Celanese (CE) Q4 Earnings Miss, Revenues Beat Estimates

Celanese Corporation CE logged earnings from continuing operations of $4.83 per share in fourth-quarter 2021, down from $12.50 in the year-ago quarter.

Barring one-time items, adjusted earnings were $4.91 per share, up from $2.09 in the year-ago quarter. However, the figure missed the Zacks Consensus Estimate of $5.05.

Revenues of $2,275 million increased 43% year over year and beat the Zacks Consensus Estimate of $2,241.5 million.

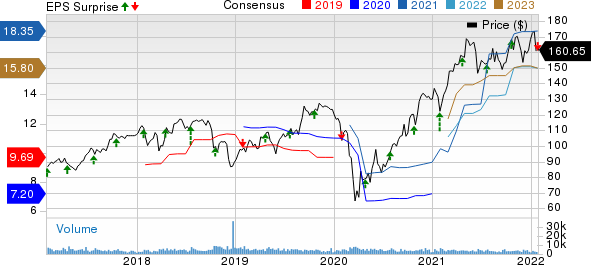

Celanese Corporation Price, Consensus and EPS Surprise

Celanese Corporation price-consensus-eps-surprise-chart | Celanese Corporation Quote

Segment Review

Net sales in the Engineered Materials unit were $707 million in the fourth quarter, up 23.6% year over year. The segment witnessed record net sales in the quarter on the back of pricing increase. Volumes dropped 1% while pricing rose 5% sequentially. The business continued to offset the majority of raw material, energy and logistics cost inflation which led to higher costs of roughly $60 million sequentially.

The Acetyl Chain segment posted net sales of $1,476 million, up 62.2% year over year. The segment witnessed a 10% sequential increase in prices and a decline in volume. The business shifted more volume to the Western Hemisphere in the wake of the ongoing moderation in acetic acid and VAM industry pricing in China. Higher pricing in the reported quarter more than offset roughly $60 million in raw material, energy and logistics cost inflation from the previous quarter.

Net sales in the Acetate Tow segment were $129 million, down 3.7% year over year. The company witnessed a slight increase in pricing and stable volume in the segment on a sequential-comparison basis.

FY21 Results

Earnings for full-year 2021 were $17.06 per share compared with earnings of $16.85 per share a year ago. Net sales rose around 51% year over year to $8,537 million.

Financials

Celanese ended 2021 with cash and cash equivalents of $536 million, down 43.9% year over year. The long-term debt inched down 1.6% year over year to $3,176 million.

Celanese generated an operating cash flow of $1.8 billion and a free cash flow of $1.3 billion in 2021. Capital expenditures amounted to $467 million.

The company also returned $1.3 billion to shareholders through dividend payouts and share repurchases during the year.

Outlook

Celanese stated that the early 2022 order book reflects strong demand for its products across most end markets. It continues to monitor the impact of Covid-19 variants on demand conditions. However, the constant inflationary and volatile supply chain environment remains its biggest challenge. It forecasts sequential margin expansion in first-quarter 2022 in its downstream businesses, led by Engineered Materials. The upside will likely offset the anticipated moderation in Acetyl Chain pricing conditions and boost expected first-quarter adjusted earnings of $4.30-$4.60 per share. With a strong start to 2022, the company is optimistic about its ability to achieve adjusted earnings of at least $15.00 per share in 2022, the company noted.

Price Performance

Celanese’s shares have gained 31.1% in the past year against a 6.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Celanese currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Albemarle Corporation ALB, Nutrien Ltd. NTR and AdvanSix Inc. ASIX.

Albemarle, currently sporting a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 51.3% for the current year. The Zacks Consensus Estimate for ALB's earnings for the current year has been revised 5.4% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with the average being 22.1%. ALB has rallied around 26.3% over a year.

Nutrien, sporting a Zacks Rank #1, has a projected earnings growth rate of 53.8% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 17.4% upward in the past 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 73.5%, on average. NTR has rallied around 40.9% in a year.

AdvanSix has a projected earnings growth rate of 7.4% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised 5.3% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, with the average being 46.9%. ASIX has surged 95.3% over a year. ASIX sports a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance