Budgeting 101 – 8 Apps to Manage your Expenses

If you’re not making enough moolah (and let’s be honest, in this economy, who is?), the biggest favour you can do yourself is to pick up some financial management skills. Start by learning how to budget your expenses. Getting your spending under control does magical things, from giving you hope to dare to dream of retiring, to making you realise you don’t absolutely need to stay in a job with a toxic work environment.

No need to keep your receipts or pull out spreadsheets and excel files to track your expenditure though. Just download a nifty app from one of our suggestions below to help you get a grip on your expenses.

Budget app | Cost |

Household Account Book | Free |

Spendee Spendee Plus | Free $20.36/year |

YNAB | Free for 34 days, then it’s $16.28/month or $114.08/year |

Wally Wally Gold | Free $2.70/month or $33.94/year |

Toshl | $6.78/month, $54.31/year or $162.93/36 months. Without bank account syncing, it’s $4.06/month, $27.13/year or $81.42/36 months. |

Zenmoney | Free |

Money Manager | Free |

Monny | Free |

Household Account Book

Need some kawaii cartoon characters to motivate yourself to budget? Household Account Book is so adorable you’ll be dying to save money together with mascot Pisuke.

The app itself is fairly simple — you manually log your income and expenses, and then see how much you have left for the month at the top of the screen, as well as the breakdown of your monthly spending with a pie chart. The app then sends you alerts to inform you how much you have left for the month.

What’s unique is its comic book feature which entices you to continue using the app in order to gain more access to its contents. You can also download cute wallpapers for your phone.

This is a great app for people with a love for cute stuff and aren’t looking for something particularly advanced.

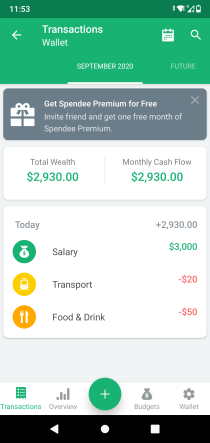

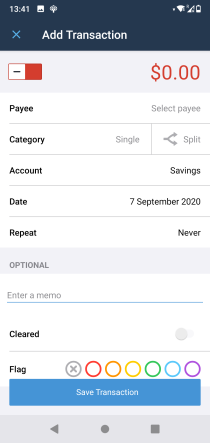

Spendee

Spendee has all the features you could possibly look for in a budgeting app, but at a price. The free version does not offer account syncing, so you’ll need to input and categorise all your income and spending info manually.

For US$14.99 (S$20.36) a year, you get Spendee Plus, which gives you an unlimited number of cash wallets and budgets, and can also import and export your transactions from your accounts so you don’t have to key everything in manually. Meanwhile, their top tier Premium account, which costs US$22.99 (S$31.22), lets you sync your bank accounts, which basically automates the entire process of tracking your spending.

This is an expensive but feature-packed option. If you need extra help with reaching your savings goals but don’t want to pay, the free version works just fine so long as you bother to input your income and spending.

YNAB

Here’s another app that purports to help you get your financial life in order… for a fee. You Need A Budget, or simply YNAB, offers a free trial that lasts 34 days. After trying it out, you can opt to pay US$11.99 (S$16.28) a month or US$84 (S$114.08) a year. At such prices, they’d better be helping you save money!

Note that linking of accounts is limited to the US and Canada, so the rest of us will have to add everything manually.

YNAB’s main differentiating factor is that the app acts more like a trainer than just an app for recording spending. When your money comes in, you need to decide ahead of time what you’re going to use it on by assigning categories to the amounts. The idea is that you should check your budget each time you spend, so you know which categories you can still spend on.

That is a lot of work, so it’s most useful to people who are actually struggling financially, and not those who simply want to record spending. Seriously though, the app is clunky to use, which makes it daunting for beginning budgeters. And at such prices, it’s more worth it to figure out your own low tech budgeting system.

Wally

Not only is Wally a budgeting app that can be linked to your bank account, it also acts as a digital planner. The main downside is that it’s only available for iPhone users.

Other than letting you log all your transactions and create budgets by category, Wally also acts as a document repository by enabling you to store scans of your bills, warranties and receipts. Another nifty feature is that you can set reminders to pay bills and create shopping lists.

If you have family or housemates who use Wallyn as well, you can manage shared finances, such as by creating group budgets and sharing documents like your rental contract or shopping lists.

The app is free, but you need to pay for certain functions. For instance, Wally Gold, which costs US$24.99 (S$33.94) a year or US$1.99 (S$2.70) a month, gives you access to functions like tracking of foreign accounts and currency conversion. That being said, basic account syncing is free, so you can still get quite a bit of utility out of the app without paying anything.

Toshl

Toshl lets you sync your bank account and cards to log your expenses. Instead of using the usual pie chart that many apps use to show where your money is going, they use a flow chart that’s supposed to let you see more clearly what you’re spending your money on.

Other than that, it functions as a pretty ordinary budgeting app with the usual records of your spending and the budget creation feature. It’s best for people who use many different credit cards and want to keep track of how much they’ve spent on each.

Toshl isn’t free. If you want to automatically sync your bank account, one month’s worth of use will cost you US$4.99 (S$6.78). Longer-term subscriptions will cost US$39.99 (S$54.31) for 12 months and US$119.99 (S$162.93) for 36 months. Without bank account syncing, you’ll need to pay US$2.99 (S$4.06) a month, US$19.99 (S$27.13) for 12 months or US$59.99 (S$81.42) for 36 months.

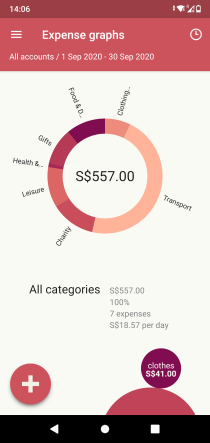

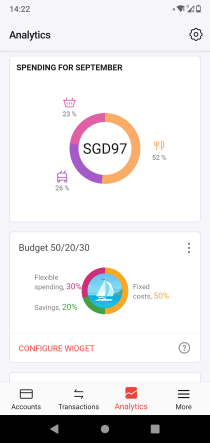

Zenmoney

This is a fairly basic expense tracker from Russia that can be linked to your bank account and tracks all your spending automatically. For a free app, Zenmoney offers a decent selection of features.

Other than logging your spending and showing how much you have left for the month, the app has a fairly good selection of analytics and also lets you allocate your budget according to the 50/30/20 rule or any other proportions you choose.

You can also set notifications, such as credit card payment reminders or alerts about new bank transactions.

Money Manager

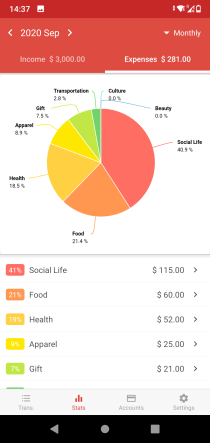

Money Manager is a basic, fuss-free app that does the job without the bells and whistles, all for free. All data is added manually, so you’ll need to be prepared to whip out your phone and enter an expense each time you spend money.

The app has a calendar view that tracks what — and when — you spend. You can also view weekly and monthly spending patterns, as well as a pie chart of your various spending categories. Spending and income can also be categorised according to type, such as cash, accounts, credit card, savings, loan or insurance.

Overall, it’s not the sexiest app, but it does the job for free and doesn’t take up much space in your phone.

Monny

Monny is an iPhone-only app with a cute, cheery interface. It lets you log your spending, monitor your expenses for the month and create budget and savings goals, all while being encouraged by their mascot, Monny the Bunny.

Beneath its cutesy fonts and playful graphics, Monny is actually a fairly basic app. All data has to be entered manually, and the analytics generated are also straightforward. But that’s not a bad thing. If all you need is to track how much you’re spending each month, Monny lets you do it easily, pleasantly and for free.

What budgeting app do you use? Share your recommendations in the comments!

Related articles

Managing Money And Expenses – A Guide To Budgeting Income In Singapore

Are You Busting Your Budget Every Month? Here are 4 Tips That Will Help You Stick To It

How to Budget Effectively According to Your MBTI Personality Type

The post Budgeting 101 – 8 Apps to Manage your Expenses appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

Yahoo Finance

Yahoo Finance