Buying Shares Post-Split: Good or Bad Idea?

Many stock splits have occurred in recent years, with companies aiming to increase liquidity within shares and erase barriers to entry for potential investors.

Of course, it's critical to remember that a split does not directly impact a company's financial position or performance.

Several companies – Monster Beverage MNST, Tesla TSLA, Alphabet GOOGL, Palo Alto Networks PANW, and Shopify SHOP – have all split their shares over the last year.

It raises a valid question: is buying post-split a good strategy? Let’s take a closer look at the performance of each post-split.

Monster Beverage

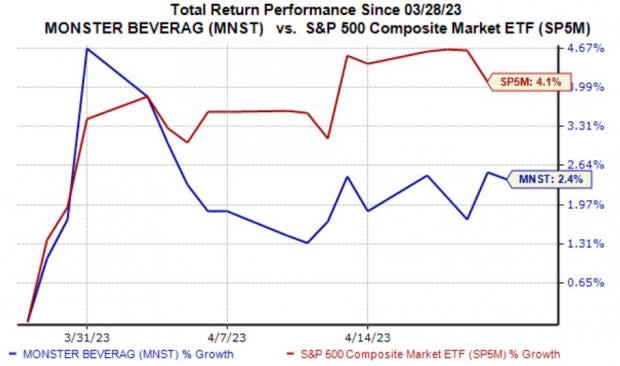

On February 28th, 2023, the energy beverage titan Monster declared a 2-for-1 split; shares began trading on a split-adjusted basis on March 28th, 2023.

Since the split, MNST shares have etched in a 2.4% gain, underperforming relative to the S&P 500 by a fair margin.

Image Source: Zacks Investment Research

Monster sports a solid growth trajectory, with earnings forecasted to climb more than 30% in its current fiscal year (FY23) and a further 17% in FY24.

Image Source: Zacks Investment Research

Tesla

In June of 2022, the mega-popular EV manufacturer announced a three-for-one stock split; shares began trading on a split-adjusted basis on August 25th, 2022.

Since the split, Tesla shares have declined by 45% in value, coming nowhere near the general market’s performance.

Image Source: Zacks Investment Research

Tesla reported earnings this week; results came in somewhat mixed, with the company posting a 2.4% EPS beat and a negative 1% sales surprise. The market didn’t appreciate the results, with TSLA shares facing selling pressure post-earnings.

Image Source: Zacks Investment Research

Alphabet

The tech titan Alphabet announced a 20-for-1 split in early 2022. Shares began trading on a split-adjusted basis on July 18th, 2022.

Alphabet shares have retraced 3.5% in value post-split so far, again underperforming relative to the general market.

Image Source: Zacks Investment Research

Watch for Alphabet’s upcoming quarterly release expected on April 25th; the Zacks Consensus EPS Estimate of $1.06 indicates a roughly 14% year-over-year pullback within earnings.

The quarterly earnings estimate has been revised roughly 5% lower since January, as we can see illustrated below.

Image Source: Zacks Investment Research

Palo Alto Networks

PANW’s three-for-one stock split in mid-September didn’t get much attention. The company’s shares started trading split-adjusted on September 14th, 2022.

Palo Alto Networks shares have been hot throughout 2023, as shown below. Since the split, PANW shares are up 5.7%, marginally outperforming the S&P 500.

Image Source: Zacks Investment Research

Value-focused investors may not find PANW shares attractive, with the company carrying a Style Score of “F” for Value. Presently, PANW’s 8.5X forward price-to-sales ratio resides on the expensive side, above the Zacks Computer and Technology sector average and the 7.5X five-year median.

Image Source: Zacks Investment Research

Shopify

SHOP shares started trading split-adjusted on June 29th, 2022; the company performed a 10-for-1 split.

As shown below, Shopify shares have delivered a strong performance overall since the split, up nearly 50% and crushing the general market’s performance.

Image Source: Zacks Investment Research

The stock has displayed significant momentum in 2023, delivering a 40% return and exceeding the Zacks Computer and Technology sector’s impressive 19% gain.

Image Source: Zacks Investment Research

Bottom Line

We’ve seen several stock splits over the last few years, with companies aiming to boost liquidity within shares and make them more affordable for potential investors.

All five companies above – Monster Beverage MNST, Tesla TSLA, Alphabet GOOGL, Palo Alto Networks PANW, and Shopify SHOP – have split their shares over the last year.

Interestingly enough, only PANW and SHOP shares reside in the green post-split of the five listed.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance