Chemours (CC) Earnings Beat, Revenues Miss Estimates in Q1

The Chemours Company CC registered a profit of $100 million or 61 cents per share in the first quarter of 2020, up 6.4% from a profit of $94 million or 55 cents per share a year ago.

Adjusted earnings were 71 cents per share for the quarter, which surpassed the Zacks Consensus Estimate of 51 cents.

Total revenues fell 5.2% year over year to $1,305 million. Lower volume in the company’s Fluoroproducts unit and lower global average prices across all segments more than offset higher volume in the Titanium Technologies unit. Further, revenues lagged the Zacks Consensus Estimate of $1,342.2 million.

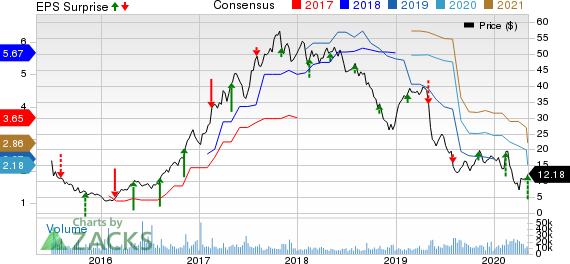

The Chemours Company Price, Consensus and EPS Surprise

The Chemours Company price-consensus-eps-surprise-chart | The Chemours Company Quote

Segment Highlights

Revenues in the Fluoroproducts segment fell 14.5% year over year to $600 million in the reported quarter. The decline was mainly caused by the impacts of the coronavirus outbreak in the Asia Pacific and many end markets worldwide.

Revenues in the Chemical Solutions unit were $92 million, down 31.3% year over year. The company saw lower prices in the quarter mainly due to lower raw material price pass-throughs and regional customer mix.

Revenues in the Titanium Technologies division were $613 million, up 10.5% from the prior-year quarter. The increase was attributable to a higher volume of Ti-Pure titanium dioxide.

Financials

Chemours ended the quarter with cash and cash equivalents of $714 million, up 2.4% year over year. Long-term debt was $4,012 million, up 1.2% year over year.

Cash flows provided by operating activities were $44 million in the quarter against cash used for operating activities of $44 million a year ago.

Outlook

The company withdrew its guidance for 2020 due to uncertainties created by the coronavirus outbreak.

Chemours stated that it is taking actions to cut costs by reducing overhead, discretionary spend and capital expenditure for 2020. Notably, the company reduced capital expenditure from $400 million to $275 million for 2020. Also, it launched a program to lower costs by $160 million for 2020 to enhance financial flexibility.

Price Performance

Chemours’ shares have lost 61.4% in the past year compared with the 32.3% decline recorded by its industry.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the basic materials space are Equinox Gold Corp. EQX, Franco-Nevada Corporation FNV and Newmont Corporation NEM.

Equinox Gold currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 231% for 2020. The company’s shares have gained 51.1% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 22% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 105.2% in a year.

Newmont has a projected earnings growth rate of 95.5% for the current year. The company’s shares have rallied around 111% in a year. It currently has a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance