Business leaders in Texas are fired up about Trump

Business leaders in Texas are looking forward to the Trump administration.

The Dallas Fed’s latest Texas manufacturing report released Monday showed a sharp rise in business activity and optimism during November.

“There is a great deal of optimism from our customers that the new pro-growth and lower-tax focus by the incoming administration will be a positive change from the past eight years,” said one executive in the fabricated metal business. (Emphasis added.)

“We continue to be very busy, which is normal for this time of year but still a good thing and we are thankful for it,” said a printing industry executive.

Adding: “I would like to think that business will remain steady now that the election is over and a pro-business candidate will be president. There is so much government interaction, interference and added cost that businesses have to endure that any positive change to reduce that impact will be a huge benefit. Time will tell and hopefully it’s not a long time that is required.” (Emphasis added.)

The report’s general business index rose to 10.2, indicating expansion in business, after almost two straight years of negative readings. This report had closely tracked the declining fortunes of many in the oil and gas business in the region.

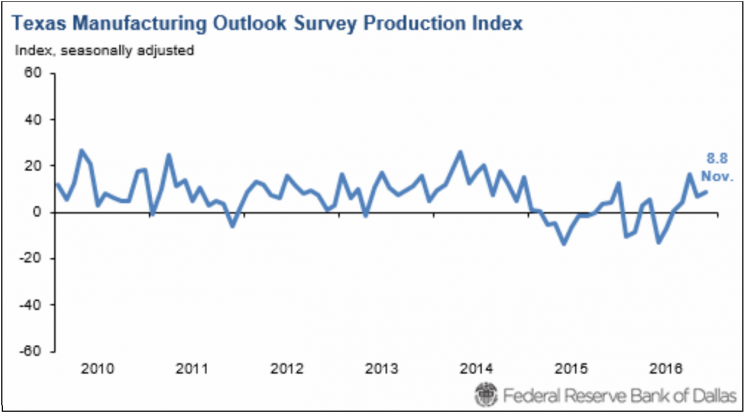

The manufacturing outlook hit 8.8, the fifth-straight month of positive readings.

This report follows last Wednesday’s consumer sentiment survey from the University of Michigan, which showed sentiment rose following the election.

“The initial reaction of consumers to Trump’s victory was to express greater optimism about their personal finances as well as improved prospects for the national economy,” said Richard Curtin, chief economist for the survey.

As we’ve noted, some economists have argued that survey-based economic reports should be more closely tracked in the coming months given that these will provide a better view on how consumers and businesses are reacting to Trump’s election than backward-looking data like the jobs report.

Of course, playing into the consumer sentiment readings was likely a sense of relief from some that the election is finally over, with Curtin adding last week, “The upsurge in favorable economic prospects is not surprising given Trump’s populist policy views, and it was perhaps exaggerated by what most considered a surprising victory as well as by a widespread sense of relief that the election had finally ended.”

In Monday’s Dallas Fed survey, a similar sentiment — or something like that — certainly resonated among some business leaders.

As one manufacturing executive said bluntly, “We are looking forward to the end of the disastrous socialist policies of the last eight years.

“Please reduce the regulation, taxes and government interference so we can compete globally. We hope the new administration makes good on its promises and, if so, it will increase our business expansion, hiring and investments.”

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance