CenterPoint Energy (CNP) Q4 Earnings Beat, Revenues Up Y/Y

CenterPoint Energy, Inc. CNP reported fourth-quarter 2019 adjusted earnings of 45 cents per share, which exceeded the Zacks Consensus Estimate of 37 cents by 21.6%. The bottom line also jumped 25% from the year-ago quarter’s 36 cents.

The company’s GAAP earnings came in at 25 cents per share compared with the 18 cents registered in the prior-year quarter.

For 2019, CenterPoint Energy posted adjusted earnings of $1.79 per share, beating the Zacks Consensus Estimate of $1.69 by 5.9%. Full-year earnings also improved 11.9% from the year-earlier tally of $1.60.

Revenues

CenterPoint Energy’s total revenues in the quarter were $3,230 million, which lagged the Zacks Consensus Estimate of $3,897 million by 17.1%. However, the reported figure came in 6.4% higher than the prior year’s $3,036 million.

Increased contributions from both utility segments fueled top-line growth.

For 2019, the company’s total revenues of $12,301 million missed the Zacks Consensus Estimate of $12,890 million by 4.6%. The top line, however, came in 16.2% higher than the $10,589 million registered in 2018.

Operational Results

Total expenses during the fourth quarter flared up 2.1% to $2,928 million.

The company’s operating income surged 80.8% to $302 million from the $167 million registered in the year-ago period.

Interest and other finance charges increased to $139 million from the prior year’s $102 million.

Segment Results

The Electric Transmission & Distribution segment reported operating income of $102 million in the fourth quarter compared with the $100 million witnessed in the year-ago quarter.

The Natural Gas Distribution segment registered operating income of $167 million compared with the year-ago quarter’s $100 million.

The Energy Services segment incurred operating loss of $32 million compared with the operating loss of $27 million posted in the year-earlier period.

The Infrastructure Services segment recorded operating income of $45 million compared with the $95 million witnessed in the prior-year quarter.

The Other Operations segment incurred operating loss of $6 million, flat year on year.

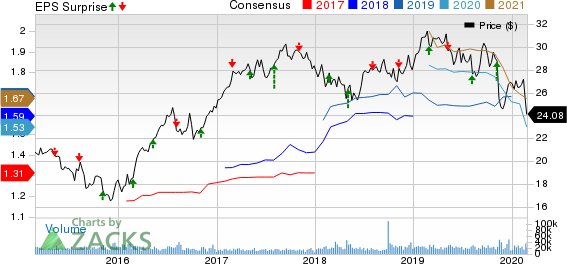

CenterPoint Energy, Inc. Price, Consensus and EPS Surprise

CenterPoint Energy, Inc. price-consensus-eps-surprise-chart | CenterPoint Energy, Inc. Quote

Financial Condition

As of Dec 31, 2019, CenterPoint Energy had cash and cash equivalents of $241 million, down significantly from $4,231 million as of Dec 31, 2018.

Total long-term debt was $14,244 million as of Dec 31, 2019, compared with $8,682 million as of Dec 31, 2018.

At the end of 2019, the company’s net cash from operating activities was $1.638 million, up from the previous year’s $2,136 million.

Further, CenterPoint Energy’s total capital expenditure summed $2,580 million in 2019, up from the $1,720 million witnessed last year.

2020 Guidance

CenterPoint Energy has issued its 2020 earnings guidance. The company currently expects to generate earnings of $1.10-$1.20 per diluted share, excluding certain impacts associated in relation to its merger with Vectren. Its Midstream Investments EPS projected range is 23-28 cents.

The Zacks Consensus Estimate for ongoing-year earnings is pegged at $1.58, which lies above the mid-point of the company’s guided range.

Zacks Rank

CenterPoint Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

CMS Energy CMS reported fourth-quarter 2019 adjusted earnings per share (EPS) of 68 cents, considerably up 70% from the year-ago quarter reported figure of 40 cents. The bottom line, however, missed the Zacks Consensus Estimate of 69 cents.

NextEra Energy NEE posted adjusted earnings of $1.44 per share for the December-end quarter, lagging the Zacks Consensus Estimate of $1.54 by 6.5%.

Dominion Energy D delivered operating earnings of $1.18 per share for the final quarter of 2019, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance