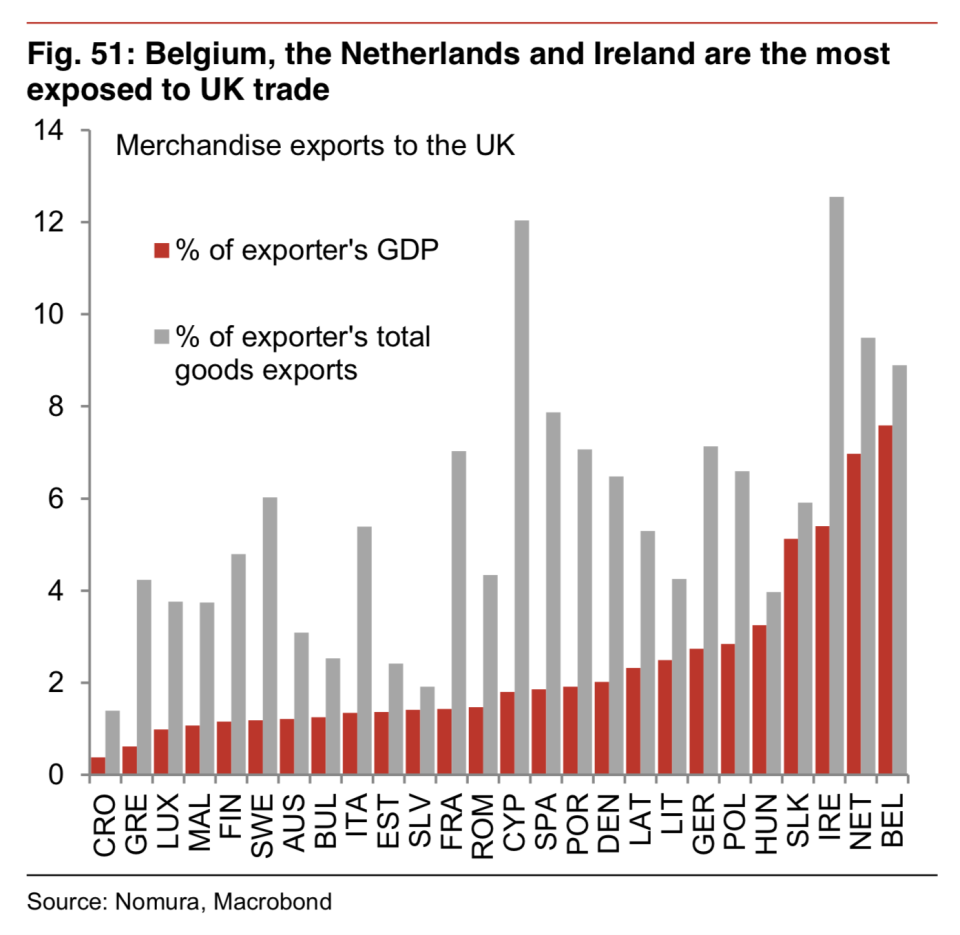

This chart shows the EU countries most reliant on trade with the UK

Belgium’s economy is the most exposed to Brexit within the EU, while Ireland’s exports could take the biggest hit of any European country.

Figures compiled by Japanese investment bank Nomura show that Belgium’s economy is the most reliant on trade with the UK, with around 8% of Belgian GDP dependant on trade with Britain. That’s the highest level within the EU27.

Belgium exports over €30bn of goods to the UK, which is Belgium’s fourth largest export market. It sells things like textiles, vehicles, chemicals, and food and beverages to the UK.

Belgium’s finance minister has previously called for a quick trade deal with the UK post-Brexit to protect thousands of jobs in the country.

When trade is looked at purely in terms of exports, Ireland is the most exposed. Around 13% of all Irish exports end up in Britain. The Netherlands also has a large reliance on the UK for exports and GDP.

In a major research note sent to clients on Tuesday, titled “Brexit Guide 2019,” Nomura looked at how Brexit might effect the EU. As part of this, the bank mapped out which countries within the EU are most reliant on trade with the UK.

Here’s Nomura’s chart:

Brexit would likely have a negative economic effect on these trading relationships, Nomura said, to the detriment of both the UK and EU member states.

“In the event of a hard Brexit the UK would almost certainly apply a tariff schedule to imports from the EU that looks similar to the EU’s external tariffs,” Nomura’s chief UK economist George Buckley and team wrote.

“Together with a lower sterling that would adversely affect EU export growth to the UK — particularly for important trading partners like Germany (think autos), France, the Netherlands and Ireland. Even if the EU and UK agreed zero tariffs, should the UK leave the EU’s customs union free movement would be severely curtailed.”

Nomura said the impact of any trading slowdown between Britain and the EU would likely be felt more keenly in Britain as “the Brexit effect will be more dissipated among the remaining EU27 and more concentrated in the UK.”

Yahoo Finance

Yahoo Finance