China Minzhong – Who Should We Really Trust?

The Financial Times is calling it the “Singapore Squeeze”. It seems that Singapore has become a battleground between short sellers and management of companies.

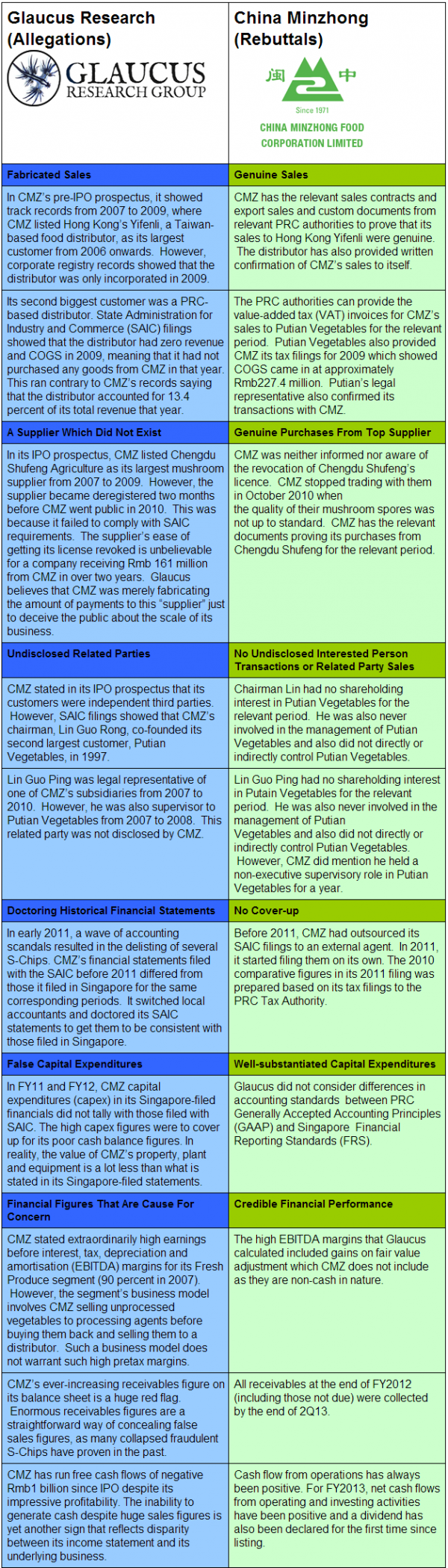

The latest fracas drew in prominent S-Chip, China Minzhong (CMZ) and US research firm, Glaucus Research. In case you are not sure just what each side is saying, we have compiled the points below for your easy reading.

Source: Glaucus research report and press release by CMZ, table on pointers raised by both sides

Shortly after China Minzhong (CMZ) revealed its response to Glaucus Research, it announced an unconditional cash offer from its largest shareholder, PT Indofood Sukses Makmur. Thereafter, CMZ’s share price made a spectacular rebound from a low of $0.50 to $1.12 (the price of PT Indofood’s offer).

If investors recall, such an event also happened to commodities player, Olam International, late last year. In the same way, Olam’s share price also rebounded after being backed by sovereign wealth fund, Temasek Holdings.

Just so you can draw comparisons of parallels between both cases, we have attached a condensed version of the Muddy Waters versus Olam pointers below.

Source: Muddy Waters report and Olam press releases, table on pointers raised by both sides

Olam And China Minzhong – Disturbing Similarities

As can be seen by comparing both tables, disturbing similarities have arisen. These include anything from suspected doctoring of financial statements to failing business models to fears of insolvency.

Since the attack by Muddy Waters, Olam seems to have changed its modus operandi. It has since halved its capital spending plans and pledged to sell stakes in various projects.

Despite an initial rebound, Olam’s shares are still underperforming its other counterparts.

Who Can We Trust?

Ultimately, the question comes to the fore, just who can we trust? Can we trust the companies to ensure that its financial reports are up to standards? Can we trust the auditors?

Apparently, based on these two case studies, we can trust none of them. Not even the supposedly neutral analysts who cover these stocks.

Why? Because not too long ago (only back in June), analysts from two local research houses rated China Minzhong as “Buys”. Perhaps Glaucus Research missed out on something our local research analysts found appealing?

Then surely, we can trust our regulators? Unfortunately, the Singapore Exchange, the regulatory authority of our stock markets, did not reply to requests for comments at the time of publication. We can only assume that what the regulators have done is to merely ask the company to explain for the fall in its stock price.

How Can Trust Be Earned?

We here at Tradeable feel that despite all these happening, there are still many opaque points of contention that the public is unsure of. Some of the rebuttals by CMZ have been half-hearted and did not specifically address the allegations made by Glaucus.

Perhaps, the only way for the public’s trust to be earned is through greater transparency. This can only be achieved if the regulatory authorities are able to introduce frameworks that ensure companies are forced to be transparent.

Were you affected by the CMZ and Olam fracas? What would you do to improve the transparency of companies? What steps can the authorities take? Share your thoughts with us below

More From Shares Investment:

Yahoo Finance

Yahoo Finance