Bye bye, bank tellers: Why digital banking is the future

People are just now starting to use their smartphones like digital wallets, but people have turned to their phones, computers, and ATM machines to facilitate banking for some time now. Thing is, it’s not only more efficient for consumers — it’s hugely beneficial for banks, too.

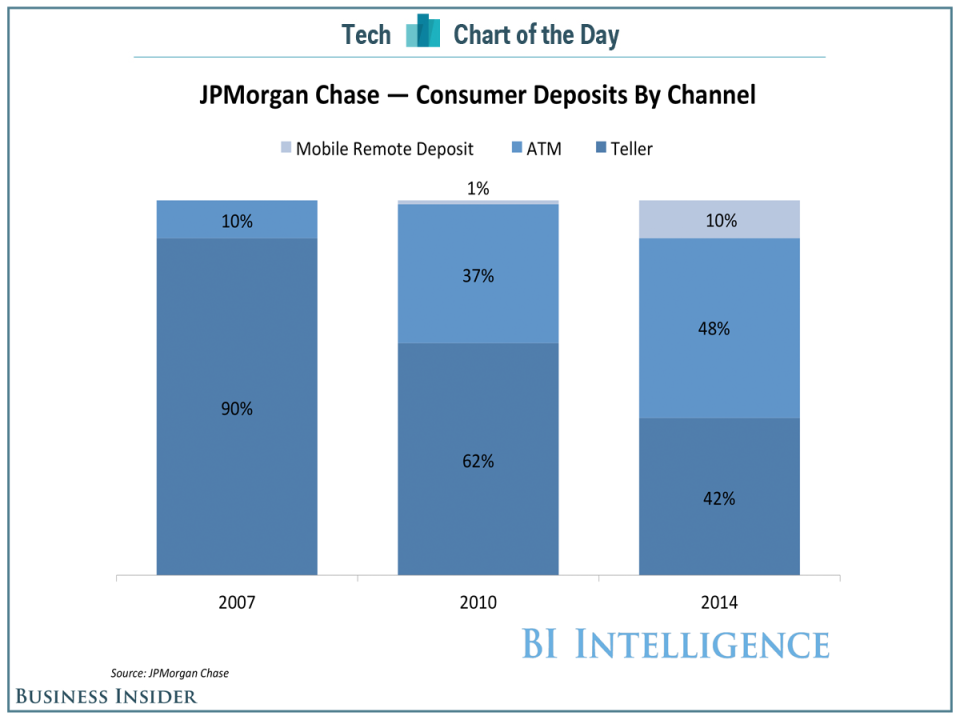

Based on JPMorgan Chase data charted for us by BI Intelligence, ATM deposits have jumped from 10% of total deposits in 2007 to 48% of deposits last year, mobile deposits jumped from 0% to 10% during that same span, and deposits involving human tellers dropped from 90% of total deposits 7 years ago to just 42% in 2014.

Here’s why that’s great for banks: According to JPMorgan Chase, deposits made by tellers cost an average of $0.65, but deposits made via ATMs cost just $0.08. And you can bet banks will encourage safe mobile deposits in the years to come: Mobile deposits cost banks just $0.03 apiece.

BI Intelligence

NOW WATCH: Foolproof signs that you should give up on your business idea

The post Bye bye, bank tellers: Why digital banking is the future appeared first on Business Insider.

Yahoo Finance

Yahoo Finance