Charter's (CHTR) Q4 Earnings Top Estimates, Revenues Up Y/Y

Charter Communications CHTR delivered fourth-quarter 2021 earnings of $8.93 per share, beating the Zacks Consensus Estimate by 29.23%. The reported figure also surged 62.4% year over year.

Revenues of $13.2 billion increased 4.7% on a year-over-year basis, owing to growth in the Internet, mobile and advertising sales revenues. The top line missed the consensus mark of $13.26 billion.

Segmental Details

Residential revenues came in at $10.27 billion, up 4.7% from the year-ago quarter’s levels.

Monthly residential revenues per customer (excluding mobile) totaled $114.14, up 2% year over year.

Internet revenues rose 11.6%, year over year to $5.42 billion, driven by growth in Internet customers, promotional rate step-ups, reduced bundles discounts and higher bundled revenue allocation.

Video revenues declined 0.4% to $4.4 billion, driven by a greater mix of lower-priced video packages, decline in video customers, lower bundled revenue allocation, rate adjustments and promotional rate step-ups.

Voice revenues declined 11.8% to $396 million due to a decline in wireline voice customers and value-based pricing.

Commercial revenues rose 4.8% year over year to $1.7 billion on solid SMB and enterprise revenue growth. Small and medium business revenues came in at $1.05 billion, up 5.72% year over year, reflecting customer relationship growth.

Enterprise revenues were up 3.2% to $643 million.

The fourth-quarter advertising sales revenues of $448 million slid 28.2% year over year.

Mobile revenues climbed 47.5% year over year to $632 million. Other revenues came in at $209 million, down 6.2% year over year.

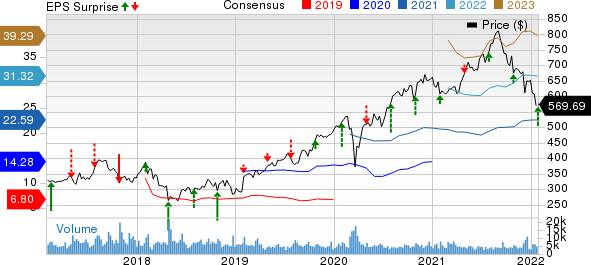

Charter Communications, Inc. Price, Consensus and EPS Surprise

Charter Communications, Inc. price-consensus-eps-surprise-chart | Charter Communications, Inc. Quote

Subscriber Statistics

As of Dec 31, 2021, Charter had 32.1 million total customer relationships, with 939K net new customer relationships added over the last 12 months.

The company had 28 million residential Internet customers, up 4.1% year over year.

Charter added 172K residential Internet customers in the reported quarter.

Charter added 380K mobile lines in the December-end quarter. As of Dec 31, 2021, the company served a total of 3.6 million mobile lines.

As of Dec 31, 2021, Charter had 15.25 million residential video customers. However, the company lost 154K voice customers from the year-ago quarter’s figure.

Operating Details

Total operating costs and expenses increased 2.7% from the year-ago quarter to $7.83 billion.

Programming costs dropped 0.5% year over year to $2.9 billion, reflecting fewer video customers and a higher mix of lower-cost packages. Regulatory, connectivity and produced-content costs were up 11.3% to $592 million.

Costs to service customers edged down 0.5% year over year to $1.86 billion. Marketing costs were $791 million, up 4.3% year over year.

Notably, mobile costs jumped 38.5% year over year to $724 million.

The adjusted EBITDA increased 7.7% year over year to $5.38 billion. Moreover, the adjusted EBITDA margin expanded 110 basis points (bps) to 40.7%.

Balance Sheet & Cash Flow

As of Dec 31, 2021, cash and cash equivalents were $601 million compared with $466 million as of Sep 30, 2021. The company’s credit facilities provided roughly $3.9 billion of additional liquidity.

As of Dec 31, 2021, the total debt was $91.2 billion compared with a debt of $87.9 billion as of Sep 30, 2021.

Cash flows from operating activities totaled $4.2 billion compared with the year-ago quarter’s $4.1 billion.

Property, plant and equipment expenditures totaled $2.07 billion in the reported quarter.

Free cash flow was $2.3 billion compared with the year-earlier quarter’s $2.1 billion.

Zacks Rank & Stocks to Consider

Charter currently holds a Zacks Rank #3 (Hold).

Charter shares have dropped 9.2% in the past year compared with the Zacks Cable Television industry’s decline of 11.9% and the Consumer Discretionary sector’s fall of 19.9%.

Gildan Activewear GIL, Fox FOXA and Nexstar Media Group NXST are some better-ranked stocks that investors can consider in the broader sector. All the three stocks sport a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gildan Activewear is set to announce fourth-quarter 2021 results on Feb 23.

GIL is up 55.7% in the past year against the Zacks Textile – Apparel industry’s decline of 1.6% and the Consumer Discretionary sector’s fall of 19.8%.

Fox (FOXA) is all set to announce its second-quarter fiscal 2022 results on Feb 9.

FOXA is up 17.2% in the past year against the Zacks Broadcast Radio and Television industry’s decline of 23.3% and the Consumer Discretionary sector’s fall of 19.7% in the past year.

Nexstar Media Group is all set to announce its fourth-quarter fiscal 2021 results on Feb 22.

NXST is up 36.1% in the past year against the Zacks Broadcast Radio and Television industry’s decline of 23.3% and the Consumer Discretionary sector’s fall of 19.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charter Communications, Inc. (CHTR) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Nexstar Media Group, Inc (NXST) : Free Stock Analysis Report

Fox Corporation (FOXA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance