Brokers Really Like These 4 Shipping Stocks

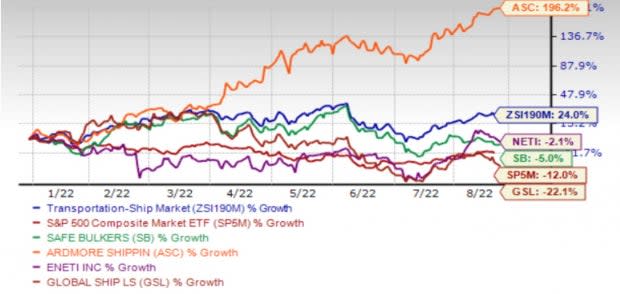

Shipping stocks have provided solid returns to shareholders this year, with the industry returning +24.0% year to date compared to the S&P’s loss of -12.0%. But a number of factors are now conspiring to perhaps hurt its strong outlook. The question is, given all these factors, should we still expect upside? This question can only be answered by taking stock of what these factors are exactly.

One obvious factor is oil prices. Since shipping companies need fuel to operate and greener alternatives have not been broadly adopted yet, nor have they been particularly in plentiful supply of late, oil prices do have an effect on them. And so, for instance, during the Jun 7 to July 7 period when oil prices were peaking, the industry did give back some of the gains. But as oil prices started to falter, it has come back strongly.

Another obvious factor that affects the companies’ revenues and profitability is economic growth. Since shipping stocks carry bulk goods, both finished products and raw materials including agricultural products, any slowdown in the economy would affect their utilization, which in turn would pull down both revenue and profits. So if we are really entering a recession, these stocks shouldn’t be in a good place as of now.

But it isn’t that simple. Shippers typically operate on long-term or spot term contracts. The spot terms are usually a few months while the long-terms are a few years. Long-terms offer the advantage of better visibility and stability (even in times of weakness in the economy) because they have locked in their clients. They also allow for better utilization (since there is more time to fill capacity).

The disadvantage is that when things like oil prices rise, their operating expenses increase. And since their rates are fixed by contract, their margins get squeezed. That’s the reason why many of the players operate a flexible model, deploying some vessels on long-term contracts and others on spot contracts.

Another factor that is significantly impacting these companies is the rate hikes. Since this is a very capital-intensive business, most companies carry quite a bit of debt. In a rising rate environment, this is an obvious negative. Companies generally refinance their obligations to fixed rate instruments at such times, or raise funds by other means, as most of the companies discussed here have done.

Temporary factors that are also playing a role, although not as significantly as in the last couple of years is COVID 19. As a result of port lockdowns, restrictions, crew repatriation and various related factors, shipping companies have seen some bottlenecks.

These issues are clearing up, but could come back quickly in case there are other waves, as recently seen in China. The Ukraine conflict and subsequent sanctions on Russia also had a disruptive effect on the supply chain, which have impacted shippers catering to those regions.

Considering all of the above, it seems that unlike some other sectors that are crumbling under recession fears, things are not that negative for this industry, as the discussion below also reveals:

Ardmore Shipping Corp. ASC

Pembroke, Bermuda-based Ardmore Shipping transports petroleum products and chemicals worldwide through voyage charters, commercial pools and time charters. Its customers include oil companies, oil and chemical traders, chemical companies, and pooling service providers.

As of Jun 30, 2022, the company had 27 vessels in operation, including three chartered vessels. Additionally, it had three Carl Büttner's chemical tankers under commercial management. Its 21 MR tankers earned an average time charter equivalent (TCE) rate of $29,984 per day in the second quarter of 2022. The six product/chemical tankers earned an average TCE rate of $20,254 per day.

In the current quarter, 93% of its MR tankers will be operating in the spot market and management has said that as of Jul 27, 45% of its total revenue days in the quarter had been fixed at an average TCE rate of approximately $46,600 per day, which is a big jump from the previous quarter. Around 45% of the product/chemical tankers’ total revenue days have also been fixed at approximately $33,000 per day, also a significant increase.

Estimates have moved up in response to management’s upbeat comments. Earnings estimates for the September quarter have increased 57% in the last 30 days. The 2022 and 2023 estimates have increased a respective 20% and 49% during the same time period.

The shares carry a Zacks Rank #1. The average broker recommendation is also 1 (Strong Buy).

Global Ship Lease, Inc. GSL

London, UK-based Global Ship Lease owns and charters containerships of various sizes under fixed-rate charters to container shipping companies. As of March 10, 2022, it owned 65 mid-sized and smaller containerships with an aggregate capacity of 342,348 twenty-foot equivalent units.

Global Ship Lease follows a conservative, risk-averse business model, which means that it tries to secure long-term fixed rate charters. As of the last earnings announcement, this meant secure, contracted revenue of $1.9 billion over 2.6 years, “enough to fully cover expenses, debt service, CAPEX, and dividends, while also building cash liquidity to manage any challenges and capitalize on opportunities that may lie ahead.”

The company is also likely to benefit from imminent vessel shortage in the mid-sized and smaller vessel classes in which it operates, because of relatively limited supply growth compared to that for larger vessels. Decarbonization regulations along with an aging global fleet and almost no scrapping in recent years are expected to exacerbate this shortage.

GSL has an agreement with Aqualung Carbon Capture AS for the development of containerized carbon capture units to be retrofit-able to containerships and other seagoing vessels. This would help its own compliance.

In the first half of 2022, its adjusted EBITDA more than doubled and it is on track to generate solid earnings growth both this year and the next.

Earnings estimates for the current quarter are up around 6% in the last 30 days. For 2022, they’re up about 1.5% and for 2023, up about 11%. The earnings profile continues to improve as newer, higher-rate contracts come into play.

It also pays a dividend that yields 8.4%.

The shares carry a Zacks Rank #1. The average broker recommendation is also 1.

Eneti Inc. NETI

Since the acquisition of Seajacks International Limited in August 2021 and its exit from the dry bulk business in July 2021, Monaco-based Eneti Inc. has become engaged in the offshore wind and marine-based renewable energy market.

In February, it changed its name from Scorpio Bulkers Inc. to Eneti Inc. Today, it owns and operates five wind turbine installation vessels (WTIVs), catering to an important niche market within the fast-growing offshore wind industry.

The medium-term outlook for the industry is highly positive. Based on management commentary, we see that “demand for 12MW+ capable vessels outpaces supply from 2025 onwards”. Additionally, the increasing cost of newbuilds and limited number of vessels available for upgrading is expected to keep vessel supply tight.

Operators’ pricing and therefore, daily earnings are expected to remain strong. And this is of course a big positive for Eneti.

Eneti has two newbuilds under contract with Daewoo Shipbuilding and Marine Engineering, one of which will be delivered in the third quarter of 2024 and the other, in the second quarter of 2025. The three NG 2500Xs (shorter contracting cycles than the large vessels) have been identified as non-core assets, and the company is in the process of finding a way to maximize their monetization.

Analysts are highly positive about the company’s prospects. Earnings estimates for the current quarter have therefore jumped 21% in the last 30 days. The same trend is evident in the 2022 and 2023 estimates, which have increased 86% and 150%, respectively.

Its dividend yields 0.51%.

The shares carry a Zacks Rank #1, same as the average broker recommendation.

Safe Bulkers, Inc. SB

Monaco-based Safe Bulkers, Inc., together with its subsidiaries, provides marine drybulk transportation services. It owns and operates drybulk vessels for transporting bulk cargoes primarily coal, grain and iron ore. As of Jul 22, the company had a fleet of 42 drybulk vessels with an average age of 10.5 years and an aggregate carrying capacity of 4.2 million deadweight tons.

Its fleet consisted of 12 Panamax class vessels, 8 Kamsarmax class vessels, 15 Post-Panamax class vessels, and 7 Capesize class vessels. In the last quarter, it agreed to acquire another second-hand capsize vessel. It has 10 newbuilds on order.

Safe Bulkers has taken delivery of a new Kamsarmax vessel in the last quarter. The extra charges it levies for vessels that have its exhaust gas cleaning device (scrubber) installed are expected to bring substantial operational and commercial advantages, while also satisfying environmental regulations on the reduction of CO2 emissions per vessel. As on Jul 22, 18 of its 42 existing vessels had scrubbers installed and there were agreements for four additional vessels.

The company has a flexible operating strategy, making use of both period and spot time charters, depending on the circumstances. It recently signed two 3-year charters, one in May and the other in June. As of July 22, it had 9 spot charters and 33 period charters with average remaining charter duration across the fleet of 1.1 years. As of Jul 22, 63% of its remaining 2022 capacity (83% for the full year), 33% of its 2023 capacity and 26% of its 2024 capacity have been contracted.

Safe Bulkers’ 2022 TCE came in nearly 19% higher than in the year-ago quarter while net income came in over 55% higher.

Analysts are quite positive about its prospects and have raised their estimates. Accordingly, the 2022 estimate has increased around 8% and the 2023 estimate nearly 29% in the last 30 days.

Its dividend yields 5.59%.

Like the average broker recommendation, the shares carry a Zacks Rank #1.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Safe Bulkers, Inc (SB) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report

Eneti Inc. (NETI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance