How Challenger Technologies Stand Out Amidst Retail Competition?

With Courts Asia’s recent proposed takeover offer from the listed Japanese electronics retailer, Nojima on 18 January 2019, market attention has turned to other electronics retailers (both non-public and public-listed) to understand if market consolidation has now set upon these electronics retailers. Are privatisations or deep restructuring plans needed to ensure the continued sustainability among the various players in the electronics retailing industry?

Challenger Technologies Stands Out

Most of us have read about the closures or downsizing of several electronics retailers during 2018 including the likes of Newstead Technologies or the public-listed Epicentre. Newstead, for example, entered into liquidation mode in October 2018. The homegrown electronics retailer was established in 1998 and used to own brands such as Digital Style, Nubox, and @notebook.com. It also owns outlets in several shopping malls in Singapore, and is considered one of the toughest competitors against Challenger Technologies.

Epicentre Holdings, a Catalist-listed, announced in January 2018 that it exited as the Apple Authorised Reseller and Apple Premium business in Singapore. The entry of Apple’s own stores in the heart of Orchard Road has taken the toll on Epicentre’s sales operations in Singapore. According to a Straits Times report, in the first-half of December 2017, the business at the four physical stores and online store made a net loss before income tax of about $55,000.

With the two fiercest competitors bowing out of the electronics retail scene, leaving only players like Australian-listed Harvey Norman, and Courts Asia, Challenger Technologies managed to stand out for its continuous drive to adapt to the retail environment.

For example, in the most recent development, it opened a niche store called Musica Boutique in Ion Orchard and is focused on selling audio products with digital elements that can be hooked up to customers’ phones. The 2,000 sqft store is also equipped with soundproof spaces where listeners can compare premium brands in one location.

Challenger Technologies has also maintained both an online and offline presence. Since closing its flagship megastore at the former Funan Centre in 2016, the electronics retailer set out to establish an online presence with its Hachi.tech marketplace and has since opened a new flagship store at Bugis Junction in 2017.

The management under the helm of CEO, Loo Leong Thye, recongnised that the retail environment has changed, and with manpower challengers, and high rental costs, the whole team saw the necessity of capturing the changing e-commerce crowd.

Financial Performance

In the most recent financial results ending September 2018, Challenger Technologies saw an increase of one percent in total revenues for the nine months at $236.31 million, while net profit saw an increase of 35 percent year-on-year (yoy) during the same time period to $13.8 million.

Source: Company Filings

The Group’s cash and cash equivalents balance as at 30 September 2018 stood at $61.9 million, with no significant interest-bearing debt. The Group also had a positive net operating cash flow (CFO) position of $12.5 million for the nine months ending 30 September 2018. This compares to the $5.9 million net CFO during the same period in 2017.

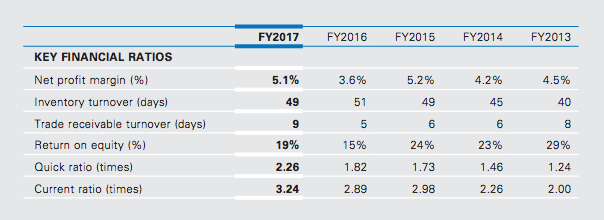

Source: Company Annual Report (FY17)

Looking at the table of financial ratios, we noted that while profit margins are in the single digits at around four to five percent per annum since FY13, the current ratio has gradually improved from two times in FY13 to 3.2 times in FY17. We also noted that while the return on equity at 19 percent was lower than the peak of 29 percent in FY13, it is still higher than FY16 figure of 15 percent.

At the share price at around $0.50, Challenger Technologies’ is valued at a market capitalisation of $172.6 million. The stock is also trading at a trailing twelve months (TTM) price-earnings (P/E) ratio of 8.8 times, and a forward dividend yield of 6.6 percent, with an annual dividend payout of three Singapore cents.

Peer Compaison

Company Name | P/E | Dividend Yield (%) | Price-To-Book (P/B) Value | Market Capitalisation ($’millions) | Total Revenue ($’millions) (Latest Full Year) |

Challenger Technologies | 8.7 | 6.6 | 2.0 | 172.6 | 325.5 |

Courts Asia | – | – | 0.54 | 103.5 | 695.0 |

Compared to Courts Asia, we noted that Challenger Technologies financials do stand out with a profitable operation compared to Courts Asia.

Are Investors Taking A Closer Look at Challenger Technologies?

At a market capitalisation of $172.6 million, with relatively lower P/E multiple of around 8 to 9 times, and a forward dividend yield of about 6 to 7 per cent per annum, the three-month average trading volume of 34,450 is merely at less than one per cent of the current shares float of 53.8 million. The 10-day average trading volume is 83,890.

With a low trading volume, and an under-researched counter, there could be a potential undervaluation in the overall stock price given the strong company fundamentals the stock brings to the table, coupled with no significant interest-bearing debt.

What are the risks associated with Challenger Technologies?

As indicated earlier in the paragraph, the electronics retailing industry in Singapore is subjected to various economic cycles and the intense competition owing to the nature of the industry which is considered as part of the fast moving consumer goods (FMCG) industry. The changes in buyers’ behaviours need to be monitored closely, and shifts in global economic situation such as trade tensions could impact the business significantly.

There are also succession questions within the internal management that needs to be monitored. CEO, Mr. Loo Leong Thye has been the Group’s CEO since its founding in 1982. Although his daughter, Ms. Loo Pei Fen is currently the Group’s chief marketing officer, there have been no formal announcements of any management board changes. With no formal succession plans, investors might express some concerns of the continuity of the Group’s overall business directions.

Challenger Technologies has been quick to adapt to the various shifts in the electronics retailing industry, and they are slowly diversifying while keeping in mind that each business venture needs to be managed soundly and maintaining a sustainable capital structure.

Related Article:

Yahoo Finance

Yahoo Finance