Cheap Dividend Paying Stock In June

Westlake Chemical Partners is one of the undervalued dividend stocks worth considering today. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks. Coupled with an attractive share price and you’d stand to gain from capital appreciation as well. If you’re a buy and hold investor, these undervalued dividend stocks can generously contribute to your portfolio value.

Westlake Chemical Partners LP (NYSE:WLKP)

Westlake Chemical Partners LP operates, acquires, and develops ethylene production facilities and related assets in the United States. Westlake Chemical Partners is headed by CEO Albert Chao. With a current market cap of USD $796.26M, we can put WLKP in the small-cap category

Over the past 4 years, Westlake Chemical Partners has been distributing dividends back to its shareholders, with a recent yield of 6.44%. WLKP’s yield exceeded United States’s top dividend payer average yield of 4.11%. The company’s payout ratio currently stands at 72.74%, illustrating that its dividend payments are well-covered by its earnings. WLKP is also trading below its intrinsic value by 81.75%, meaning that now is a good time to buy WLKP at a good price. Dig deeper into Westlake Chemical Partners here.

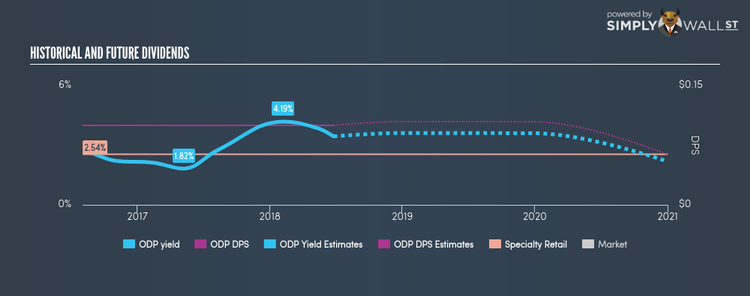

Office Depot, Inc. (NASDAQ:ODP)

Office Depot, Inc., together with its subsidiaries, provides various products and services. Started in 1986, and currently run by Gerry Smith, the company now has 45,000 employees and has a market cap of USD $1.62B, putting it in the small-cap group.

Office Depot has been paying dividend over the past 2 years. It currently paid an annual dividend of US$0.10, resulting in a dividend yield of 3.45%. ODP’s upcoming dividend are appropriated covered by its profits over the next three years, according to industry analysts, with a forecasted payout ratio of 27.39%. At the current payout ratio of 50.67%, ODP’s yield surpasses United States’s low-risk savings rate of 1.50%. In addition to this, ODP is also trading below its intrinsic value by 38.51%, making ODP an attractive investment at the current share price of US$2.90. Interested in Office Depot? Find out more here.

Rice Midstream Partners LP (NYSE:RMP)

Rice Midstream Partners LP owns, operates, develops, and acquires midstream assets in the Appalachian Basin. The company was established in 2014 and has a market cap of USD $1.83B, putting it in the small-cap group.

Rice Midstream Partners has been paying dividend over the past 3 years. It currently paid an annual dividend of US$1.22, resulting in a dividend yield of 6.82%. RMP’s yield exceeded United States’s top dividend payer average yield of 4.11%. The company’s payout ratio currently stands at 64.24%, illustrating that its dividend payments are well-covered by its earnings. RMP is undervalued by 40.64%, meaning RMP can potentially bring about strong capital gains through mispricing. More on Rice Midstream Partners here.

For more mispriced dividend stocks to add to your portfolio, explore this interactive list of undervalued dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance