Buyers Expect Prices to Fall in the Next 12 Months, But Are Optimistic for the Long Term

By Mr. Propwise

iProperty Group Ltd, a leading real estate portal network in Asia, has released its Asia Property Market Sentiment Report H2 2016 (APMSR H2 2016). It’s 200+ pages full of data and charts of results from their survey covering the property markets of Malaysia, Indonesia, Singapore and Hong Kong. For this article I’ve extracted some of the key findings on the Singapore market I found interesting, but if you’re interested in all the details you should check out the report.

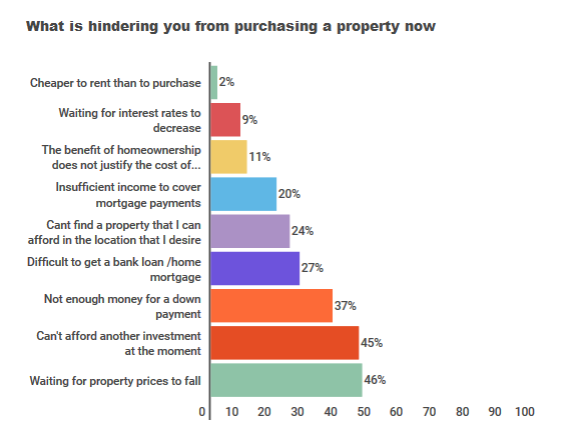

Buyers find property prices unaffordable; waiting for prices to fall

“Waiting for property prices to fall” was the top reason and quoted by 46% of buyers as the key reason holding them back from purchasing a property. The other highly cited reasons were a lack of funds and the inability to get financing.

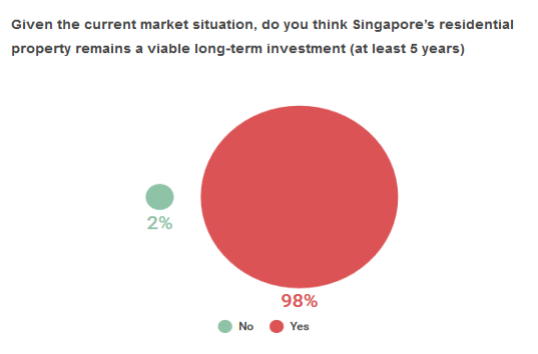

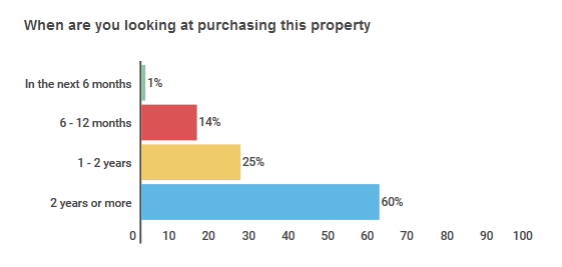

Property still attractive in the long term, but most looking to wait a couple of years before buying

While the overwhelming majority (98%) of respondents to this survey thought that Singapore residential property was still a good long term investment, almost the same number (97%) thought property prices would continue to fall in the next 12 months.

As such, most planned to avoid the property in the near term and instead 60% of respondents only planned to purchase a property in two or more years’ time. This does not bode well for transaction volumes over the next couple of years.

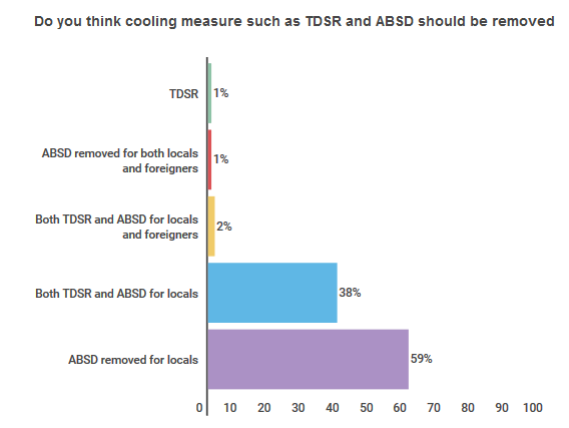

“Cooling measures should be removed, but it ain’t going to happen”

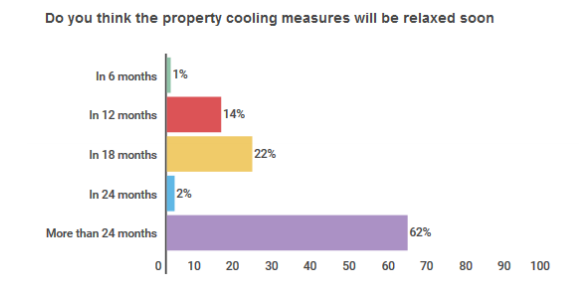

While the majority of survey respondents (60%) thought that the Additional Buyer’s Stamp Duty should be removed for locals, almost the same number (62%) thought it would not be relaxed for at least the next 24 months.

Personally, I think the cooling measures will only be relaxed when there is a prolonged weakness in the property market, with a price drop of at least another 10 to 15 percent necessary before the government has a change of heart.

Wait and see

To conclude, based on the survey results, most buyers are still in a “wait and see” attitude, looking for property prices to go down further before deciding to make a move. This tends to create a self-fulfilling prophecy as transaction volumes dry up and the more desperate buyers being forced to lower prices to get their unit sold, pushing prices down further.

It’ll be an interesting 24 months ahead.

By Mr. Propwise, founder of www.Propwise.sg, a Singapore property blog dedicated to helping you understand the real estate market and make better decisions. Click here to get your free Property Beginner’s and Buyer’s Guide.

Related Articles

7 Reasons Why Property Prices Won’t Recover Soon (at Propwise.sg)

What is a “Meaningful”Correction of Property Prices? (at Propwise.sg)

Singapore Property Prices Reach All-Time High Yet Again, But… (at Propwise.sg)

Yahoo Finance

Yahoo Finance