British Pound, New Zealand Dollar Berated by Central Bank Commentary

ASIA/EUROPE FOREX NEWS WRAP

Mob mentality. It’s a psychological condition that arises when individuals or smaller groups of people are influenced by a larger group to behave in certain ways or follow certain trends; to act in unison. The typical scene is a riot; an angry protest breaks out into violence and everyone fights, regardless if they have a reason to pick up arms. Why bring this up? The smaller, less significant (on a global scale) central banks are starting to exhibit these very characteristics.

So who is the smaller group in this example? The Bank of Canada, the Bank of England, the Reserve Bank of Australia, and the Reserve Bank of New Zealand. In 2011, these currencies were quite strong relative to their peers; the commodity currency complex has been resilient since 2009, as investors chased relatively higher yield in a ZIRP environment. But the tables are starting to turn; after fighting the larger group’s trend of massive monetary supply expansion over the past four years, mob mentality is starting to set in.

The British Pound and the New Zealand Dollar are the latest victims of this psychological phenomenon. Both currencies had their central banks talking down their values in the Asian and European sessions: RBNZ Governor Graeme Wheeler said that “when the New Zealand Dollar is coming under upward pressure, we want investors to know that the Kiwi is not a one way bet”; the BoE February meeting Minutes showed that policymakers’ collective stance is becoming more open to additional easing, as the central bank overlooks inflation to help stimulate the economy – exporters are benefiting from the weak Sterling, as the BoE Minutes displayed.

Why do these type of comments matter? Central banks are beginning to shift away from domestic issues to focus on exogenous ones – the exchange rate of their currency – as a way to operate monetary policy. The BoE and the RBNZ may be smaller fish – but they too are starting to fire shots in the ‘currency war.’

Taking a look at European credit, peripheral yields continue to fall, help keep the Euro elevated. The Italian 2-year note yield has decreased to 1.565% (-1.4-bps) while the Spanish 2-year note yield has decreased to 2.458% (-2.6-bps). Likewise, the Italian 10-year note yield has decreased to 4.365% (-2.2-bps) while the Spanish 10-year note yield has decreased to 5.113% (-5.9-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:30 GMT

CHF: +0.13%

EUR: +0.05%

JPY: +0.02%

CAD:-0.28%

AUG:-0.31%

GBP:-0.78%

NZD:-1.22%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.19% (+0.57% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: Maintaining the same bias as the move to 1.3280/300 has yet to be completed: “Price has steadied below 1.3400, entering the Bull Flag range set in mid-January, from 1.3280 to 1.3390. On lower-term timeframes, a Bear Flag may have formed, with the measured move pointing to 1.3280/300. A break lower can’t be ruled out, but as long as the ascending trendline off of the mid-December and early-January lows holds at 1.3215/35, any setbacks are seen as near-term corrections.”

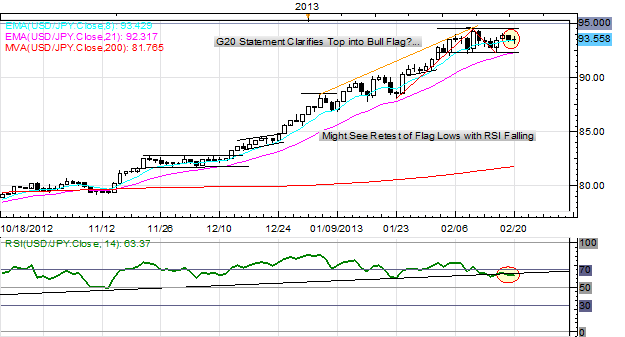

USDJPY: No change: “Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again.” Resistance comes in at 93.40/45 (monthly R1), 93.85 (weekly R1) and 94.00/10. Support comes in at 92.90/95 (weekly pivot), and 91.75/95 (weekly S1).

GBPUSD: Selling persists on further bad data from the UK and dovish commentary from the BoE, setting up for a test of the significant June 1 low at 1.5265/70. With technical conditions extremely oversold on shorter-term timeframes (1H and 4H) and longer-term views moving to extremes as well, a rebound at such a significant level wouldn’t be surprising. Support comes in there and 1.5000. Resistance is 1.5425/50, 1.5560/80, and 1.5660/80.

AUDUSD:A week ago I said: “The bounce from the 1.0265/90 area may have completed, with the rally halted at the 200-DMA at 1.0305/10. The pair is sitting at the 100% extension at 1.0265 now, and a break implies a deeper setback towards 1.0135/75, early-September and –October swing lows, as well as the 161.8% extension. Although there was an overshoot into 1.0360, former support, failure has occurred, signaling further downside is possible. Price has struggled further to overcome this level. I’m still looking for a move into 1.0135/75.”

S&P 500: A week ago I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1520; the December 2007 highs of 1520/24 could be reached on an overshoot. The 100% Fibonacci extension on the fiscal cliff rally and flag comes in at 1530. Bottom line: I’m expecting a significant setback (-10%) in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

GOLD: No change: “Gold broke below trendline support off of the January 2011 and May 2012 lows at 1650 last week, prompting a sharp sell-off into 1600, where price broke out in mid-August before a rally into the post-QE3 high at 1785/1805. However, with oversold conditions persisting on the 4H and daily timeframes, a rebound should not be ruled out; each of the past two daily RSI oversold readings has produced a rally in short order. Resistance is 1625 and 1645/50. Support is 1585 and 1555/60.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance