Charlie Munger had snarky words for get-rich gurus — how he urged investors to build wealth instead

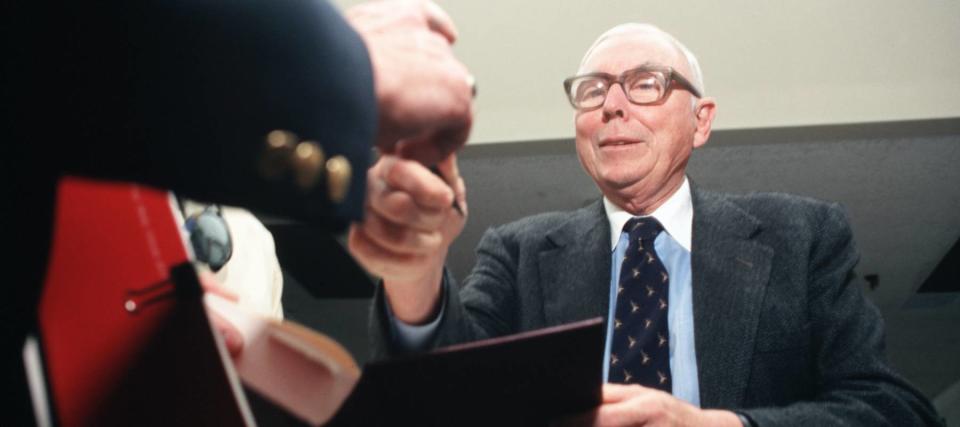

Warren Buffett’s longtime business partner, the late Charlie Munger, had a reputation for being curt when speaking with shareholders. Whether he was talking about building wealth or expressing skepticism about cryptocurrency, Munger would often speak candidly.

During the 2019 Daily Journal shareholders meeting, Munger turned his attention toward the emerging daytrading-influencer market. Suffice to say, he wasn’t a fan of social media gurus teaching inexperienced investors how to trade stocks.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

“If you take the modern world where people are trying to teach you how to come in and trade actively in stocks, well, I regard that as roughly equivalent to trying to induce a bunch of young people to start off on heroin,” he said. “It is really stupid.”

Here’s why the legendary investor was “tired” of get-rich-quick gurus.

Financial misinformation

There’s a financial literacy problem across the nation. According to the 2024 TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), U.S. adults correctly answered only 48% of the 28 index personal finance questions on average. The index notes this figure has hovered around the 50% mark since the inaugural survey in 2017.

There could be many reasons for this, but one place to look is where people get their information. A whopping 79% of American millennials and Gen Z have gotten financial advice from social media, according to a 2023 survey commissioned by Forbes Advisor.

Social media is driven by content these platforms deem engaging. Many influencers use their clout and content to promote their own products and services, which is a business model Munger doesn’t appreciate.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

He thought it was silly “when you’re already rich to make your money by encouraging people to get rich by trading,” Munger told shareholders. “There are [also] people on TV and they say ‘I have this book that will teach you how to make 300% a year and all you have to do is pay for shipping.’”

He added: “They mislead you on purpose and I get tired of it. I don’t think it’s right that we deliberately mislead people as much as we do.”

Bad financial advice can have tangible consequences.

Low-risk investing

Buffett and Munger often talked about the virtues of passive investing. Buffett believes most active investors would fail to outperform an index, so it might be best for the common investor to put their money in an index fund. Munger also talked up the virtues of everyday people investing in index funds in the past.

With this in mind, investors may want to consider a safe and relatively consistent index fund to build wealth over time. For example, since its introduction, the S&P 500 has delivered an average annual return of over 10%, according to the Official Data Foundation.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Stop crushing your retirement dreams with wealth-killing costs and headaches — here are 10 'must-haves' when choosing a trading platform (and 1 option that has them all)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.