Buy these seven shares to profit from driverless cars and artificial intelligence

The idea of investing in technology companies will, for many, bring back painful memories of the tech bubble bursting at the turn of the millennium.

Today, there is little of the mania of two decades ago. Technology firms are typically more expensive to buy than the wider market, but are now delivering significant profits – which were conspicuously absent the first time around.

Some investors will have exposure to technology through companies such as Amazon, Facebook and Google, which are popular holdings in many funds available to British savers. Such businesses are involved in many cutting-edge areas of technology, including autonomous cars, artificial intelligence, machine learning and more.

But there is another approach: investing in companies that make “enabling” technology, the components and software used in many of the most advanced developments.

Telegraph Money asked a number of technology fund managers to name some of their favourite stocks. There are very few quoted technology firms in Britain, so many of the stocks discussed here are listed overseas.

A number of investment shops, including Hargreaves Lansdown and TD Direct, offer international share dealing, although not all do so within an Isa. You may need to fill in special forms before you trade, depending on the country.

Autonomous vehicles

Fully autonomous cars are estimated to be just five years away, depending on both technology and the development of a regulatory system. This will dramatically increase the market for the components required.

For now, much of the growth comes from “advanced driver assistance systems”, such as automatic braking or adaptive cruise control.

Infineon Technologies (German listed)

Market value: £19.5bn

Last year’s pre-tax profit: £763m

This semiconductor firm was tipped by all of the technology fund managers we spoke to. It makes components used in systems such as emergency braking and battery management.

Hyunho Sohn, manager of the £2bn Fidelity Global Technology fund, said: “Infineon exemplifies a company poised to gain from the move to electric and autonomous cars. It has a market-leading position and, as the technology going into each vehicle increases, it should experience increases in revenue and margin.”

Delphi (US listed)

Market value: £18.7bn

Last year's pre-tax profit: £1.9bn

Delphi integrates different technologies into packages that meet the rigorous standards of the automotive industry, Mr Sohn explained

He said: "The firm has strong relationships with the major car manufacturers, and is well positioned to profit from both the rapid proliferation in low-level systems, and the eventual roll-out of fully autonomous driving."

The company recently assembled an autonomous Audi which drove itself from San Francisco to New York, which Mr Sohn described as the "most sophisticated autonomous vehicle to date".

Artificial intelligence and machine learning

The concept of artificial intelligence – the ability of a computer system to learn and adapt – has existed for decades.

Ben Rogoff, manager of two Polar Capital technology funds totalling £2.5bn, explained that, as with any technology, AI started out as a promise with no means of delivery.

“Today, it feels like we have the capability, thanks to computing breakthroughs, cheap data storage and the internet. Right now the applications are straightforward, such as facial recognition and improving search results, but they will expand,” he said.

Nvidia (US listed)

Market value: £75bn

Last year’s pre-tax profit: £1.9bn

Nvidia, tipped by several managers, could fall under a number of the categories here. Its graphics processing units (GPUs) are becoming increasingly important for “vision systems” in autonomous cars, Mr Rogoff said.

He said AI offered another avenue for expansion, as GPUs could be used to “train” AI networks.

“This is what makes AI intelligent – the ability of the network to improve by looking at its past mistakes. Nvidia has become the best way to play this theme among quoted stocks,” he said.

Blue Prism (UK listed)

Market value: £578m

Last year’s pre-tax profit: £5m loss

This firm makes software “robots” that automate tasks to create a so-called “digital workforce”.

Chris Ford, manager of Smith & Williamson’s new Artificial Intelligence fund, described it as “one of the very few pure AI companies anywhere in the world”.

He said: “It’s covered by only two analysts and could fall into the ‘undiscovered gems’ camp despite the huge recent rise in the share price. We think this technology will become ubiquitous for financial firms to reduce cost and improve accuracy. The ability to avoid regulatory breaches is just as important as the cost saving.”

Xilinx (US listed)

Market value: £11.8bn

Last year's pre-tax profit: £699m

There are multiple parts of an AI network, with some companies specialising in different parts of the chain.

Mr Rogoff explained that once an AI network has been trained, "it needs to be able to make decisions".

Xilinx is a "veteran" semiconductor company that handles the inference part of machine learning. It was the inventor of a type of "logic" chip that is used in such systems, and enjoys a major market share as a result.

Machine vision

Cognex (US listed)

Market value: £6.7bn

Last year’s pre-tax profit: £161m

Cognex makes “machine vision” systems that are used to scan and check products or labels.

Tom Riley, manager of the Axa WF Framlington Robotech fund, said the technology was becoming more widespread, with “more and more manufacturing applications” and increasing use in logistics.

Mr Rogoff added: “We’re pretty sure that Apple is a big customer and that Amazon is using their systems.”

Big data

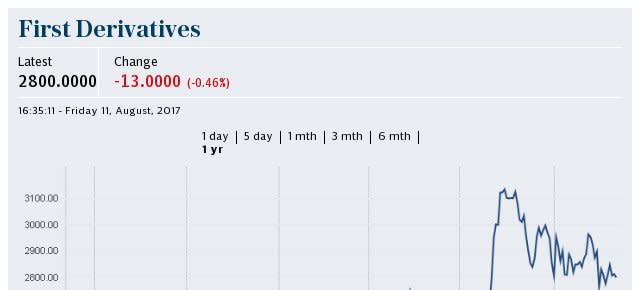

First Derivatives (UK listed)

Market Value: £705m

Last year's pre-tax profit: £12m

This data and consulting company has a proprietary database that is used in big data applications within finance, such as spotting insider trading, according to Mr Rogoff.

He has a position in the company - a rare UK holding - but explained it is small due in part to liquidity issues.

"We think we have the best of the UK technology sector covered, and the UK takes up less than 2pc of the Global Technology fund," he said.

Prefer a fund? This one is the best

If you don’t want to buy individual stocks, there are a number of technology funds that invest around the globe.

Ryan Hughes, head of funds at AJ Bell, the investment shop, said: “There is one stand-out team – Polar Capital Global Technology. It is led by Ben Rogoff, who has been a technology investor for 20 years.”

Follow us for more investing ideas: @TelegraphInvest

For investment tips and ideas five days a week, read Questor

Yahoo Finance

Yahoo Finance