Broadcom (AVGO) Q1 Earnings Beat Estimates, Revenues Miss

Broadcom AVGO reported first-quarter fiscal 2020 non-GAAP earnings of $5.25 per share surpassing the Zacks Consensus Estimate by 0.57%. However, the figure declined 5.4% from the year-ago reported quarter.

Net revenues came in at $5.858 billion, up 1% from the year-ago quarter. However, the top line missed the Zacks Consensus Estimate of $5.925 billion.

Segmental Revenues

Beginning first-quarter fiscal 2020, the company clubbed reporting of revenues from Intellectual property licensing with Semiconductor solutions segment. The company now reports in two reporting segments: Semiconductor solutions and Infrastructure software.

Semiconductor solutions’ revenues (72% of total net revenues) totaled $4.191 billion, down 4% from the year-ago quarter owing to soft demand of wireless products. Nonetheless, robust demand for high capacity drives, networking, and broadband products, offset the decline.

Infrastructure software revenues (28%) improved 19% year over year to $1.667 billion. The company is benefiting from synergies from acquisitions of Brocade, CA and Symantec’s enterprise security business.

Markedly, on Nov 4, 2019, Broadcom concluded the acquisition of Symantec’s enterprise security business. The buyout is expected to aid the company in expanding presence in infrastructure software space. Notably, the first-quarter results exclude Symantec’s Managed Security Services business, which the company is divesting to Accenture.

Notably, CA and Symantec’s enterprise security business contributed $880 million and $400 million to revenues in the reported quarter.

Operating Details

Non-GAAP gross margin expanded 160 bps on a year-over-year basis to 73%. The increase can be attributed to improving mix of semiconductor sales and synergies from acquisitions of CA and Symantec’s enterprise security business in infrastructure software vertical.

Total operating expenses on a non-GAAP basis increased 10.4% year over year to $1.193 billion. As a percentage of net revenues, the figure expanded 170 bps to 20.4%.

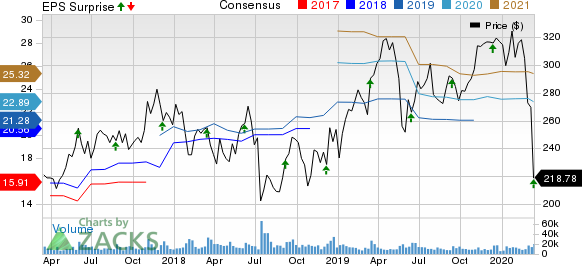

Broadcom Inc. Price, Consensus and EPS Surprise

Broadcom Inc. price-consensus-eps-surprise-chart | Broadcom Inc. Quote

Consequently, non-GAAP operating margin contracted 10 bps from the year-ago quarter to 52.6%.

Adjusted EBITDA (excluding $146 million of depreciation) came in at $3.265 billion, representing 55.7% of net revenues in the fiscal first quarter.

Balance Sheet & Cash Flow

As of Feb 2, 2019, cash & cash equivalents were $6.444 billion, compared with $5.055 billion reported as of Nov 3, 2019.

As of Feb 2, 2019, long-term debt (including current portion) was $44.718 billion compared with $32.798 billion as of Nov 3, 2019.

Broadcom generated cash flow from operations of $2.322 billion compared with $2.479 billion in the previous quarter. Capital expenditure totaled $108 million, compared with the last reported quarter’s $96 million. Free cash flow during the quarter was $2.214 billion compared with $2.383 billion in the prior quarter.

During the reported quarter, Broadcom returned $1.372 billion in form of dividends to shareholders during the fiscal first quarter.

On Mar 12, 2020, the company announced a quarterly dividend of $3.25 per share. The quarterly dividend is payable on Mar 31, 2020, to shareholders as on Mar 23, 2020.

Guidance

Broadcom withdrew prior outlook for fiscal 2020 citing uncertainty owing to the coronavirus crisis. Management hasn’t witnessed “a meaningful impact on bookings” but visibility of spending from cloud and data center customers is unclear.

Nevertheless, the company continues to expect to pay down $4 billion of debt in fiscal 2020. Cash dividend pay outs are anticipated at $5.5 billion.

For second-quarter fiscal 2020, the company anticipates revenues of $5.7 billion (+/- $150 million). The Zacks Consensus Estimate is currently pegged at $5.91 billion. Adjusted EBITDA is anticipated at $3.135 billion in the fiscal second quarter.

Conclusion

Broadcom delivered mixed fiscal first-quarter results, wherein earnings surpassed the estimates, while revenues lagged the same. Moreover, the company withdrew prior guidance for fiscal 2020, owing to coronavirus crisis-led uncertainty. Further, slowdown in IT spending, as estimated by IDC, remains an overhang.

However, the company is well poised to gain from roll outs of 5G smartphones in semiconductor space amid accelerated deployment of 5G. Further, synergies from acquisitions of Brocade, CA and Symantec’s enterprise security business are expected to boost Broadcom’s presence in infrastructure software vertical, in the days ahead.

Zacks Rank & Stocks to Consider

Currently, Broadcom carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the broader sector are Microsoft MSFT, Applied Materials AMAT and Garmin GRMN. All the three stocks currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microsoft, Applied Materials and Garmin is currently pegged at 13.22%, 9.94%, and 7.35%, respectively.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance