Carvana (CVNA) Dips 4.7% Since Wider-Than-Expected Q3 Loss

Carvana Co.’s CVNA shares have declined 4.7% since the company incurred wider-than-expected third-quarter 2021 loss on Nov 4 after the closing bell. Loss per share of 38 cents widened from the year-ago figure of 10 cents a share. The Zacks Consensus Estimate was pegged at a loss of 28 cents. The underperformance stemmed from lower-than-expected gross profit per unit from ‘used vehicle’ and ‘other’ sales.

The top line, however, was better than expected and improved year over year. Third-quarter revenues of $3,480 million outpaced the Zacks Consensus Estimate of $3,252 million and surged 125% year over year.

During the September-end quarter, the number of used vehicles sold to retail customers grew 74% to 111,949 from the prior-year period’s 64,414. Total gross profit amounted to $523 million, up a whopping 100% year over year. SG&A expenses came in at $546 million, flaring up 108.4% year on year.

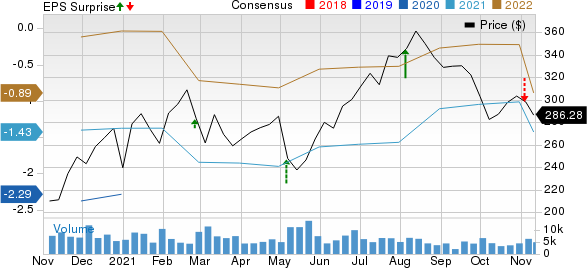

Carvana Co. Price, Consensus and EPS Surprise

Carvana Co. price-consensus-eps-surprise-chart | Carvana Co. Quote

Segmental Performance

Used vehicle sales totaled $2,650 million for the third quarter, rocketing 105.6% year over year. The sales figure also beat the Zacks Consensus Estimate of $2,468 million. Gross profit per unit for used vehicles amounted to $1,769, declining 4.8% year over year. The metric also fell short of the Zacks Consensus Estimate of $1,780.

For the reported quarter, wholesale vehicle sales summed $552 million, soaring a whopping 324.6% year over year. The figure also topped the consensus mark of $418 million. Gross profit per unit for wholesale vehicles came in at $420, up 58.4% year over year. The metric also outpaced the consensus mark of $362 million.

For the July-September period, other sales and revenues shot up 122.4% year over year to $278 million. The figure also trumped the Zacks Consensus Estimate of $260 million. Gross profit per unit came in at $2,483, surging from the year-ago period’s $1,934. The metric, however, lagged the Zacks Consensus Estimate of $2,565.

Financial Position

Carvana had cash and cash equivalents of $297 million as of Sep 30, 2021 compared with $301 million on Dec 31, 2020. Long-term debt amounted to $3,134 million as of Sep 30, 2021, up from $1,167 million recorded on Dec 31, 2020. The firm currently carries a Zacks Rank #3 (Hold). It estimates total gross profit per unit in low-to-mid $4,000 in 2021.

How Did CVNA’s Close Peers Fare in Q3?

TrueCar TRUE reported third-quarter adjusted loss of 2 cents a share, narrower than the Zacks Consensus Estimate of a loss of 3 cents. The bottom line, however, deteriorated from the year-ago earnings of 14 cents a share. Revenues of $55 million declined from the year-ago figure of $77 million and missed the consensus mark of $59 million.

TrueCar surpassed earnings estimates in each of the trailing four quarters, with the average being 58.3%. The Zacks Consensus Estimate for TRUE’s 2022 earnings and revenues implies year-over-year growth of 100% and 14.9%, respectively.

TrueCar currently carries a Zacks Rank #3. The stock has declined 5% year to date.

CarGurus CARG reported third-quarter adjusted earnings of 38 cents a share, beating the Zacks Consensus Estimate of 32 cents. The bottom line also rose from the year-ago earnings of 37 cents a share. Revenues of $223 million grew 51% year over year and topped the consensus mark of $215 million.

CarGurus surpassed earnings estimates in each of the trailing four quarters, with the average being 37.9%. The Zacks Consensus Estimate for CARG’s 2021and 2022 sales implies year-over-year growth of 48.8% and 18.8%, respectively.

CarGurus currently carries a Zacks Rank #3. The stock has increased 22.2% year to date.

Vroom VRM reported third-quarter adjusted loss of 70 cents a share, narrower than the Zacks Consensus Estimate of 74 cents. Yet, the bottom line deteriorated from the year-ago loss of 31 cents a share. Revenues of $897 million jumped from the year-ago figure of $323 million and outpaced the consensus mark of $894 million.

Vroom surpassed earnings estimates in two of the trailing four quarters, matched the same once and missed on another occasion, with the average negative surprise being 1%. The Zacks Consensus Estimate for VRM’s 2021 and 2022 revenues implies year-over-year growth of 130.9% and 48.5%, respectively.

Vroom currently carries a Zacks Rank #3. The stock has slumped 54.6% year to date. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TrueCar, Inc. (TRUE) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

CarGurus, Inc. (CARG) : Free Stock Analysis Report

Vroom, Inc. (VRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance