Bull Of The Day: Photronics (PLAB)

Photronics (PLAB) is a Zacks Rank #1 (Strong Buy) that sports a B for Value and an A for Growth. I never make an investment decision based soley on the belief that an acquisition is in the works, but it sure looks like that could be the case for this stock. Let’s explore more about that idea in this Bull Of The Day article.

Description

Photronics is a leading worldwide manufacturer of photomasks. Photomasks are high precision quartz plates that contain microscopic images of electronic circuits. A key element in the manufacture of semiconductors and flat panel displays, photomasks are used to transfer circuit patterns onto semiconductor wafers and flat panel substrates during the fabrication of integrated circuits, a variety of flat panel displays and, to a lesser extent, other types of electrical and optical components. They are produced in accordance with product designs provided by customers at strategically located manufacturing facilities in Asia, Europe, and North America.

Possible Deal

With a market cap just over $1B, PLAB is potential buyout target for many names in semiconductor space. Its growth and margin expansion would make an acquisition accretive to most buyers.

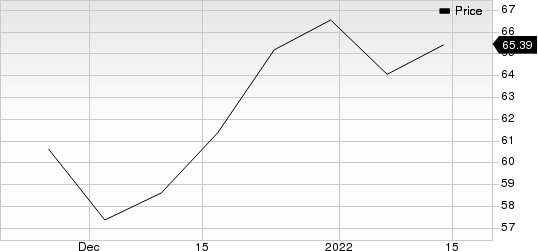

The signal that tipped me off to the idea was the stock chart. Here is a chip name that has seen strength in throughout December while the rest of the market saw aggressive selling. When a stock bucks a big selling trend – for an extended period of time – it tells us that there are still buyers for that name. It could also signal that selling is limited and the end result is the same.

Photronics, Inc. Price

Photronics, Inc. price | Photronics, Inc. Quote

If you look at the chart for Activision Blizzard (ATVI), which was recently acquired by Microsoft (MSFT), you will notice that this stock was also rather strong throughout the month of December.

Activision Blizzard, Inc Price

Activision Blizzard, Inc price | Activision Blizzard, Inc Quote

Just as a reminder, it is never a good idea to make an investment based on a potential acquisition. That said, let’s look at the other criteria for making a possible investment in PLAB.

Earnings History

When I look at a stock, the first thing I do is look to see if the company is beating the number. This tells me right away where the market’s expectations have been for the company and how management has communicated to the market. A stock that consistently beats has management communicating expectations to Wall Street that can be achieved. That is what you want to see.

For PLAB, I see a decent history of beating the Zacks Consensus Estimate. There are two beats over the last four quarters. The two quarters that were not beats were meets.

The average positive earnings surprise over the last fours quarters works out to be 12.5%.

Earnings Estimates Revisions

The Zacks Rank tells us which stocks are seeing earnings estimates move higher. For CMC, I see annual estimates moving higher.

Over the last 60 days, I see a few increases.

This quarter has increased from $0.22 to $0.31.

Next quarter has also seen a large increase from $0.24 to $0.34.

The full fiscal year 2022 has moved from $1.03 to $1.30.

Next fiscal year has just seen an initial estimate of $1.50.

Positive movement in earnings estimates like that is why this stock is a Zacks Rank #1 (Strong Buy).

Valuation

The forward earnings multiple for PLAB checks in at 14x, which is extremely low given topline growth last quarter came in at 21%. The price to book mulitple is 1.1x, and that level will keep value investors interested. The price to sales multiple checks in at 1.6x.

Margins have moved higher for this stock over the last three quarters and that coupled with topline growth is fueling higher earnings estimates. I see operating margins moving from 5.8% to 6.1% and then to 7.8% over the last three quarters.

Photronics, Inc. Price and Consensus

Photronics, Inc. price-consensus-chart | Photronics, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Photronics, Inc. (PLAB) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance