CBI calls on the Chancellor to use the Budget to aid slowing manufacturing sector; Catalonia crisis lifts the pound against the euro

FTSE 100 nudges up after engineer GKN rallies 5.1pc on break-up speculation; Japanese stocks buoyed by prime minister Shinzo Abe's landslide victory

Euro sinks on growing Catalonia crisis; sterling advances 0.3pc to €1.225 against the euro

Spire Healthcare rejects FTSE 100 firm Mediclinic's takeover approach; Mediclinic already owns 29.9pc of Spire but the FTSE 250 firm said that the offer undervalues it

Dow Jones hits another record intraday high despite General Electric's plunge

Markets wrap: CBI calls on the Chancellor to use the Budget to boost the manufacturing sector

The CBI has called on the Government to use the Budget to boost manufacturing activity after its industrial trends survey showed growth slowing in the sector.

CBI Chief Economist Rain Newton-Smith said that the Government should use next month's budget "to provide a fillip for factories through business rate reforms" to boost investment growth.

Elsewhere, the FTSE 100 has eked into positive territory this afternoon thanks in large part to engineer GKN's 5.1pc rally on speculation that it its two main divisions - automotive and aerospace - will split.

On the FTSE 250, Spire Healthcare has soared 15pc after management rejected a takeover attempt by top shareholder Mediclinic.

Meanwhile, the prospect of Mediclinic having to shell out more cash in attempt to persuade Spire shareholders sent the FTSE 100 firm sinking to the bottom of the blue-chip index.

On the currency markets, sterling has taken advantage of the euro's Catalonia crisis-related weakness to advance 0.4pc against the currency while against the dollar, the pound has pared early losses to nudge up 0.1pc to $1.32.

Oleg Deripaska's energy group En+ valued at almost £6.5bn

Russia’s largest private power and metals maker could be valued at $8.5bn, or £6.4bn, when it becomes the first major Russian listing on the London market since 2014.

Oleg Deripaska, a billionaire oligarch and close friend of Vladimir Putin, plans to price the shares in En+ at between $14 to $17 in London and Moscow in the first test of western appetite for Russian companies since the Crimean crisis three years ago.

The listing could value the company at between $7bn to $8.5bn before the group issues $1bn in new shares to raise the funds needed to pay down its debt.

The listing comes just months after Russia’s largest gold producer Polyus raised more than $800m in a secondary public offering in London and Moscow.

Read Jillian Ambrose's full report here

Investors pour £36m into online estate agency Nested which helps you buy a house before you sell yours

Venture capitalists have poured £36m into Nested, an estate agency which will give you funds to buy a new house before you sell your old one.

The new injection of funding into Nested represents the biggest 'proptech' investment in Europe this year. In the last 18 months it has raised almost £50m.

The company, started by Matt Robinson, who co-founded online payments company, GoCardless, provides sellers with 97pc of the property's value before it is sold so they can compete with cash buyers and are not reliant on a chain.

Nested will market the property and find a buyer like an ordinary estate agent; if it is not sold within 90 days, the seller will receive 97pc of its value to get on with their next sale. When it finally sells, Nested passes on the extra if it exceeds its valuation. It charges around 3pc of the property's value if it is sold for Nested's valuation, and 1.5pc if it sells for below that.

Read Isabelle Fraser's full report here

RBS at risk of 'further action' from watchdog over controversial turnaround unit

The Royal Bank of Scotland's turnaround unit mistreated customers but did not force them to go bust in order to profit, the City watchdog has said - though it has warned there could be grounds for further action.

The Financial Conduct Authority published an update of its review into the Royal Bank of Scotland's controversial Global Restructuring Group (GRG) on Monday, weeks after MPs threatened to use parliamentary powers to force its publication.

GRG has been accused of helping push firms into bankruptcy after the financial crash in order to sweep up their assets cheaply.

In a summary of its review, the FCA pointed to "widespread inappropriate treatment" of smaller customers and identified a number of failings.

These included "a failure by RBS to adopt adequate procedures concerning the relationship with customers" as well as failures to "ensure that appropriate and robust valuations were made by staff" in the unit.

However the regulator did not find that the bank "set out to artificially engineer a position" to push a customer into the restructuring unit, noting that all of the companies were clearly in financial difficulty. #

Read Lucy Burton's full report here

General Electric's 4pc slide can't stop the Dow Jones hitting another record intraday high

General Electric's 4pc plunge early on over in New York hasn't been enough to stop the Dow Jones from hitting another record intraday high.

Spreadex analyst Connor Campbell hasn't had this most thrilling of days by the sounds of it.

He said on today's markets:

"Boy oh boy has today been dull. Pendragon plunge aside there hasn’t been much going on, with all the week’s juicy stuff arriving Wednesday onwards.

"The Dow Jones nudged to a fresh all-time high this Monday despite a meagre 0.1% rise – not so much propelled to a record peak by Donald Trump’s tax plans, then, but rather gently shuffled along. The Dow has hit these highs with such regularity over the last month or so that they no longer really register, especially since much of it has been done – like today – through a routine daily grind rather than fireworks."

With UK GDP growth figures due on Wednesday and the ECB's crucial monetary policy meeting the day after, the fun's all to come later this week.

Bank of America's Merrill Lynch hit with £34.5m fine for breaking reporting rule

The City watchdog has fined US bank Merrill Lynch £34.5m for breaking a reporting rule put in place to boost transparency after the financial crisis.

Merrill Lynch International failed to report 68.5 million derivative trades in the two years to February 2016, the Financial Conduct Authority (FCA) said, breaking a rule put in place after the crisis to help authorities assess potential risk in financial markets.

While this is not the first time the bank has been slammed by the regulator for reporting failures - it faced a £13.3m fine in 2015 for incorrectly reporting 35m transactions and failing to report thousands of others - this is the FCA's first penalty of its kind under European Markets Infrastructure Regulation (Emir) rules.

Read Lucy Burton's full report here

Premier Oil defies doubters by keeping North Sea push on track

Premier Oil’s cornerstone North Sea oil project Catcher has installed crucial floating production equipment ahead of winter, defying doubters who believe it will not start up before the end of the year.

The project milestone has been keenly watched by investors in the debt-wracked oil producer, which is relying on Catcher to boost its production by 60,000 barrels of oil a day by the year-end.

Market commentators had feared that a delay to the arrival of the floating storage and production unit (FSPO) could mean the work to fully integrate the project may take longer as weather conditions become more hostile offshore.

But the oil producer assured the market on Monday that the FPSO was hooked up to the Catcher oil project off the coast of Aberdeen last week. Experts believe it will now take around two months for the equipment to be commissioned before oil begins to flow.

Read Jillian Ambrose's full report here

Euro continues to drift downwards as Catalonia crisis deepends

#Catalonia poll: 83.4% of Catalans against Spanish police violence against voters #1O

Poll from pro-unionist newspaper.#CatalanReferendumpic.twitter.com/fszyx5Rbvc— Ramon Tremosa �� (@ramontremosa) October 23, 2017

The euro is still drifting downwards on the currency markets on reports that Catalan officials will defy the Spanish government if it attempts to strip it of its powers.

Sterling has advanced 0.3pc to €1.1235 against the euro on the currency markets as tensions grow in Catalonia but the IBEX 35, which has suffered some sharp falls in the last month on the back of the crisis, has only retreated 0.3pc today.

Lukman Otunuga, research analyst at FXTM, believes ECB president Mario Draghi could lift the euro back up to its summer highs:

"With political drama in Spain punishing the Euro, could Mario Draghi offer a lifeline to the currency on Thursday? Although expectations remain elevated over the European Central Bank QE tapering this month, investors still need clarity on how much the monthly purchases will be reduced by in 2018 and how long tapering will last.

"If Draghi adopts a cautious stance, and suggests that QE may be extended beyond 2018, the Euro is at risk of depreciating further as markets acknowledge this as a dovish taper."

Struggling Interserve wins £140m contract extension with the BBC

Interserve has been given a boost this week after winning a £140m extension to a contract to provide cleaning and security services for the BBC.

The firm will now manage the broadcaster’s estate until 2023, a four-year extension to its existing contract.

The news comes after a turbulent few weeks for the outsourcer in which it warned that its profits for this year were likely to be half what they were last year amid spiralling costs for a troubled energy-from-waste contract.

It also said there was “a realistic prospect” of it breaching its financial covenants with its lenders.

However, despite its problems, figures revealed by The Telegraph this week showed that the public sector has continued to hand hundreds of millions of pounds' worth of contracts to the company during the last year.

Read Rhiannon Bury's full report here

Manufacturing picture not all bad

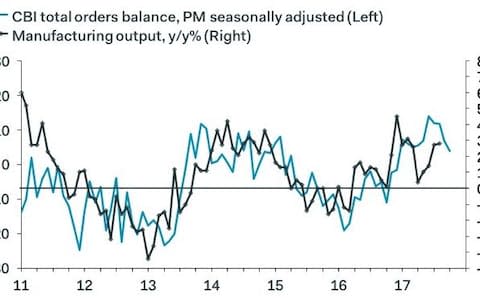

A slightly more upbeat reaction from Capital Economics to today's CBI survey.

Andrew Wishart, UK economist, reckons the survey "is still consistent with the manufacturing sector maintaining its new-found momentum in Q4".

He continues:

Admittedly, the headline total orders balance fell unexpectedly from +7 to -2, the weakest reading since last November. But note that this is still well above the series’ long run average of -19

However, the CBI's business optimism survey is more detailed, he says, and here the responses are less cheery:

Meanwhile, the more detailed quarterly questions did not provide much cause for optimism. In particular, business optimism fell to -11, below the series long run average of -5. And investment intentions weakened, with uncertainty over demand being cited as a key factor.

Manufacturing sector slowing

Today’s CBI industrial trends survey has confirmed that the UK’s bright spot, the manufacturing sector, is beginning to slow.

IHS Markit’s manufacturing PMI survey also indicated that the sector was decelerating but the deterioration has been “exaggerated by season distortions”, according to Pantheon Macro UK economist Samuel Tombs.

Has Mr Tombs suddenly turned bullish on the UK economy?

Not quite. He added that his seasonally adjusted measure still showed the CBI’s orders balance falling to +4, its lowest level since December.

Lunchtime update: Pound stagnates on forex markets; manufacturing sector is slowing, says CBI

The pound has largely been a passenger on the currency markets this morning, retreating against the buoyant dollar and advancing on the euro weakening on the growing crisis in Catalonia.

The CBI's latest industrial trends survey indicating that the manufacturing sector is beginning to slow has had little effect on the pound ahead of crucial third quarter GDP figures due on Wednesday.

The organisation called on the Chancellor to use next month's Budget to boost the sector with last week's falling public sector net borrowing figures giving Philip Hammond the opportunity to loosen the purse strings.

Elsewhere, the FTSE 100 has nudged up into positive territory despite commodity stocks edging down with Spire Healthcare rejecting top shareholder Mediclinic's advances this morning's corporate highlight.

Building materials group CRH has jumped 2.2pc after sealing a $3.5bn deal for US peer Ash Grove while engineering group GKN has risen 3.5pc on speculation that it will split its automotive and aerospace divisions.

CBI industrial trends reaction: Challenging domestic conditions are offsetting promising export environment

Manufacturing output growth eased in the three months to October. #CBI_ITShttps://t.co/hi00lEfMj0pic.twitter.com/08KOgNRv5n

— CBI Economics (@CBI_Economics) October 23, 2017

Today's CBI industrial trends survey indicates that the manufacturing sector is "faltering after a robust third quarter", according to EY ITEM Club's chief economic advisor Howard Archer.

Challenging-looking domestic conditions are offsetting promising export environment, he said.

Mr Archer added:

"On the export side, a very competitive pound and healthy global demand are helping UK manufacturers competing in foreign markets. The weakened pound could also encourage some companies to switch to domestic sources for supplies, which would help manufacturers of intermediate products.

"On the domestic front, increased prices for capital goods and big-ticket consumer durable goods, weakened consumer purchasing power, and economic and political uncertainty threaten to hamper manufacturers. Businesses’ willingness to invest and buy capital goods is being tested by extended lacklustre UK economic activity as well as Brexit uncertainties."

Car dealer Pendragon warns on profits as consumer demand 'wanes'

British car dealership chain Pendragon has warned on full-year profit, blaming a decline in demand for new cars and the consequent price correction in the used car market.

Share in the company tumbled more than 18pc in early trade to 23.50p.

Pendragon also said chairman Mel Egglenton has stepped down for personal reasons, with immediate effect, and had been replaced by Chris Chambers, a non-executive director since 2013.

The group said it now expected a pre-tax profit of £60m in 2017 versus previous expectations of £75.2m, according to Reuters data, and £75.4m made in 2016.

Growth in the manufacturing sector is slowing, according to the CBI's industrial trends survey

The CBI has called on the Government to use the Budget to boost manufacturing activity after its industrial trends survey showed growth in the sector softening in the three months to October.

The survey indicated that optimism on business conditions fell for the first time this year with a balance of -22pc of respondents saying that they were more optimistic about the general business situation compared to three months ago.

Rain Newton-Smith, CBI Chief Economist, said that while growth in output and orders are still above historical norms, the outlook for investment is becoming more "subdued".

She added:

"To boost investment growth, Government should use the Budget to provide a fillip for factories through business rate reforms, including exempting new plant and machinery from rates altogether, and switching to the more recognized CPI inflation measure rather RPI when calculating upratings."

Pound set for a crucial week

After nudging down on the foreign exchange markets last week, the pound is largely a passenger to other currencies' movements this morning, slipping against the rising dollar and nudging up against the sinking euro.

CBI business optimism figures are due to drop any minute but the first estimate of third quarter GDP growth on Wednesday will dictate much of sterling's momentum this week.

Chief executive of RationalFX Paresh Davdra explained:

"The pound looks to be set for another crucial week against its major peers. Last week saw the currency strengthen on the back of positive signals regarding Brexit from the EU at Friday’s summit, but it came following a week of poor data suggesting a slowing UK economy.

"The pound was able to rise against the euro, as uncertainty over the on-going Catalonia tensions continue to unsettle investors, but yielded to a strengthening dollar."

Brent crude slips off Friday's high under pressure from a rising dollar

Oil prices are under pressure from a rising dollar this morning with Brent crude nudging down 0.3pc to $57.50 per barrel.

The price has been supported in recent weeks by fighting between Iraqi and Kurdish forces igniting fears of a supply squeeze in the area.

A shipping source has told Reuters in the last few moments, however, that the crude oil flow rate through the pipeline running from Iraqi Kurdistan to Turkey has nudged up slightly to 255,000 barrels per day.

Chris Beauchamp explained how events in the Middle East have affected the price of oil recently:

"The Iran/Iraq/Kurdistan quagmire shows no sign of improvement, and about the only positive thing that can be said about the situation is that it has, so far, not spread to involve other nations like Saudi Arabia.

"This geopolitical nightmare would likely push oil yet higher, but with Trump still sabre-rattling over Iran the situation could rapidly get out of hand."

Deepening crisis in Catalonia sinks the euro

The euro is this morning's big mover on the currency markets after sinking on the Catalonia crisis stepping up another notch.

Prime minister Mariano Rajoy has moved to fire Catalonia president Carles Puigdemont, saying that he had no choice but to apply Article 155 to strip the regional government of its powers. The deepening crisis has helped sterling advance 0.2pc against the euro this morning to €1.1220.

Besides being woefully undemocratic, Rajoy's strategy against Catalan Independence is politically inept and doomed to fail https://t.co/91mTZgs3zH

— Mark Friis Hau (@MfHau) October 23, 2017

Markets will be awaken from their slumber later this week, according to Spreadex analyst Connor Campbell.

He said:

"UK and US Q3 GDP readings! The latest ECB rate vote and press conference! A slew of manufacturing and services PMIs! There’s so much stuff to look forward to this week – sadly none of it is today, with the markets having little reason to crawl out of bed this Monday."

Prospect of more 'Abenomics' boosts Japanese stocks and sinks the yen

Japanese stocks were boosted overnight by prime minister Shinzo Abe securing a landslide victory in the country's snap election, extending the Nikkei 225's winning streak to an incredible 15 days.

Six straight quarters of GDP growth were enough to convince voters that 'Abenomics' was boosting the economy and the prospect of continuing loose monetary policy at the Bank of Japan has sunk the Japanese yen to a three-month low against the dollar.

Michael Stanes, investment director at Heartwood Investment Management, explains what Abe's victory means for Japan:

"For some observers, Abe’s achievements thus far have only amounted to coercing the Bank of Japan into bankrolling an ever-rising debt mountain, thereby propping up the stock market rather than reflating the economy.

"Japan’s ‘lowflation’ conundrum has mired domestic growth prospects for more than two decades. When Abe first came to power in 2012, the three arrows of so-called Abenomics – monetary easing, fiscal stimulus and structural reforms – were heralded as the great panacea to revive Japan’s economic fortunes.

"As events transpired, Abe has focused on just one arrow, monetary easing, with the economy relying heavily upon the Bank of Japan’s shock-and-awe tactic of flooding the market with liquidity."

Spire rejects takeover approach from top shareholder Mediclinic

How this for a bit of corporate boardroom drama to digest with your cornflakes?

Spire Healthcare's shares diving last month after its profits dropped due to a legal settlement and it gave a gloomy outlook for its NHS business gave FTSE 100 peer and its top shareholder Mediclinic the opportunity to try and snap up the healthcare provider on the cheap.

Spire shares open up 12% after it rehects bid from 30% shareholder FTSE 100-listed Mediclinic as too low.

— Garry White (@GarryWhite) October 23, 2017

Swirling takeover rumours and an analyst note arguing that the NHS slowdown might not be as severe as initially thought boosted Spire shares by 15pc last week and this morning the company confirmed that it had been approached by Mediclinic.

However, Spire has recommended that shareholders reject Mediclinic's approach, arguing that it has undervalued the company. With Mediclinic owning a 29.9pc stake in the company and its chief executive Danie Meintjes having a seat on Spire's board, this one could turn a bit nasty.

Spire shares have soared this morning on the back of the rejected approach, rising 13pc to the top of the FTSE 250.

Agenda: Catalonia crisis lifts the pound against the euro; Nikkei 225 buoyed by Japanese PM's landslide victory

There's no top tier earnings for investors to digest this morning but there's drama aplenty from the corporate world with Spire Healthcare's board rejecting Mediclinic's takeover approach and beleaguered outsourcer Interserve bagging a BBC contract just days after issuing a profit warning.

Spire's board has recommended shareholders to reject Mediclinic £1.2bn cash plus shares offer despite the FTSE 100 firm already owning a 29.9pc stake in the healthcare provider, saying that the proposal undervalues the firm.

The FTSE 100 has nudged down into the red this morning with banking stocks and its two oil giants weighing heavily early on.

Overnight, the Nikkei 225 has been buoyed by Japanese prime minister Shinzo Abe's resounding victory in the country's snap election, closing 1.1pc higher.

Asia stocks starting in risk-on mode to the week. #Japan shares at two-decade top after Abe win. US tax reform hopes adding to positivity. pic.twitter.com/jWPHPk2cWL

— Holger Zschaepitz (@Schuldensuehner) October 23, 2017

CBI's business optimism survey is the sole release on a very sparse economics calendar with this week's agenda hotting up from Wednesday in the form of third quarter UK GDP growth figures and the European Central Bank's monetary policy decision.

Meanwhile on the currency markets, the pound is taking advantage of the euro sinking on the growing tensions in Catalonia, advancing 0.3pc to €1.225, but remains stuck in flat territory against the dollar.

Interim results: Braemar Shipping Services

Trading statement: Petra Diamonds, Essentra

AGM: City of London Investment Group, Goldplat

Economics: CBI business optimism

Yahoo Finance

Yahoo Finance