Century Aluminum (CENX) Q4 Earnings, Sales Top Estimates

Century Aluminum Company CENX swung to a profit of $35.8 million or 37 cents per share in fourth-quarter 2017 from a loss of $168.5 million or $1.93 per share it posted a year ago.

The results in the reported quarter were aided by a non-cash gain of $7.3 million associated with the termination of certain legacy contractual obligations. The company also benefited from cost management actions, stable operations and favorable operating metrics.

Barring one-time items, Century Aluminum’s adjusted earnings were 26 cents per share in the quarter, which topped the Zacks Consensus Estimate of 23 cents.

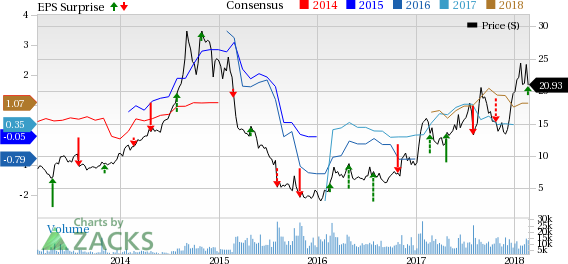

Century Aluminum Company Price, Consensus and EPS Surprise

Century Aluminum Company Price, Consensus and EPS Surprise | Century Aluminum Company Quote

Revenues and Shipments

The company registered revenues of $434 million in the reported quarter, up around 8% year over year. It surpassed the Zacks Consensus Estimate of $427 million. Shipments of primary aluminum in the quarter were 189,000 tons, up from 183,210 tons shipped a year ago.

FY17 Results

For 2017, profit was $48.6 million or 51 cents per share, versus a loss of $252.4 million or $2.90 per share logged a year ago.

Net sales for the full year went up roughly 20% year over year to $1,589.1 million.

Financials

Century Aluminum ended 2017 with cash and cash equivalents of $167.2 million, up 26% year over year. Net cash provided by operating activities for the year was $51.8 million, a roughly 37% year over year increase.

Outlook

Century Aluminum saw higher raw material costs in the fourth quarter and sees this trend to continue in the first quarter of 2018 with an improvement is expected from the second quarter. Demand for primary aluminum and aluminum products remains good and the company expects this environment to continue for the foreseeable future.

Century Aluminum also noted that it is investing to upgrade its product mix across the plants and is also investigating the restart of capacity at the Hawesville facility. The company believes that it is well placed to serve customers amid the prevailing market environment and deliver attractive returns to its shareholders.

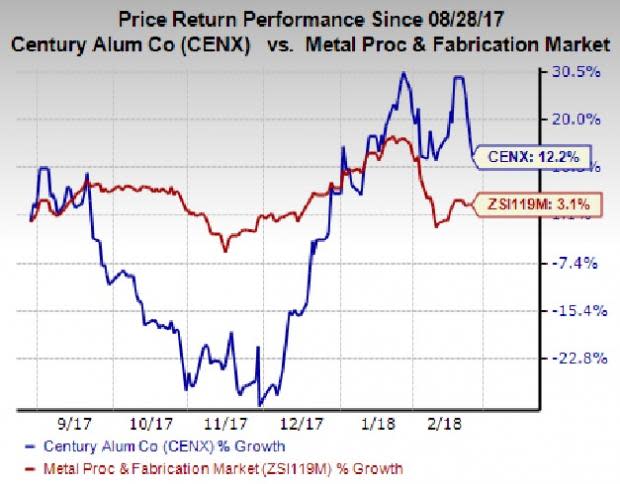

Price Performance

Century Aluminum’s shares have gained 12.2% in the last six months, outperforming the 3.1% gain recorded by its industry.

Zacks Rank and Stocks to Consider

Century Aluminum currently carries a Zacks Rank #1 (Strong Buy).

Other companies worth considering in the basic materials space include Olympic Steel, Inc. ZEUS, Methanex Corporation MEOH and The Mosaic Company MOS, each sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel has an expected long-term earnings growth rate of 7.5%. Its shares rallied around 39% over the past six months.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have gained roughly 28% over the past six months.

Mosaic has an expected long-term earnings growth rate of 9.5%. Its shares have rallied around 43% over the past six months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Century Aluminum Company (CENX) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance