Budget 2019: Smaller allowances for duty-free alcohol and GST relief for goods bought overseas

The value of goods that can be exempted from the Goods and Services Tax (GST) for travellers entering Singapore will be tightened from Tuesday, Finance Minister Heng Swee Keat said on Monday (18 February).

The decrease in allowance applicable for GST relief comes amid rising international travel, said Heng, who was delivering his Singapore Budget statement for the 2019 fiscal year.

Travellers who spend less than 48 hours outside of Singapore will have to pay 7 per cent GST for goods bought overseas that are valued more than $100, a decrease from $150 currently.

For travellers who spend 48 hours or more outside of Singapore, they will have to pay GST for purchases worth more than $500, a decrease from $600 currently.

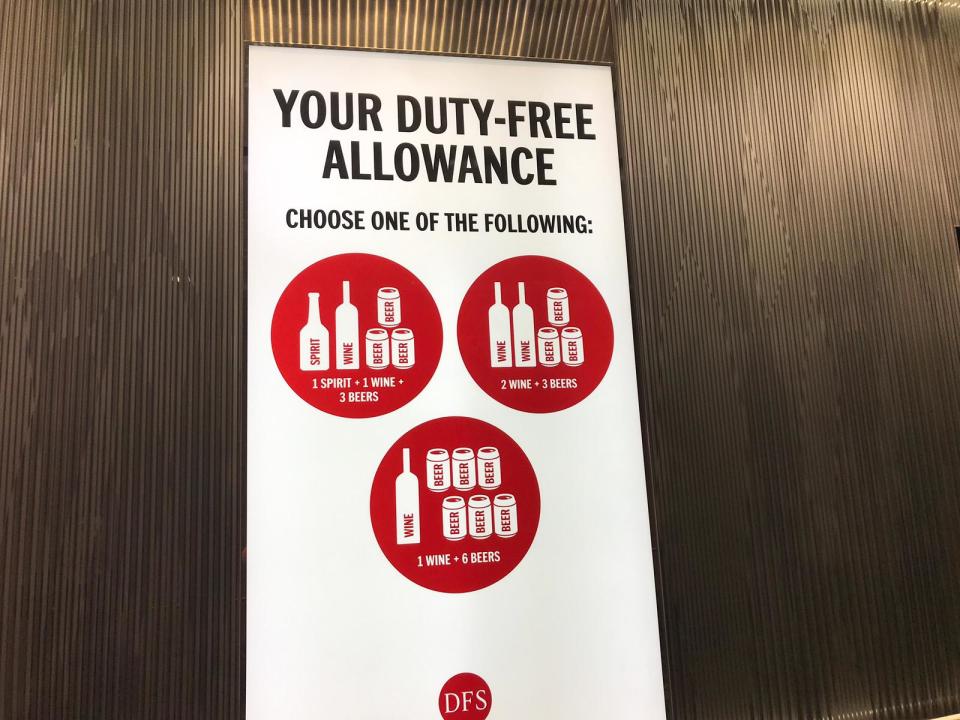

Heng also announced that duty-free alcohol allowance will be reduced from 3 litres to 2 litres, effective from 1 April.

Under the current duty-free alcohol allowance options, travellers can buy upon their return to Singapore either 1 litre of spirits, 1 litre of wine and 1 litre of beer, or 2 litres of wine and 1 litre of beer, or 1 litre of wine and two litres of beer.

With the revision, the duty-free allowance for travellers will be either 1 litre of spirits and 1 litre of wine, or 1 litre of spirits and 1 litre of beer, or 1 litre of wine and 1 litre of beer, or 2 litres of wine, or 2 litres of beer.

As with current conditions, the allowance is only applicable if the traveller has spent 48 hours outside of Singapore immediately before arrival, is not arriving from Malaysia and is buying alcohol for personal consumption.

“A fairer and more robust approach is to meet recurrent spending with recurrent revenues. Hence, we must continually review our tax system to ensure its resilience. GST is a broad-based tax that contributes significantly to our fiscal resources,” Heng said.

The changes follow Heng’s announcement last year that GST will be levied on imported services.

Related stories:

Yahoo Finance

Yahoo Finance