Canadian Resources (CNQ) Q3 Earnings Top Estimates, Surge Y/Y

Canadian Natural Resources Limited CNQ recently delivered third-quarter adjusted earnings per share of 85 cents, comfortably surpassing the Zacks Consensus Estimate of 72 cents. The better-than-expected results were driven by higher crude oil and NGLs output, and price realizations. The bottom line was also way ahead of the prior-year earnings of 15 cents a share.

Revenues came in at $4,514 million, missing the Zacks Consensus Estimate of $4,710 million due to planned maintenance activities in the North Sea and lower natural gas output. However, the top line witnessed a jump from third-quarter 2017 revenues of $3,420 million.

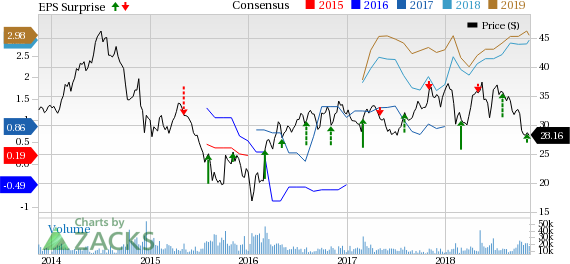

Canadian Natural Resources Limited Price, Consensus and EPS Surprise

Canadian Natural Resources Limited Price, Consensus and EPS Surprise | Canadian Natural Resources Limited Quote

Liquid Production Rises

Canadian Natural reported quarterly production of 1,060,629 barrels of oil equivalent per day (BOE/d), up from 1,036,499 BOE/d in the prior-year quarter. Oil and natural gas liquids (NGLs) output (accounting for more than 75.6% of total volumes) increased to 801,742 barrels per day (Bbl/d) from 759,189 Bbl/d recorded a year ago. Crude oil and NGLs production from operations in North America came in at 754,238 Bbl/d, higher than the year-ago quarter’s 715,581 Bbl/d.

Meanwhile, overall natural gas volumes recorded a year-over-year decline from 1,664 million cubic feet per day (MMcf/d) to 1,553 MMcf/d in the quarter under review. Production in North America came in at 1,489 MMcf/d, lower than the year-ago period’s 1,593 MMcf/d.

Prices

Canadian Natural’s realized natural gas price was C$2.32 per thousand cubic feet compared with the year-ago level of C$2.29. Realized oil and NGLs price increased 25% to C$57.89 per barrel from C$46.33 in the third quarter of 2017.

Total Expenses

Total expenses incurred in the quarter totaled C$3,754, reflecting an increase from the year-ago level of C$3,684. The increased expenses are primarily attributed to higher transportation, blending and feedstock costs.

Capital Expenditure

In the reported quarter, capital expenditure totaled C$1,473 million. Net capital expenditure totaled C$3,550 million in the first nine months of 2018.

Balance Sheet

As of Sep 30, 2018, the company had C$296 million in cash and cash equivalents, and a long-term debt of C$19,233 million, representing a debt-to-capitalization ratio of approximately 36.5%.

Guidance

Canadian Natural expects its capital expenditure to be around C$4.6 billion in 2018.

For full-year 2018, the company expects its crude oil and NGL production from North American operations in the range of 240,000-246,000 Bbl/d. It reiterated its thermal in situ oil sands production guidance at 107,000-127,000 bbl/d. It forecasts its full-year 2018 liquids output in the band of 802,000-868,000 Bbl/d (lower than the previous guided range of 815,000-885,000 bbl/d), while natural gas output is still likely to be in the range of 1,550-1,600 MMcf/d.

Fourth-quarter liquids production is anticipated within 801,000-849,000 Bbl/d and natural gas output is projected at 1,480-1,510 MMcf/d.

Zacks Rank & Key Picks

Currently, Calgary, Canada-based Canadian Natural has a Zacks Rank #3 (Hold). Investors interested in the energy sector can opt for some better-ranked stocks given below:

New York, NY-based Hess Corporation HES has a Zacks Rank #1 (Strong Buy). Its earnings for 2018 are expected to surge around 100% from the 2017 level. You can see the complete list of today’s Zacks #1 Rank stocks here.

Fort Worth, TX-based Range Resources Corporation RRC holds a Zacks Rank #2 (Buy). The company’s earnings for 2018 are expected to surge more than 100% year over year.

El Dorado, AR-based Murphy Oil Corporation MUR carries a Zacks Rank #2. The company’s sales for 2018 are expected to grow more than 20% from 2017.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Range Resources Corporation (RRC) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance