Canadian cities where singles can afford to get into the housing market

Home ownership with a partner is out of reach for many Canadians.

Buying that first home alone is even harder, but new data from Zoocasa shows going it alone in some parts of the country doesn’t have to be a pipe dream.

About half of home owners are single, and one in five of them live in a condo apartment according to Statistics Canada.

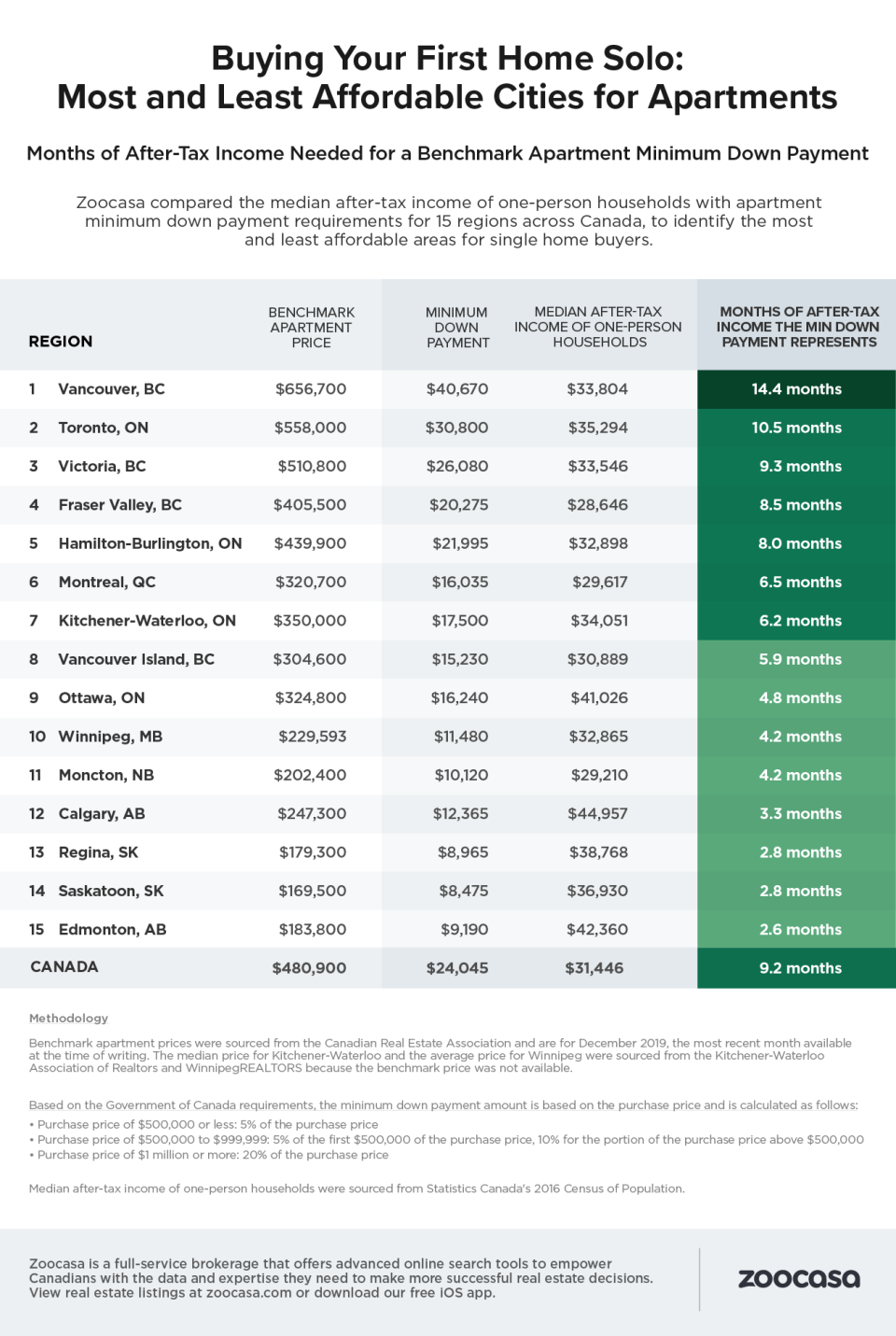

Zoocasa crunched the numbers by comparing the average price of a condo apartment and median incomes across 15 regions. The report used median income for a year and calculated how long it would take to save for a down payment assuming the buyer can somehow sock away all of their after-tax income.

If you plan to go it alone in the country’s biggest markets, the odds are stacked against you.

“For example, to purchase Vancouver real estate, which has long held the distinction as the nation’s most expensive, the required down payment would be greater than what is earned by a median single-income household in an entire year,” said Penelope Graham, managing editor at Zoocasa, in the report.

“There, a benchmark apartment costs $656,700, requiring a minimum down payment of $40,670, outstripping the $33,804 earned by single buyers.”

That means it would take a little over 14 months to save up enough for a down payment, assuming you can somehow save every penny you earn.

Toronto is an only slightly easier nut to crack. The average price is $558,000 so it would take 10.5 months to save up $30,800.

Pockets of relative affordability

The best bet for solo buyers is to head west, where the gap between the average condo apartment price and median income shifts in the buyers favour.

“Edmonton takes the top spot as most affordable for single-income buyers, with benchmark units going for $183,800, requiring a down payment of just $9,190,” said Graham.

“Meanwhile, city residents earn the relatively higher median after-tax income of $42,360; it would take just 2.6 months of setting funds aside to come up with the money needed to purchase a home.”

Saskatchewan is home to the second and third most affordable markets.

It would take 2.8 months to save up for a $8,475 down payment on a $169,500 condo apartment in Saskatoon. It would take the same amount of time for an $8,965 for a 179,300 unit in Regina.

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance