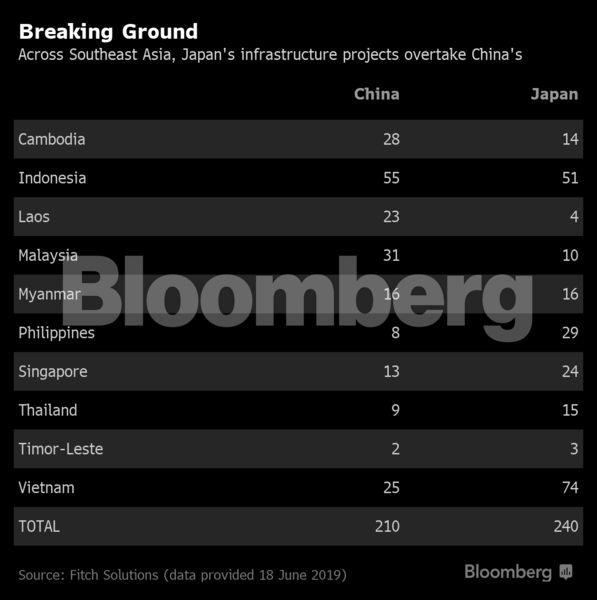

Across all of Southeast Asia and by number of projects, Japan also carries the day, though by a smaller margin: 240 infrastructure ventures have Japanese backing, versus 210 for China in all 10 Southeast Asian economies.

© 2019 Bloomberg L.P.

Yahoo Finance

Yahoo Finance