Caterpillar Infuses Optimism in Machinery Stocks: Top 4 Picks

Caterpillar Inc. CAT reported a surge of 33% in global retail sales for the three months ended February 2018, following a 34% rise noted in the past month. The company had last witnessed growth at these levels in 2011. This robust pace can be attributed to improvement across all regions as well as segments. Within Machines, Resource Industries and Construction Industries reported positive gains for the eighth and 13th consecutive months, respectively.

Caterpillar Starts 2018 on a Strong Note

In the first two months of 2018, Caterpillar’s sales growth has averaged 33.5%. In February, the company’s performance was driven by a 41% increase in Asia Pacific sales. The region has been a consistent contributor for the company since it posted the first positive reading in August 2016. Latin America registered growth of 39% while Europe, Africa and Middle East (“EAME”) and North America sales both went up 30%.

The Resource Industries segment delivered an impressive 60% sales growth in February — its best performance so far. This was led by a surge of 62% and 60% in North America and Asia Pacific sales, respectively. EAME and Latin America reported growth of 58% and 57%, respectively.

Sales growth in the Construction Industries segment went up 27%. Sales advanced 36% in Asia Pacific and 30% in Latin America. North America and EAME sales rose 25% and 20%, respectively.

Sales in the Energy & Transportation segment rose 21%. Growth was led by sales to the Oil & Gas sector, which reported a 29% rise. Sales to the Power Generation sector advanced 19%. In the Industrial sector, sales improved 12% and the transportation sector advanced 6%.

2017 was a Comeback Year

Last year marked a turning point for Caterpillar, which had been bearing the brunt of a weak mining industry over the past few years. Retail sales growth entered the positive trajectory in March following an unprecedented stretch of declines for 51 months. Retail sales have shown significant improvement ever since, notching up an average of 10.3% in 2017.

Caterpillar also reported year-over-year improvement in both top and bottom-line in the first quarter of 2017 — the first time in 10 quarters, owing to its incessant efforts to cut down costs and strength in the Asia Pacific region and the construction sector. This set the ball rolling for the company which delivered upbeat quarters for the rest of 2017 as most end-markets began to improve.

Consequently, in fiscal 2017, Caterpillar’s adjusted earnings per share surged 101% year over year to $6.88 from $3.42 in fiscal 2016. This was a major turnaround for the company which had suffered a 36% drop in earnings in fiscal 2016. Also at fiscal 2017 end, Caterpillar’s backlog was at $15.8 billion, up from $15.4 billion at third-quarter 2017 end, mainly driven by higher backlog in Resource Industries.

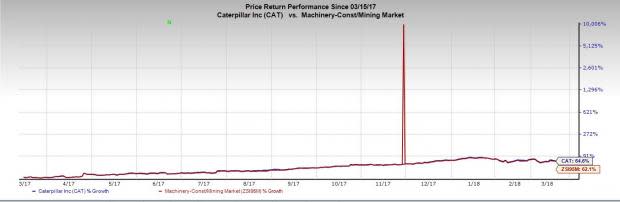

Caterpillar’s share price has surged 65% over the past year, outperforming the industry’s growth of 62%.

What’s in Store for Caterpillar in 2018?

Strong sales momentum resulting from strong order rates, lean dealer inventories and an increasing backlog bode well. Backed by these factors, along with positive economic indicators globally and many of the company’s end markets, Caterpillar guides earnings per share in the $8.25-$9.25 range for fiscal 2018, a 27% year-over-year growth at the mid-point. Reflecting the solid prospects, the Zacks Consensus estimates for earnings for 2018 and 2019 moved north 15% and 16%, respectively.

The Construction segment will benefit from continued improvement in North American residential, non-residential and infrastructure markets. President Trump’s plans of big spending in infrastructure would be a major catalyst. While anticipated seasonality of sales in China will slow down growth in the latter part of the year, most other APAC countries are expected to grow, which can be attributed to investments in infrastructure.

We believe this year, the Resource Industries segment is poised to be a catalyst. Global economic momentum and increasing commodity prices is restoring miners’ profitability and they are resuming capital spending. Further, the recently passed tax reform is likely to lead to higher spending for Caterpillar’s customers.

However, the recently imposed 25% tariff on steel imports and 10% tariff on aluminum imports remains an overhang on the industry given that it will inflate manufacturing costs.

Machinery Stocks Poised for Growth

Caterpillar’s stellar run and solid prospects and upbeat view instils optimism in the broader machinery sector as the company has been dominating the global manufacturing industry for a long time, owing to its size and scope of operations.

The company falls under the Zacks Manufacturing - Construction and Mining industry. The industry has surged 62% over the past year, way ahead of the S&P 500’s growth of 21%.

It currently carries a Zacks Industry Rank of 8 — a testimony to the fact that the industry is in fine shape. The favorable rank places the industry in the top 3% of the 256 groups enlisted.

Consequently, investing in machinery stocks makes perfect sense at this point. We have chosen few stocks based on the momentum strategy, which is based on the premise that once a trend is established, it is likely to continue.

A top Momentum Score cuts short the screening process as it takes into account several factors including volume change and performance relative to its peers. It indicates when the timing is best to grab a stock and take advantage of its momentum with the highest probability of success. Stocks with a Momentum Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) handily outperform other stocks. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apart from Caterpillar, which carries a Zacks Rank #2 and a Momentum Score of B, other stocks from the same industry that fit the bill are -

China National Materials Company Limited CASDY engages in the cement equipment and engineering services, cement, and high-tech materials businesses in China, Middle East, Africa, other Asian countries, Europe, the United States, and internationally. It sports a Zacks Rank #1 and a Momentum Score of B. The shares have soared 180% in the past year.

Hitachi Construction Machinery Co., Ltd. HTCMY manufactures, sells, services, and rents construction machinery worldwide. The stock flaunts a Zacks Rank #1 and a Momentum Score of A. The shares have surged 65% in the past year. Further, the earnings estimate for 2018 and 2019 has gone up 78% and 41%, respectively, over the last 30 days.

Komatsu Ltd. KMTUY engages in the development, manufacture, marketing, and sale of various industrial-use products and services globally. It sports a Zacks Rank #1 and a Momentum Score of B. The earnings estimates for 2018 moved up 12% while that of 2019 rose 10%. The stock has gained 33% in the past year.

H&E Equipment Services, Inc. HEES rents, sells, and provides parts and support services for hi-lift or aerial work platform equipment, cranes, earthmoving equipment, and industrial lift trucks. It carries a Zacks Rank #2 and a Momentum Score of B. Its shares have gone up 68% in the past year. Moreover, the earnings estimate for 2018 and 2019 has gone up 11% and 6%, respectively, over the last 60 days,.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley, Goldman Sachs and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Komatsu Ltd. (KMTUY) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

HITACHI CONSTR (HTCMY) : Free Stock Analysis Report

China National Materials Group Corp. (CASDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance